Hey traders,

The market tends to slow down ahead of major decisions.

Price action becomes uncertain. Volume thins out. Traders hesitate, waiting for more clarity, especially when it comes to policy announcements that can shift the bigger picture.

In moments like this, it’s easy to feel pressure to act.

You start thinking about where the market might go, what the Fed might say, and whether you should be in before the move happens.

But trading off anticipation rarely leads to consistency.

Even if the news breaks in your favor, the timing often doesn’t. The setups aren’t clean. Volume doesn’t confirm.

And what felt like an opportunity turns into a trade you’re not fully committed to.

That’s why experienced traders don’t try to guess.

They wait. They let the market react first, not just in price, but in behavior.

Whether it’s a Fed meeting, earnings report, or sector headline, the process stays the same:

React after the market shows its hand, not before.

That shift in mindset has helped me avoid a lot of unnecessary trades and focus on the ones that actually offer a real edge.

Today’s one of those days.

The Fed decision will bring movement, maybe volatility, maybe even trend shifts.

But the best trades won’t come from guessing the news, they’ll come from recognizing what the market decides to do with it.

That’s exactly how I approached UnitedHealth Group Incorporated (NYSE: UNH) this month.

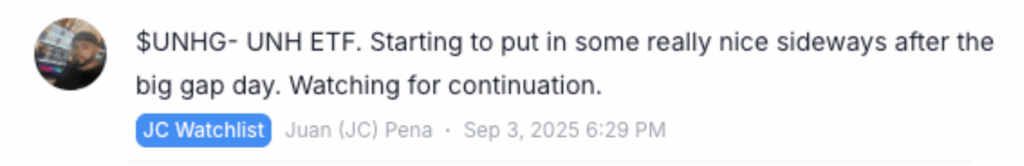

On September 3rd, JC Pena called it out in the Power Signal Alerts.

The stock had just gapped up on healthcare sector strength and was starting to hold sideways, clean consolidation after a big move.

It wasn’t a buy yet, but it was something worth watching.

Then came more positive headlines.

Analysts voiced confidence in the name, and the stock started gaining attention across the board. Still, I didn’t jump in. I let it build.

What made the trade real wasn’t the news itself. It was the way price responded after the news settled.

The chart started holding higher lows. Volume increased steadily. Buyers weren’t chasing; they were building.

That’s where the confidence came in.

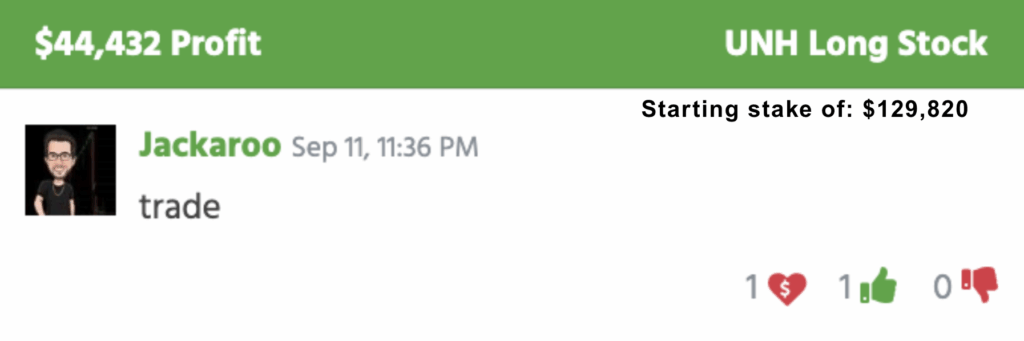

On September 11th, I stepped in with size, two entries at $264.88 and $259.64, selling both into strength..

Combined, those two trades brought in $86,102.

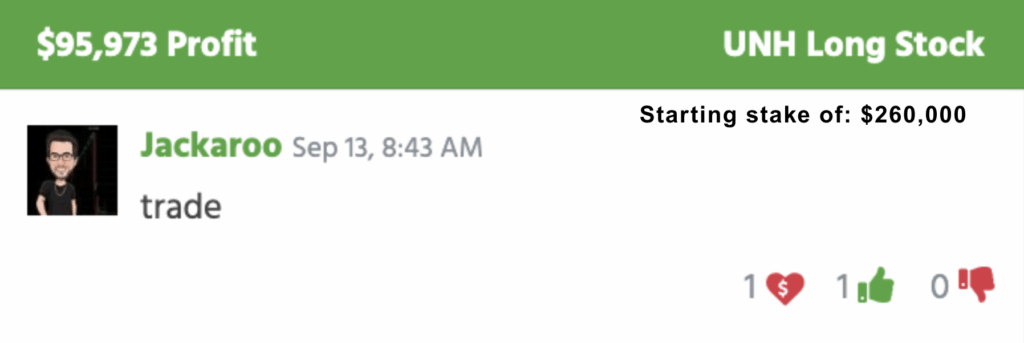

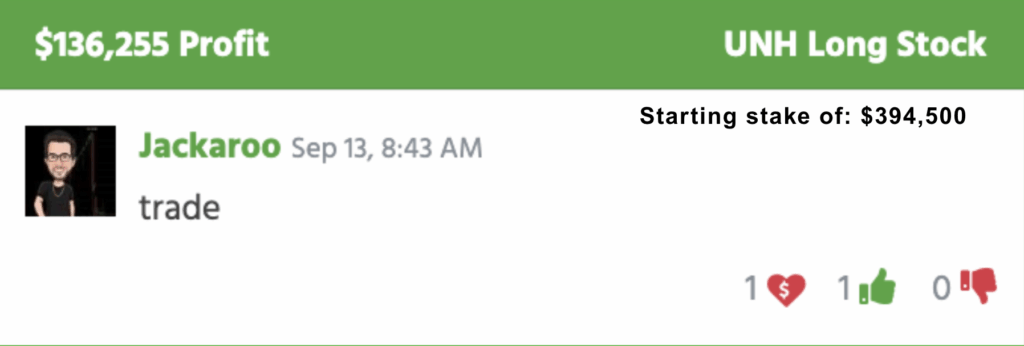

The next day, I did it again, entering at $260.00 and $263.00, exiting both positions on September 12th at $355.00.

Total profit on those: $232,228.

But here’s the point: those trades didn’t come from chasing the initial gap.

They came from letting the setup develop after the catalyst, when volume and structure confirmed what the headlines only hinted at.

Most traders rush into the move. They assume the news is enough.

But the best trades happen when you pause and wait for confirmation.

That patience can make all the difference.

Whether it’s a single stock like UNH or the entire market reacting to the Fed, the lesson stays the same:

Wait for the setup to form.

Don’t rely on headlines alone to justify a position.

That doesn’t mean ignoring the news; it means using it as a filter. A tool to narrow your focus.

A signal to watch more closely, not a green light to jump early.

As the Fed wraps up its meeting today, we’ll see movement.

That’s almost guaranteed.

But whether that movement leads to real opportunity depends on what happens after the announcement.

I’ll be watching for which names hold up, which sectors show strength, and where the follow-through lives.

If something sets up, something clean, with volume and structure, I’ll trade it. If not, I’ll wait.

I’d rather trade one clean setup after the fact than guess five times before it.

That’s how I approach catalyst-driven trading now.

And it’s worked a lot better than trying to predict the news.

Let the market show us,

Jack Kellogg