Hey traders,

For years, I thought the harder I worked, the more I’d make.

12-hour days? No problem. Staring at charts all night? Just part of the grind.

And when I was 20, that worked.

I had no responsibilities, no reason to take breaks, and a ridiculous amount of energy.

But let me tell you, keeping up that pace forever is not sustainable.

I see traders all the time pushing non-stop, thinking more screen time = more profits.

But it doesn’t. Most of the time, it just leads to exhaustion, overtrading, and worse decisions.

The best traders I know push when the market’s hot, then step back when it’s not.

They know when to sacrifice and when to cash in on the freedom trading can give you.

I’ve been shifting my own approach, focusing on only the best setups, avoiding the noise, and cutting out trades that don’t actually matter.

If you’re still grinding every single day, ask yourself: are you actually making more, or just making yourself miserable?

I’ve made some changes lately, and it’s actually helped me trade less but make more. I’ll walk you through what I’ve been doing and the setups that’ve been clicking.

The whole “hustle culture” thing sounds great until you burn yourself out.

When you’re new to trading, going all-in makes sense.

If you’re young, trying to level up fast, and have nothing to lose, putting in long hours can pay off.

But over time, non-stop grinding becomes a problem. It leads to stress, overtrading, and bad habits.

For me, the shift happened in 2023.

I made all my money in the first six weeks of the year, and the rest of the time was mostly chop.

That’s when I realized instead of forcing trades every single day, I needed to focus on only the best opportunities, the ones that actually move the needle.

Now, I trade big-picture moves.

I started this year on the right foot.

In January I was consistently pulling $80k-$200k days by sticking to my routine: bedtime at 8 PM sharp and up by 2 or 3 AM to nail those early morning setups.

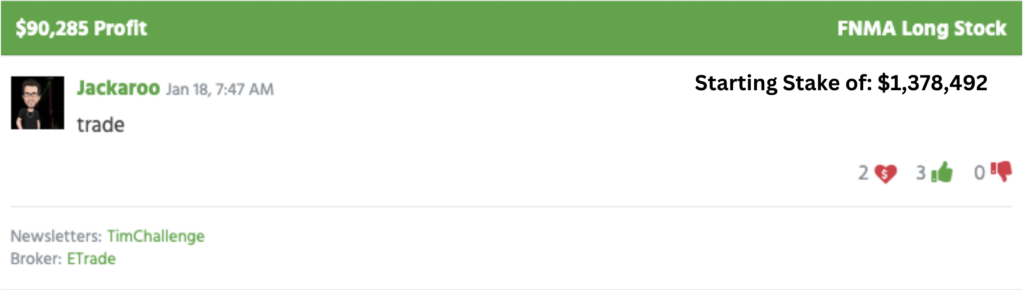

One of the cleanest trades that month was Federal National Mortgage Association (FNMA). Strong chart, big volume, clear setup.

I sized in with confidence, stuck to the plan, and locked in over $90K profit without overthinking it.

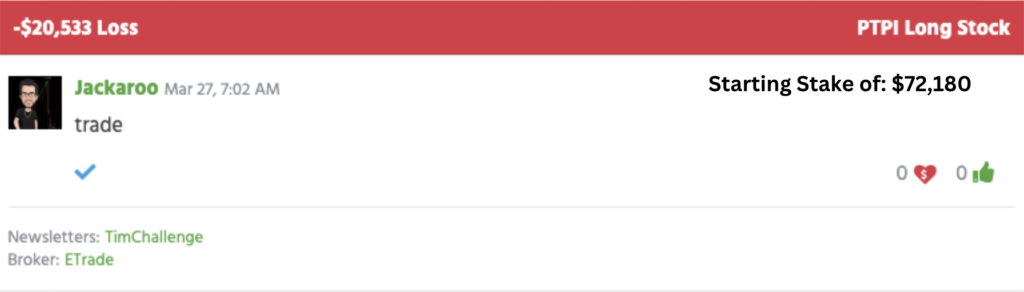

Now compare that to Petros Pharmaceuticals, Inc. (NASDAQ: PTPI). I broke my own rules, chased strength late, and turned what could’ve been a solid day into a huge loss.

If you want to trade for the long haul, here’s what actually works:

- Trade less, but wait for the best. Breakouts, first red days, first green days—only when the setup feels clean. No guessing, no forcing.

- Pay attention to cycles. Some months, I’m aggressive. Other times, I’m basically just watching and waiting. You don’t have to trade every day to make real money.

- Take care of yourself outside the market. I’m talking “dopamine detoxes”, going fishing, shutting off the phone, just turning it all off for a bit. Your brain needs that reset.

- Don’t rely on trading as your only income. It’s unpredictable. One cold streak can mess with your head if you’ve got no backup.

The goal isn’t to sit in front of a screen forever.

It’s to stack up enough wins to buy your time back.

If you’re stuck in a burnout loop, constantly overtrading and hoping something works, you’ve got to change it.

Talk soon,

Jack Kellogg