Hey traders,

Not every day is worth trading. I had to learn that the hard way.

I used to trade like a maniac, dozens of trades a week, glued to screens.

But my trade logs from back then were pitiful, months of grinding for what amounted to minimum wage.

Then I met “him.”

A hedge fund manager in Chicago who made $47 million in a year… with just two trades.

When he showed me his playbook, my stomach dropped.

Page 1: Was just two charts: NVIDIA Corporation (NASDAQ: NVDA) and Tesla, Inc. (NASDAQ: TSLA), with three clean entries circled.

Page 2: 212 blank charts titled “Opportunities I Ignored.”

He leaned in and told me, “The money isn’t in trading. It’s in waiting.”

At that moment, everything changed. I went and I deleted 90% of my watchlists.

And I’ll never forget how Tim Sykes explained how most traders take 100 trades to make $1,000 when they could’ve taken 5 to make $10,000.

It hit me like a freight train, so since then, my biggest wins came from doing less.

Want to see the three signals I now wait for?

Here’s exactly how I do it, and how you can avoid the slow-market traps that are crushing traders right now.

These three setups helped me go from overtrading and barely breaking even to making fewer trades with way bigger rewards.

1. The “72-Hour Rule”

Most traders jump into stocks before they prove themselves. I don’t.

I wait 3 full days after a stock holds a key level.

The first breakout is for gamblers. The third day is for traders.

Last month, Remark Holdings, Inc. (OTC: MARK) looked hot, pumping on news.

But instead of FOMO’ing in, I waited…

Day 1: +15%

Day 2: Flat

Day 3: -40% collapse

By waiting, I avoided a disaster.

2. Institutional Footprints

Have you ever seen a stock explode and wondered who the heck is buying all that?

Most of the time, it’s not some guy in his garage with Robinhood, it’s big money. Hedge funds, pension funds, whales.

These guys don’t trade 100 shares at a time. They move millions. And they leave footprints.

One of the biggest clues is Block bids.

I’m talking buy walls of 500,000 shares or more sitting on Level 2.

That kind of size doesn’t show up by accident.

It’s not just support—it’s institutions quietly loading up before a big move.

They try to hide it, but if you’re watching closely, you’ll see the signs.

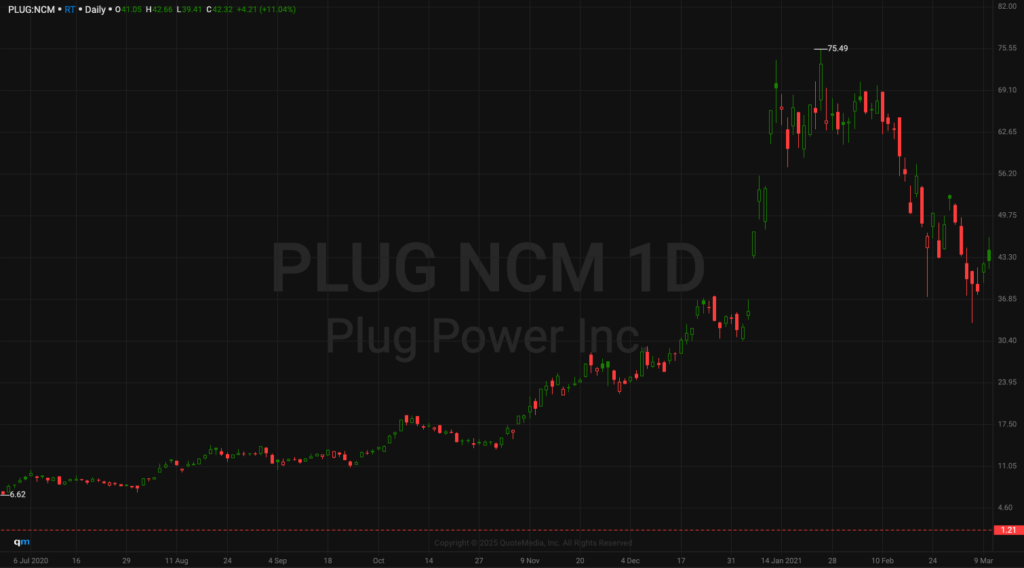

Like Plug Power Inc. (NASDAQ: PLUG), before that monster 300% run, someone slapped down an 8.2 million share bid.

Like a neon sign flashing: smart money entering here.

Now, that doesn’t mean you blindly chase it.

But when I see a giant block like that, I zoom out. I look at the chart, volume, catalysts.

If everything lines up, that footprint gives me confidence that the stock might actually go somewhere.

So next time you’re watching a stock and see a huge order that just won’t go away… it’s probably not retail.

That’s your clue to pay attention.

3. Sector Rotation

This happens when big money leaves crowded plays and moves into overlooked areas.

Traders chase yesterday’s winners while institutions quietly build positions in the next move.

The tell is in the volume and relative strength (RSI), when everything else dumps, but one sector holds bids or grinds higher.

No crash, no news, just the price accepting higher lows as weak hands get shaken out.

And by the time it’s obvious, the rotation is already halfway done.

The market’s trapping overtraders right now, and if you’re not careful, you’ll get caught too.

Choppy price action is deadly for day traders.

SPDR S&P 500 ETF Trust (NYSE: SPY) is stuck in a tight range, and low-volume breakouts keep failing.

This is the kind of environment that punishes impatience.

So look at where the money is actually going.

Big tech names like NVIDIA Corporation (NASDAQ: NVDA) and Meta Platforms, Inc. (NASDAQ: META) are holding up well, and institutions are parking their cash there.

There’s also movement in biotech, especially around FDA catalyst plays.

My number one rule right now: if the market’s giving you nothing, don’t give it anything back.

Most traders lose because they can’t sit still. The pros wait for the right pitch.

Be patient,

Jack Kellogg

P.S. The market loves humbling impatient traders. Don’t let it be you.