Hey traders,

I’ve got something fun for you today.

Most traders think they know chart patterns… until they have to spot one in real time. So let’s see where you stand:

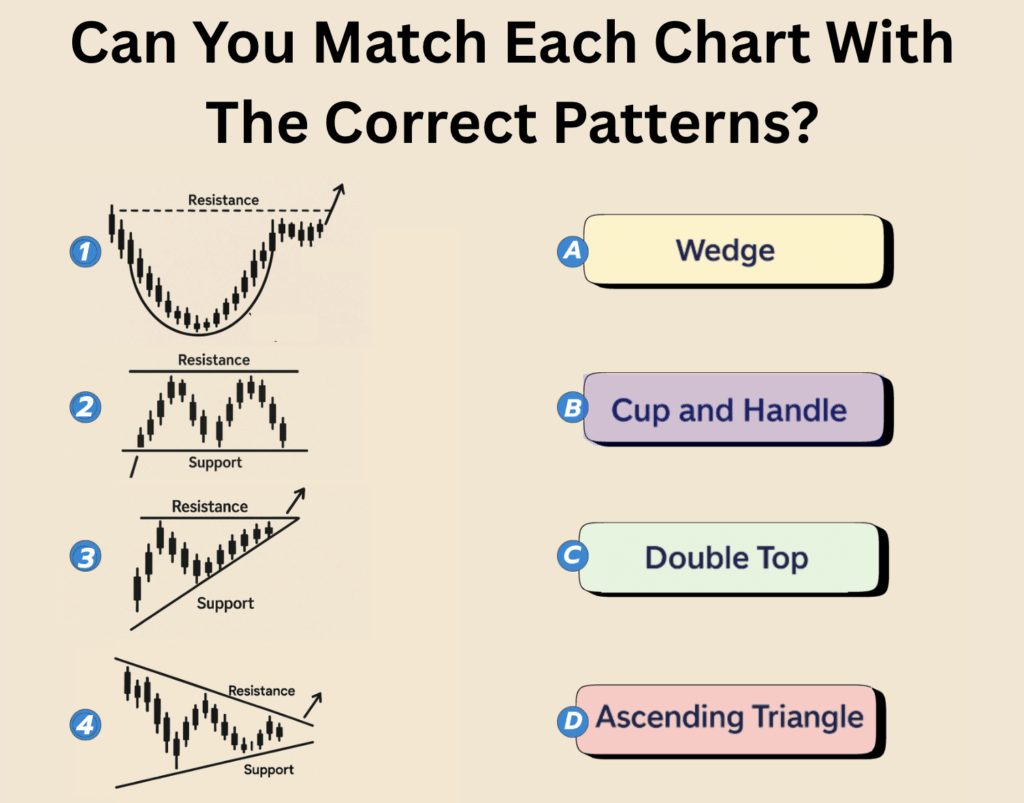

Take 30 seconds and match each chart to the correct pattern:

Which one’s which? No pressure. Just think it through and trust your pattern memory.

These four setups show up everywhere, especially in small-cap runners and breakout plays.

When you can’t recognize them quickly, you’ll always be a step behind the move.

Got your guesses locked in?

Let’s see how close you got. Here are the answers:

