Hey traders,

September looks harmless.

But it’s a trap.

You wait all summer for the action to come back. Volume returns, traders wake up, setups start to appear, and just when you think momentum’s finally here?

It yanks everything back.

September fakes strength better than any other month.

It gives you a few hot names, tempts you into sizing up, then leaves you bag-holding when the follow-through dies mid-trade.

It’s not just you.

Historically, September’s been one of the worst-performing months for decades.

Even in bull markets, this month drags. And in bear markets slice you up if you’re not careful.

I’ve had some of my biggest wins in September, and some of my most annoying givebacks.

You can trade it, but you’d better understand what you’re walking into.

Here’s how I handle September, what to watch, what to avoid, and how I’ve stayed green this month without falling for the trap.

Why September fakes so many traders:

It’s not a dead month. That’s what makes it tricky.

It’s just alive enough to lure you in, but not consistent enough to reward aggressive trades.

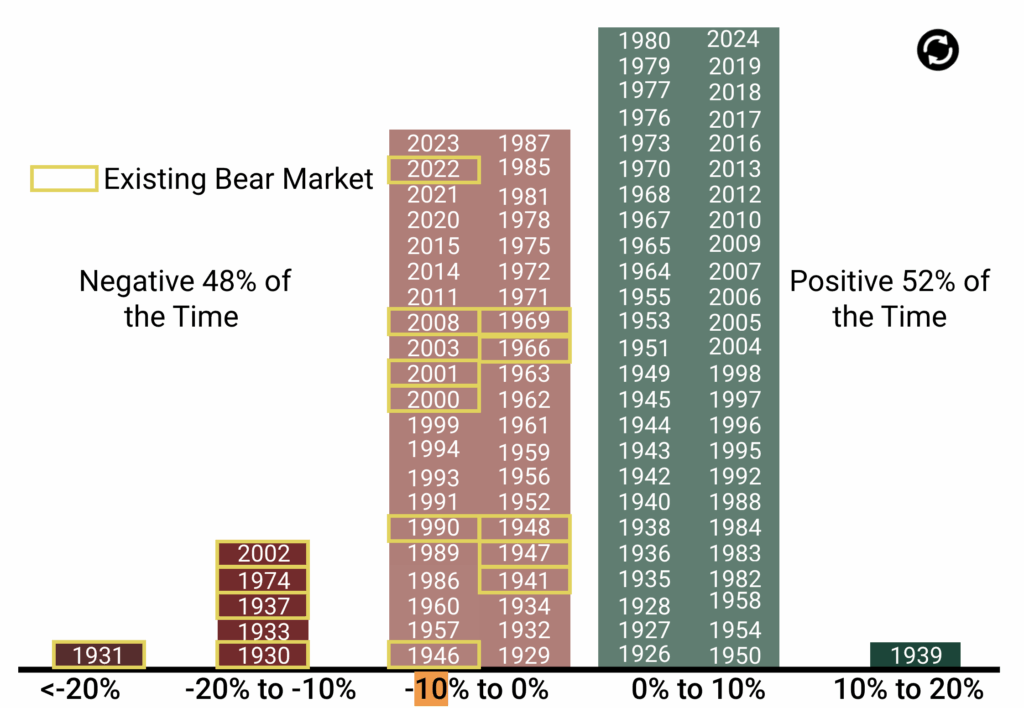

The stats back it up. September’s red almost half the time, more than any other month.

Even in good years, this one underperforms. And when the market weakens, September becomes a meat grinder.

But because traders are so ready to go after the slow summer, they push too hard too early.

One green setup makes you think the whole market’s turning.

Then you get caught.September’s track record speaks for itself.

Nearly half the time it closes red, and when it’s already a bear market, it gets even uglier.

This September’s Already Playing Games

So far this month, I’ve had some solid trades, including a big win on Opendoor Technologies Inc. (NASDAQ: OPEN), long and short.

There are opportunities if you stay focused.

But the market’s not forgiving. Momentum comes in waves, and a clean setup at 9:30 doesn’t mean anything by 10:15.

That’s why I’m staying super picky right now. One mistake and you’re back to breakeven, or worse.

