Hey traders,

Choppy markets test patience more than anything else.

There’s no clear trend right now. Breakouts fake out. Swings feel like coin flips. If you’re struggling to find direction, you’re not alone.

I’ve pulled way back on size lately, and I’m trading less often.

But that doesn’t mean I’m doing nothing.

This is the exact type of market where the best traders sharpen their edge.

You won’t catch me guessing what sector will heat up next. I’m stalking setups that are already showing strength.

Even if they’re slow, even if nobody’s talking about them yet.

Last week, I spent more time redrawing lines than placing trades. Just building the habit.

Figuring out where buyers step in. Watching how tickers move after a catalyst.

Some of my best trades came from paying attention to what’s right in front of me.

Like when Chinese AI names started heating up—everyone saw it, but not everyone acted.

I took a trade on Alibaba (NYSE: BABA):

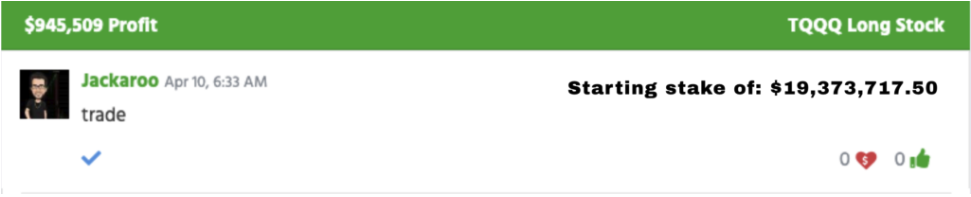

Same with ProShares UltraPro QQQ (NASDAQ: TQQQ) Tech was heating up, money was flowing in, charts were confirming strength—and I was locked in on that exact sector while most traders were still waiting around for something “obvious.”

That’s the whole game.

You don’t need to predict the next runner. You just need to stay focused on what’s right in front of you.

The tech sector was moving clean, and the Power Signal Indicator flashed green.

I traded it a few times and walked away with nearly another million.

None of that happened because I waited. It happened because I watched.

Now I’m seeing a similar setup this week. Not hype-y. Not obvious.

But it’s moving off a real catalyst—and yeah, it just triggered a Power Signal again.

When the market feels dead, I look for tickers that quietly start to move.

Lately, I’ve had my eye on USA Rare Earth, Inc. (NASDAQ: USAR).

It popped after those recent tariff headlines hit—specifically around rare earth minerals.

Most tickers that reacted to the news faded out almost immediately.

This one didn’t. It held up. Price stayed steady. Buyers kept stepping in where you’d expect them to.

I’m not watching this thing because I think it’s about to go parabolic.

I’m watching it because the move actually makes sense.

It’s tied to a real catalyst, it’s showing clean price action, and I can already tell where I’d enter and where I’d risk off.

This setup reminds me of how I approached both BABA and TQQQ—just on a smaller scale.

Back then, I wasn’t guessing what sector might get hot.

I was watching what was already trending.

Chinese AI names were spiking, volume was flowing in, the chart confirmed strength, and I got in.

Same with TQQQ—tech had clear follow-through and my Power Signal Indicator flashed right on cue. I sized in and took what the market gave me.

Now USAR is showing a similar type of behavior.

Price popped, held range, and the Power Signal just lit up again.

Not because of hype—but because the chart actually looks tradable.

I can define my risk. I don’t need to force anything.

Even if I don’t take the trade, this is exactly the type of setup I track during slow weeks.

It keeps me sharp, keeps me locked in, and keeps me ready for when the real momentum comes back.

Most traders get caught sitting on their hands in markets like this. Or worse, they overtrade garbage.

Meanwhile I just stay focused on what’s in front of me.

That’s how I caught the BABA trade.

That’s how I nailed TQQQ.

And that’s why I’m keeping an eye on USAR right now.

Stay dialed in,

Jack Kellogg

P.S. If you want to track what I track, I built the Power Signal Indicator into my system so traders can spot these moves early—even in choppy markets…