Hey, Traders,

It’s no secret I took a hit recently.

The market’s been tricky, and I made a call that schooled me.

But that’s just part of the game; sometimes you have to learn from things and move on.

At other times, regaining your confidence can be as simple as looking back on a recent win.

So, that’s what I’m doing in today’s piece.

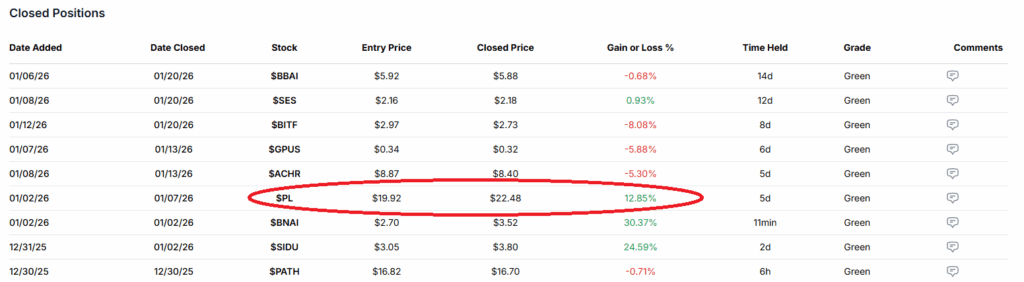

Earlier this month, I made a solid trade on Planet Labs PBC (NYSE: PL) that reminded me why patience, planning, and conviction still matter.

I took the trade from January 2–7, buying in at $19.92 per share and selling at $22.48.

That’s an almost 13% gain.

It wasn’t a crazy spiker, but it was still a nice win.

It was the kind you can stack with other small- to-moderate wins while you steadily fatten your trading account.

So, why did this one work, and what made me take the setup in the first place?

Let’s go over it.

This Is Why

First of all, the chart was clean.

PL had been basing nicely into the end of December, holding higher lows and showing strength when the rest of the market was choppy.

I had it on watch because it was starting to perk up right into the New Year.

I liked the price action, but the story behind PL was what gave me the conviction to size in.

The company, which uses satellites to take high-resolution pictures of Earth for different industries, released a better-than-expected earnings report on December 10.

Quarterly revenue hit a record $81 million, up 33% from the year-ago quarter.

This, combined with a low-key rotation into space and AI-related names, made PL more interesting.

Then, on the first trading day of 2026, the ticker popped right through the $19.75 level it had been struggling with.

The volume came in, and it held up strong through the close.

That’s when I got in there (first red arrow in the chart):

I thought that if it held trend and started to grind, I’d ride the wave, but if it failed quickly, I’d cut it.

Over the next few days, the stock climbed steadily. Each dip got bought and volume stayed consistent.

It looked like a classic trend trade.

Then, on January 7, it hit my target area near $22.50, and I locked it in (indicated by the second red arrow in the chart above).

Trust the Process

Looking back, what made this trade work was the combination of technicals and news.

It had a solid chart, real fundamentals in play, and a subtle theme building in the background — space and Earth imaging — that most people weren’t watching closely yet.

More than anything, though, this trade reminded me that I don’t need to chase or try to force things.

All I need to do is stay patient, be prepared, and wait for the setups that fit my style.

This wasn’t a crazy multi-bagger or a lightning-fast scalp, but it was clean and well-planned.

Wins like this help build confidence because they show you the process still works.

You just have to trust it.

Catch you in the next one,

Jack