Correct Matches

1. – B.) Cup and Handle

2. – C.) Double Top

3. – D.) Ascending Triangle

4. – A.) Wedge

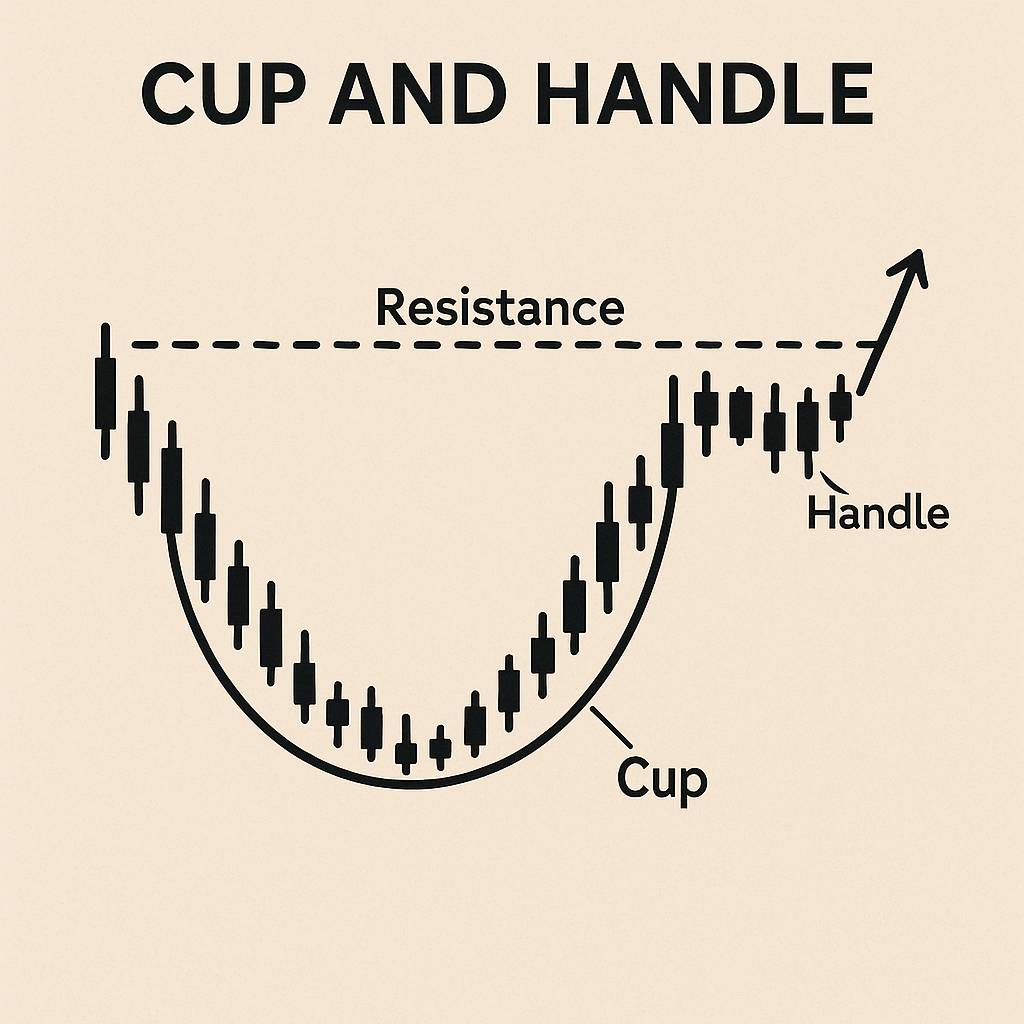

1. Cup and Handle

This pattern builds with a deep, rounded base (the cup) followed by a small pullback (the handle).

It’s one of my favorites when paired with volume and breakout news.

What I watch for:

- Strong U-shape base

- Tight consolidation in the handle

- Break above resistance with/ volume surge

Don’t chase the top of the cup… wait for the handle to form.

