Hey traders,

SharpLink Gaming, Inc. (NASDAQ: SBET) ran over 1,000% last week. Yeah, you read that right.

The stock took off after Sharplink announced a $42.5M investment from an affiliate of Acies Investments.

Mix in crypto hype, gaming momentum, and a wave of retail FOMO, and you had the perfect storm.

While other traders chased, I watched the early action and saw a clean long.

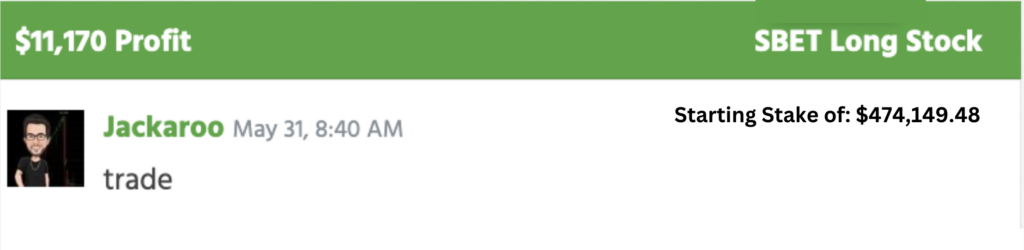

Grabbed it, rode the momentum, and locked in a solid win.

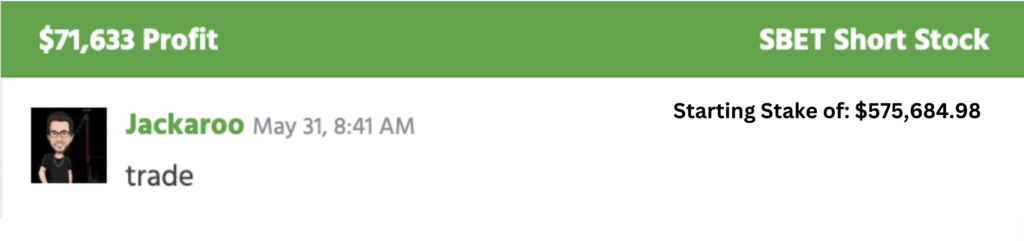

Then the crowd got sloppy, the volume blew out, and the price started breaking. I flipped short—and that’s where the real money came in.

Over $82K profit. Two trades. One ticker. Same day.

This wasn’t about guessing. It wasn’t luck.

It comes down to pattern recognition, timing, and staying ice-cold when things move fast.

You don’t need to predict the market. You just need to plan your spots and act without hesitation when they show up.

SBET gave me one shot long and one shot short. I took both. No hesitation. No noise. No emotion.

Let the hype traders chase headlines.

I’ll keep doing what works.

That same week, the whole market felt like it flipped. AI headlines started flying again.

NVIDIA blew up earnings. Crypto found a heartbeat again. And suddenly, companies in almost every industry—even snack brands—started calling their products “AI-powered,” even when the tech barely plays a role.

Adding “AI” helps grab attention, attract investors, and make products seem more innovative—even if the label doesn’t match what’s actually under the hood.

But while the crowd chased buzzwords, the market gave us something better—a real setup hiding inside the noise.

SBET didn’t show up because some influencer hyped it.

It showed up because a $42.5 million investment from Acies dropped on May 30th, paired with crypto chatter and a gaming angle.

The algos spotted it. My scanner lit up. And I did what I’ve trained to do.

This trade wasn’t about grit or mindset or motivation.

This was pure pattern recognition powered by algorithmic speed.

This wasn’t random. The whole setup was textbook, but it also hit every data signal I track.

My edge isn’t just screen time anymore—it’s human judgment backed by machine precision.

I use AI and algo tools every day. Scanners flag the volume. Filters highlight unusual activity. Models surface abnormal price action. But none of that matters if you don’t know how to act.

You’re still the trader. The tools just help you see faster.

One of the tools I trust most is The Power Signal Indicator. It helps spotlight setups with real potential—moves that match our criteria, not just whatever’s trending.

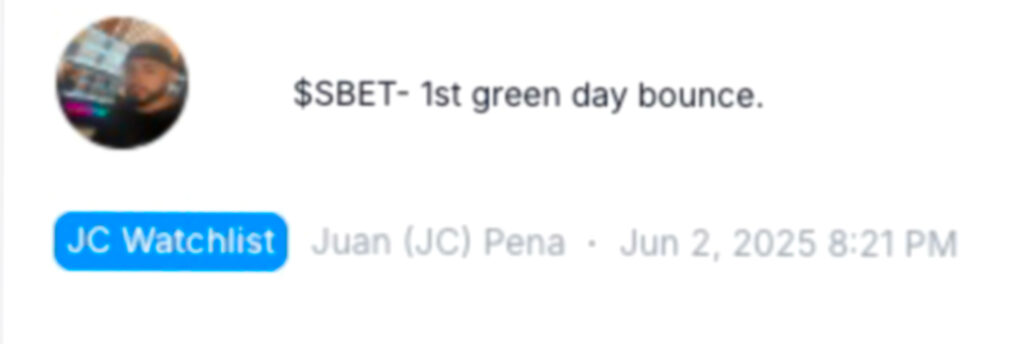

And apparently, I wasn’t the only one watching.

JC Pena dropped SBET on his Power Signal Alerts this past Monday, calling it a “1st green day bounce” after the unwind.

He saw the same setup shape backup because the best trades follow the same rules.

News + range + emotion = opportunity.

This is how you adapt in a market that moves faster than human reaction.

AI isn’t a threat. It’s a tool. But only if you’re ready to trade like one.

Trade smarter, not louder,

Jack Kellogg