Hey traders,

Markets are closed today for Labor Day. Everyone else gets a day off, and honestly, traders need that too.

But instead of burgers and beer, I want to talk about something way less fun: losing money.

When I first started trading, my PnL looked like a graveyard. Small cuts here, bigger cuts there. At the time, it felt like torture.

I hated every single one of them at the time. Losses that made my stomach churn. Losses that made me question if I should even be trading.

But looking back now? Those early losses ended up saving me.

Because if I hadn’t learned those painful lessons when the numbers were small… I would’ve repeated the same mistakes with way bigger size later. And that’s how traders blow up.

I’ll show you exactly what I mean.

I’m talking about real trades where I lost hundreds, it felt like thousands back then, but those losses ended up being cheap tuition compared to the $5k or $50k mistakes they kept me from later.

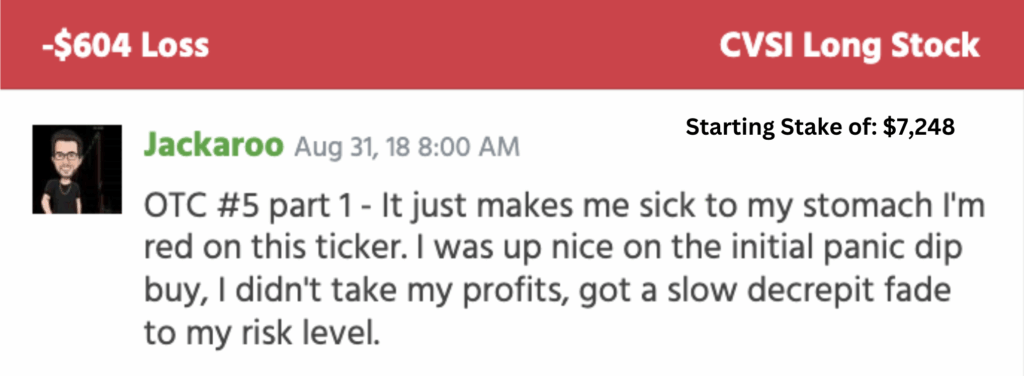

The -$604 CV Sciences, Inc. (OTCQB: CVSI) Gut Punch:

Back in 2018, I went long CVSI I tied up over $7k in that one trade.

I nailed the panic dip buy, but I got greedy. My plan said take profits early. Instead, I watched it grind lower until it hit my stop. Exited at $3.33, down $604 (-8.12%).

It made me sick. Red on a ticker I had read perfectly. The lesson was take the damn profits.

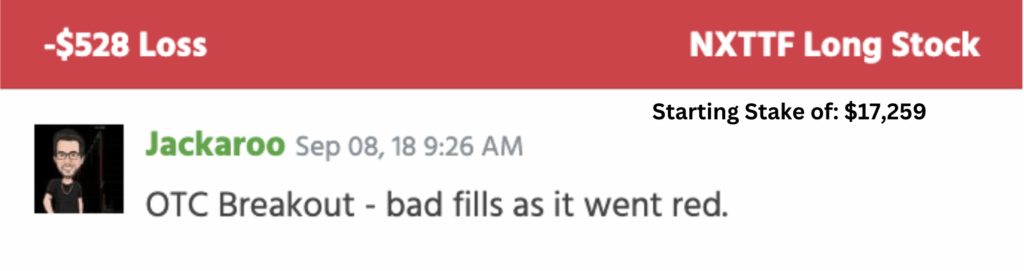

Waiting for “more” almost always means less.The -$528 Lifeist Wellness Inc. (OTCQB: NXTTF) Paper Cut

A week later, I went long NXTTF at $2.30 on a breakout setup. Got bad fills as it went red and stubbornly held overnight. Exited at $2.23, down $528 (-2.94%) on 7,500 shares.

It didn’t kill me, but it drilled home a painful truth: bad entries don’t magically fix themselves. Holding and hoping turns small losses into account-killers.

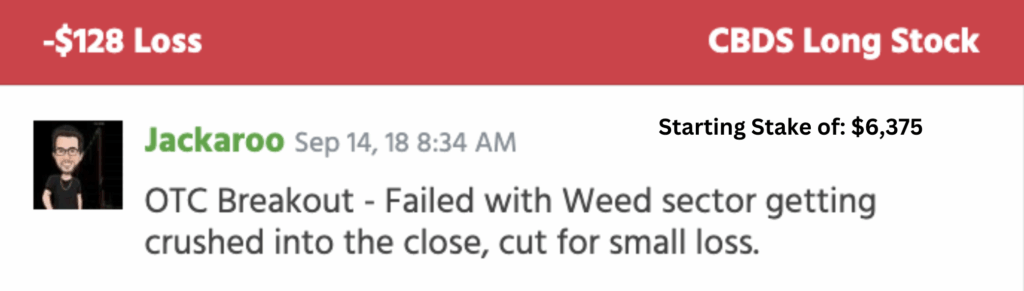

The -$128 Cannabis Sativa, Inc. (OTCQB: CBDS) Weed Sector Slap

Then came CBDS. Bought the breakout at $4.25 while the weed sector looked hot. By the close, the sector dumped. I cut at $4.17, down $128 (-1.88%) on 1,500 shares.

Smallest loss of the three, but one of the most important. Why? Because I actually cut it. Old me would’ve bag-held and hoped. That $128 pain probably saved me from a $1,280 disaster.

Why These Losses Saved Me

At the time, every one of these trades felt like a knife in the gut. $600 here, $500 there, it was money I couldn’t afford to waste.

But here’s the truth: they were cheap lessons compared to what I would’ve lost if I never learned.

- That $604 CVSI loss taught me to always lock in profits on the frontside.

- That $528 NXTTF loss taught me never to trust a bad fill.

- That $128 CBDS loss taught me to cut small before small becomes huge.

If I hadn’t taken those early hits, I would’ve repeated the same mistakes with way bigger size once I scaled up. And those numbers wouldn’t have been hundreds. They’d have been thousands… maybe tens of thousands.

Most new traders want to skip the losses. They size up too fast, chase profits, and pretend they’ll just win their way to success. But trading doesn’t work like that.

Losses come first. Wins come later. The faster you accept that, the faster you stop blowing up.

So on this Labor Day, while the markets rest, take a second to think about your own “cheap tuition.”

Every red trade costs money, but if you actually learn from it, it saves you so much more down the road.

Small pain now keeps you alive long enough to see big gains later.

Catch you in the next alert,

Jack Kellogg

P.S. Tomorrow at 10am we’re doing a live session to show you how traders are using my strategy right now. Grab a spot, it’ll open your eyes.