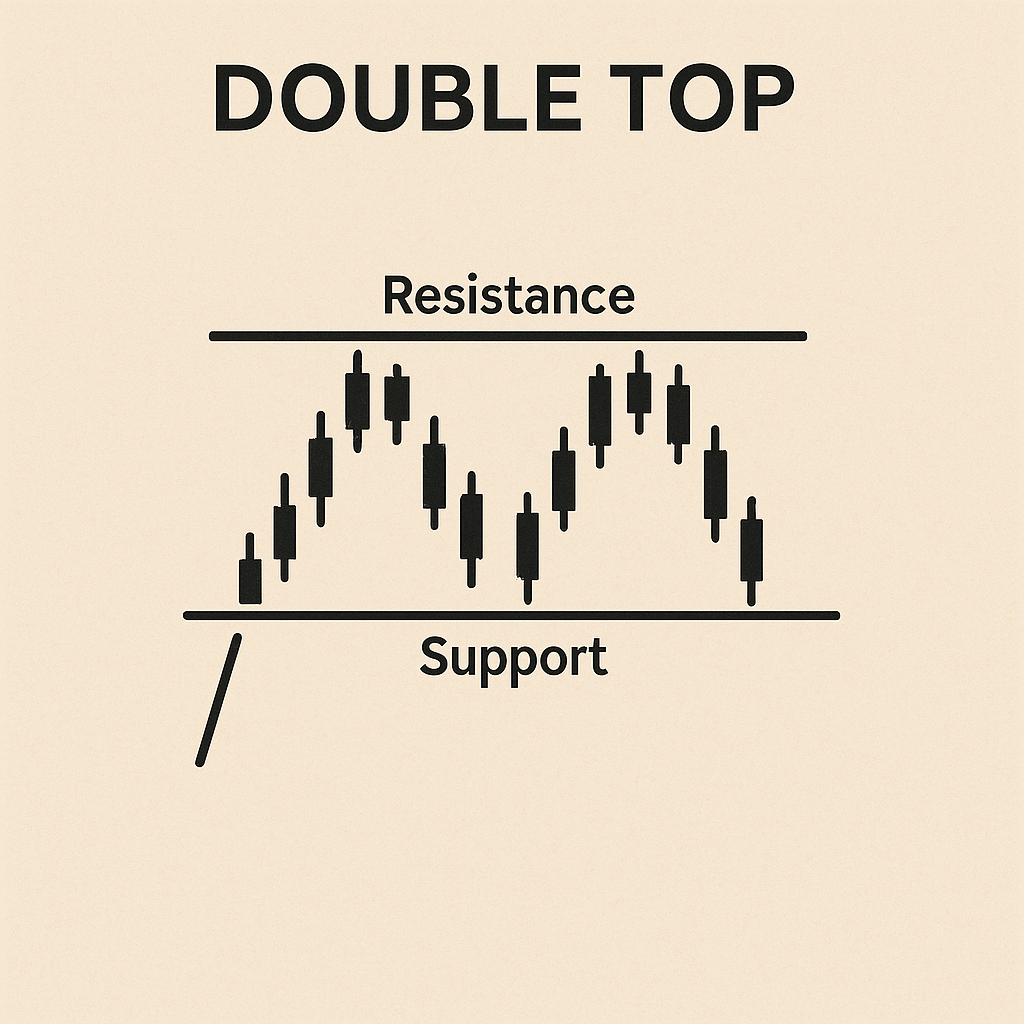

2. Double Top

This one kills bag-holders. You get two strong pushes into resistance… and then the rug.

Perfect setup for shorts after the second top fails.

Key signs:

- Equal highs with weak volume on the second push

- Stuff moves or fails to break out

- Cracks back below the support

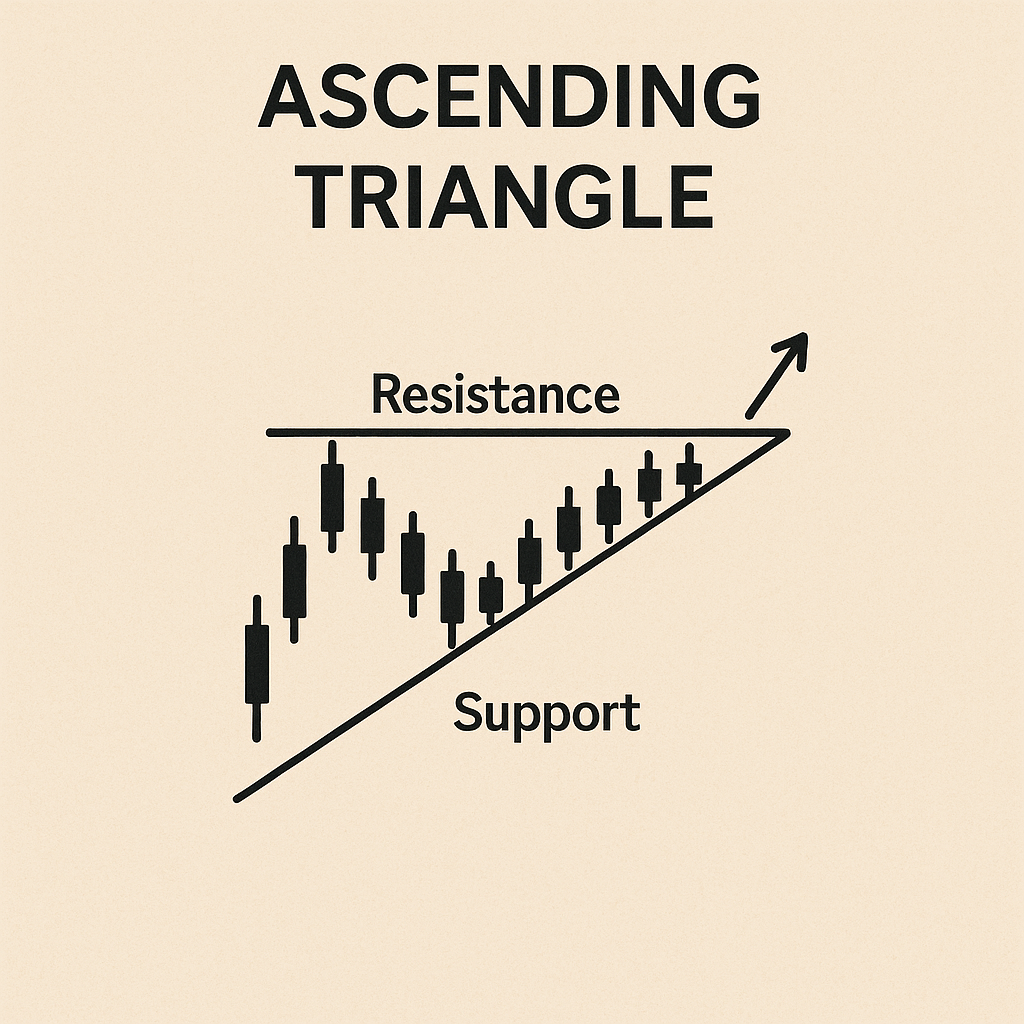

3. Ascending Triangle

Higher lows press into flat resistance, and bulls are getting pushy.

