Hey traders,

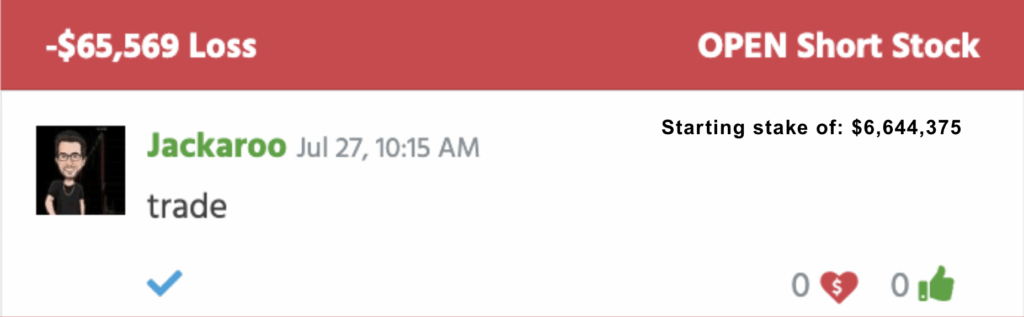

I sized into a trade last week that slapped me for $65,569.

Probably deserved it, honestly.

The setup looked solid, but I pressed too early and got smoked.

Took a step back after that. Decided to wait for better reads, better structure, and actual confirmation before hitting anything with size again.

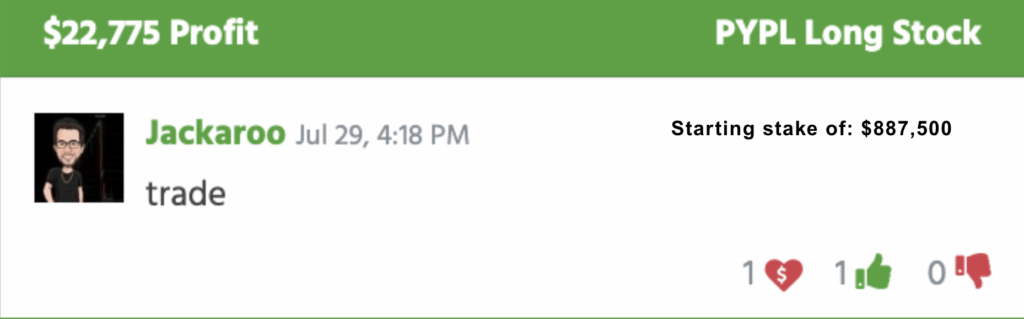

That shift paid off a few days later with a clean $22,775 win.

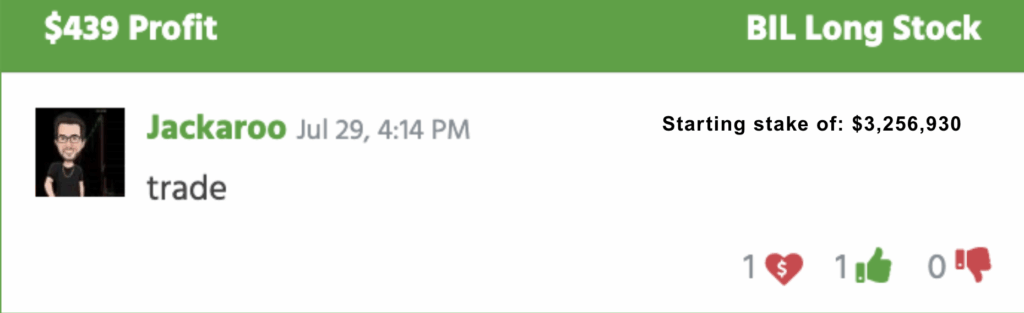

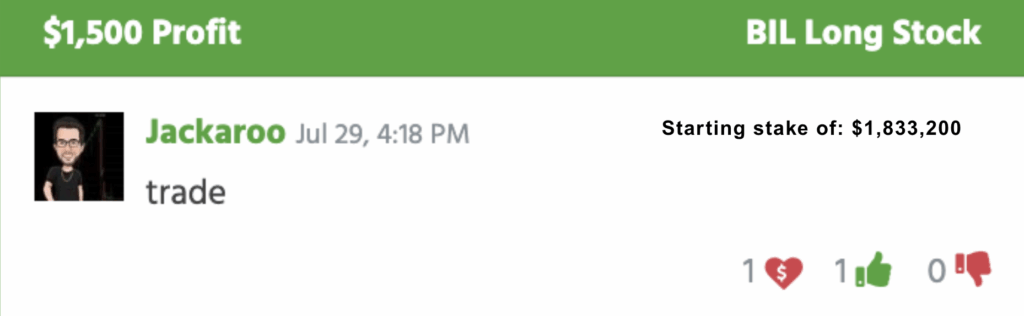

Since then, I’ve kept things tighter, and I’ve been scalping a setup that’s working almost like clockwork.