Last September Proved the Point

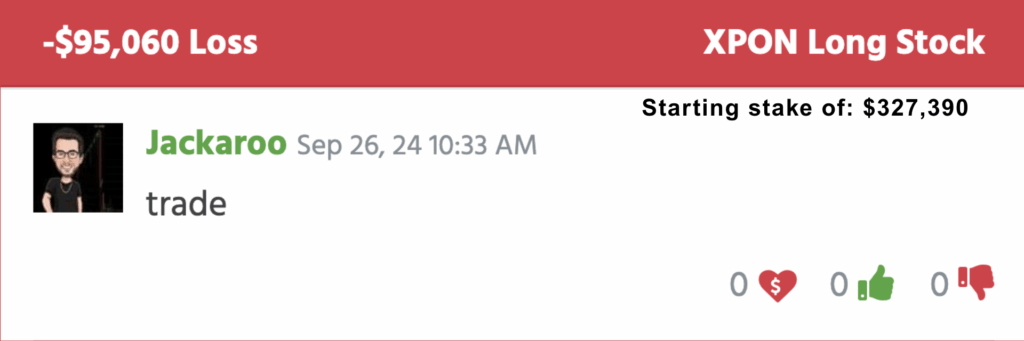

Just look at this stretch from last year:-$95,060 loss on XPON

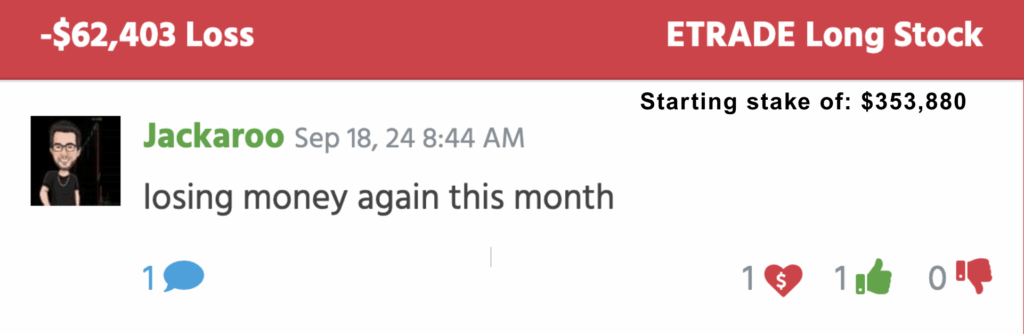

-$62,403 loss on ETRADE

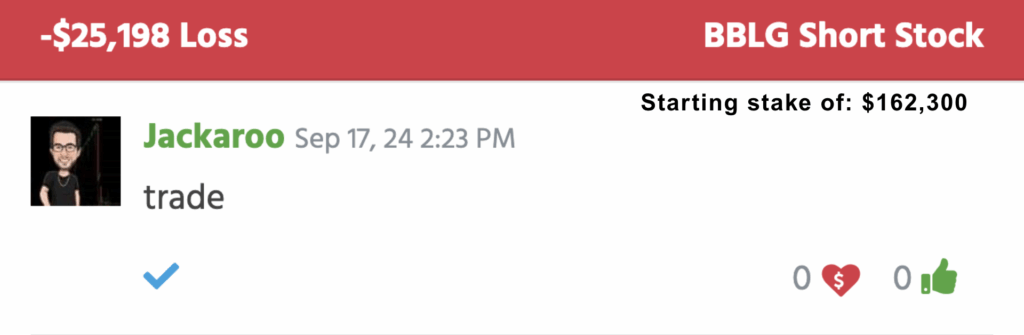

-$25,198 loss on BBLG

These were setups I thought looked solid, until they flipped.

Same week, same month, same watchlist… and just a few days earlier?