Let that volume build, I’ll usually take a starter into resistance and scale into the breakout.

Look for:

- Flat top, rising base

- Clear volume pickup near the breakout

- Hold above the breakout level = potential continuation

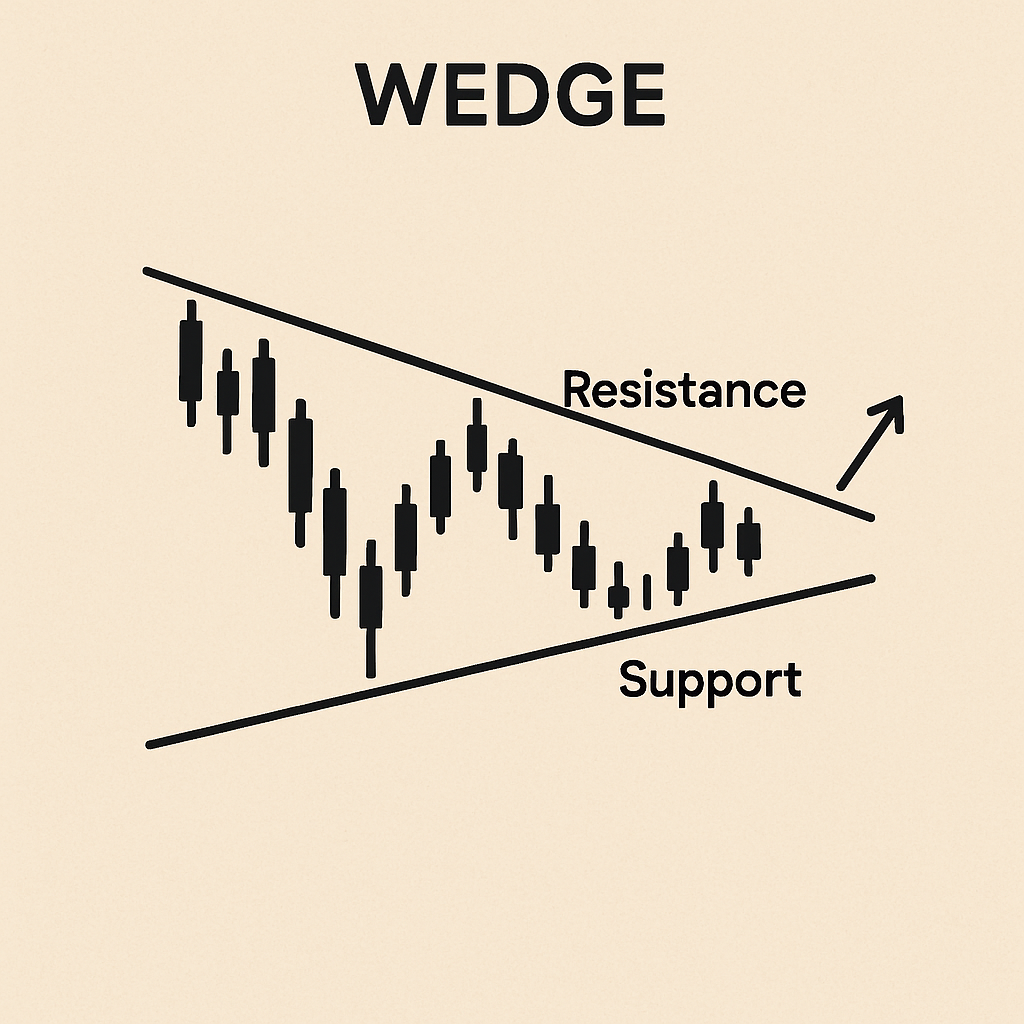

4. Wedge

A clean wedge looks like it’s winding up.

The tighter it coils, the bigger the move when it breaks.

How I play it:

- Identify the tightening range

- Wait for confirmation (breakout/down)

- Avoid guessing the direction; let the chart show you

These aren’t just textbook patterns; they actually show up in real trades almost daily.

The more you train your eye to spot them, the less hesitation you’ll feel when it’s time to pull the trigger.

While you’re trying to build confidence in your setups, this is where it starts:

✅ Recognize the pattern

✅ Know the behavior

✅ Have a plan ready

Let me know how many you got right in the quiz. Did you nail all 4? Mad respect to you.

Not quite? No worries, just keep training that eye.

The more patterns you spot, the fewer mistakes you make.

Keep training,

Jack Kellogg

P.S.

You want to get better at spotting these setups before they move? I’ve got something for you. Today at 2:00 PM ET, Erik is going live with the exact Friday prep strategy I use. He’ll show you how I map out trades before Monday even starts.