It’s not a huge range, but the fills have been clean, and the risk is nearly nothing when I time it right. I’ve hit it three times now, same entry, same feel, quick exits.

That one loss reminded me of what happens when I assume.

The trades after that reminded me how smoothly things go when I follow the tape.

This stretch has been one of the clearest reminders of what works and what doesn’t.

That loss on Opendoor Technologies Inc. (NASDAQ: OPEN) brought it all into focus.

Thought I caught the breakdown early. It had weak earnings, the chart looked soft, and I figured it would drift lower once the selling kicked in.

That’s not what happened.

Buyers stepped up way faster than I expected. I didn’t give the trade time to prove itself. I just forced it.

I realized I was wrong, and I took the $65,569 hit.

That wasn’t a “bad luck” loss; it was me front-running confirmation and assuming I knew what came next.

That kind of mistake usually shows up when I let size cloud my judgment.

I didn’t trade for a few days after that. Just watched. Let things settle.

Then PayPal Holdings, Inc. (NASDAQ: PYPL) started holding a key level into weakness.

I wasn’t looking to force anything; I just wanted something clean.

The stock tapped $71 per share multiple times and kept bouncing.

Buyers weren’t flinching. I let them tip their hand first.

Once the tape held steady, I stepped in long with 12,500 shares at $71. Sold it at $73 the same day.

That trade paid $22,775, but the part that stuck with me wasn’t the money; it was how effortless it felt when I waited for the setup to come to me.

That trade got me back into rhythm, and the rhythm showed up even clearer in the next few scalps.

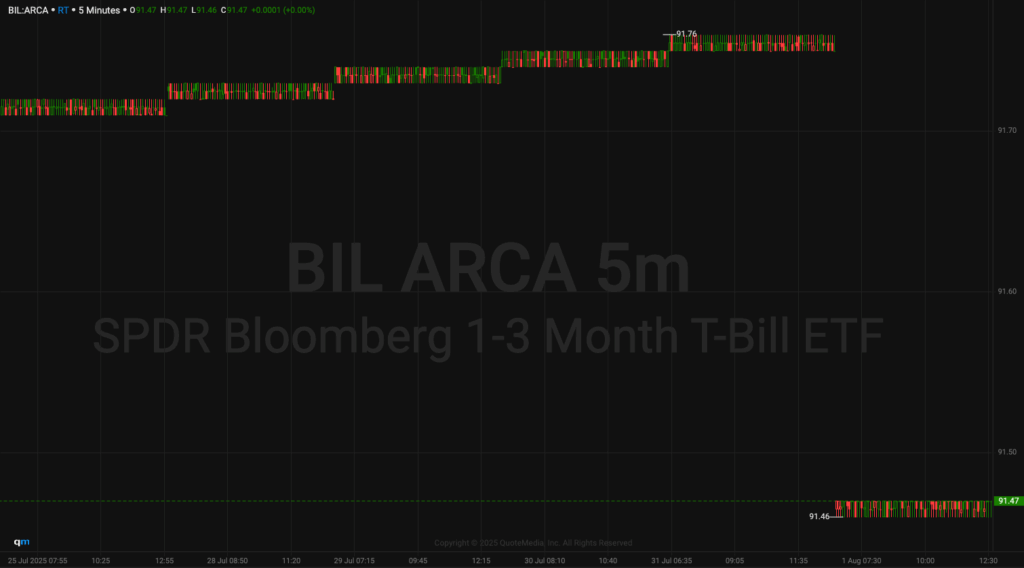

For the last week or so, I’ve been trading SPDR Bloomberg 1-3 Month T-Bill ETF (NYSE: BIL) off the same level like clockwork.

Three quick scalps, all off that $91.66 zone, it’s been the anchor.

The range looks microscopic, but the action’s been incredibly clean.

Every time it dips into that level, it finds instant support. Buyers keep stepping in, the prints stay smooth, and I’ve been able to size in with almost no heat.

What’s wild is how well that level held through multiple tests without breaking down, then it finally popped to $91.76 before settling again.

That kind of defense doesn’t happen by accident.

Someone’s soaking size down there, and if they push again, I want to be in.

BIL stays high on my watchlist this week, not for the range, but for the consistency and the potential breakout if that buyer keeps pressing.

The OPEN loss reminded me that size doesn’t fix a weak setup.

The PYPL trade showed me how clean things get when I wait for confirmation.

And those scalps proved you don’t need a wild range if your execution’s on point.

That’s all I’m doing right now, waiting for the clean ones, reacting when the tape confirms, and leaving everything else alone.

Catch you in the next one,

Jack Kellogg

P.S. Before you touch another Bitcoin trade, you need to see what’s setting up. We’re covering it today at 4:00 PM ET don’t miss this one.