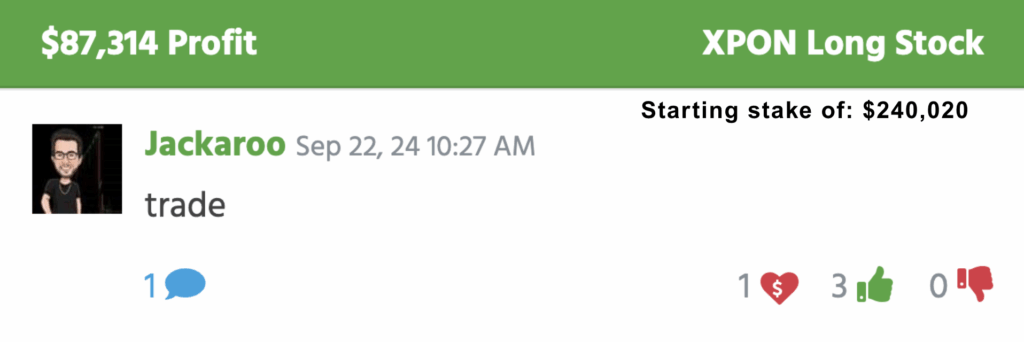

$87,314 profit on XPON

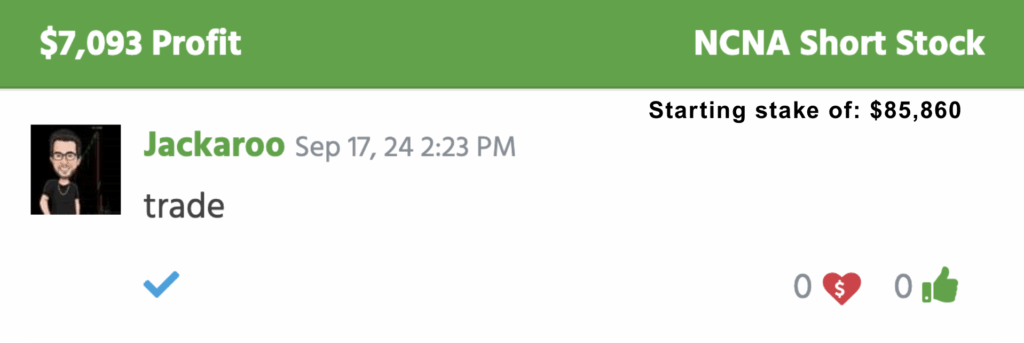

$7,093 profit on NCNA

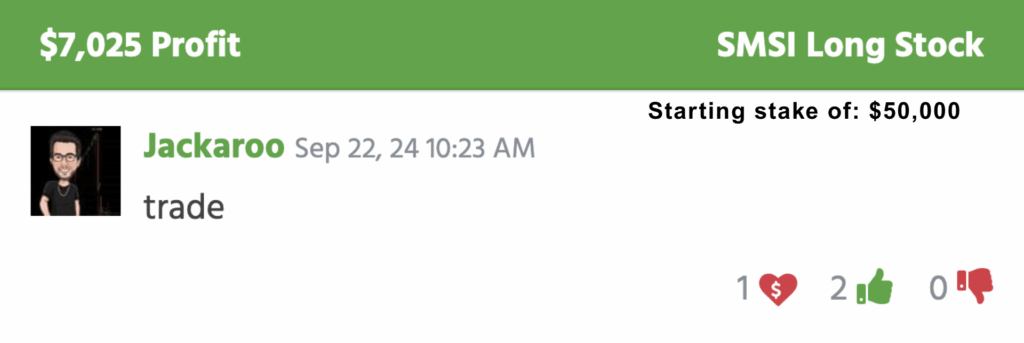

$7,025 profit on SMSI

That’s September. Hot one day, useless the next. And if you’re not adjusting fast enough, it’ll erase a week’s worth of profit in one morning.

I like to keep things stupid simple.

If one ticker’s hot, I focus on just that one.

I’m not trying to juggle ten names usually there’s only one setup actually worth trading anyway.

Everything else just looks good for a second, then fades.

Even when something does look clean, I’m not going full size right away.

September’s burned me too many times.

I’ll take the trade, but I’ll trade it like it might fail. I lock in profit quick, and if the momentum stalls? I’m out. No hesitation.

You can’t wait around hoping it bounces back, because it usually doesn’t.

And I’ve got zero interest in setups that feel “pretty good.” If I’m even a little unsure, I skip it.

This isn’t the month to get cute.

I’d rather miss something that works than get smoked by something that didn’t deserve my money in the first place.

Most days, if nothing’s there by the first hour or so, I just walk away.

Flat is fine. Flat keeps me sane. And honestly, that discipline is what separates a green September from a blown-up one.

Just because you’re at your desk early and staring at the screens doesn’t mean the market’s going to give you anything.

September, especially, loves to fake you out and waste your time.

So don’t force it.

Stay chill. Protect your confidence. Let other people burn their accounts chasing trash.

Your only job this month is to be ready.

When the real stuff starts showing up again, you’ll be the one with clear eyes.

Don’t let this month wreck you,

Jack Kellogg

P.S. I’m jumping on this webinar to break down what I’m watching, what I’m trading, and how I’m staying aggressive without getting chopped up in this market. It’s free, but spots usually go fast.