Hey traders,

Every time an AI headline hits the wire, I already know what comes next.

The herd piles into whatever stock just whispered “artificial intelligence.” Doesn’t matter if the company has no product, no revenue, and no business in AI at all.

The letters AI alone send traders chasing like it’s the next Nvidia.

And here’s the ugly part: nine times out of ten, those “AI plays” die within hours.

They’ll spike for a few minutes, maybe a couple of candles, then stall out and bleed back to nothing.

I watched it happen after DeepSeek dropped its AI model earlier this year.

For a hot second, it looked like the whole sector was catching fire.

But instead of lifting the market, Nvidia tanked 13% in a single session. And the smaller tickers barely got off the ground.

That’s the trap most traders fall into. They don’t wait for proof. They just buy the story, and the story alone never pays.

The AI story sells itself. Every week, there’s a new headline about game-changing models, record spending, or companies reinventing themselves with “artificial intelligence.”

But as traders, headlines alone don’t pay.

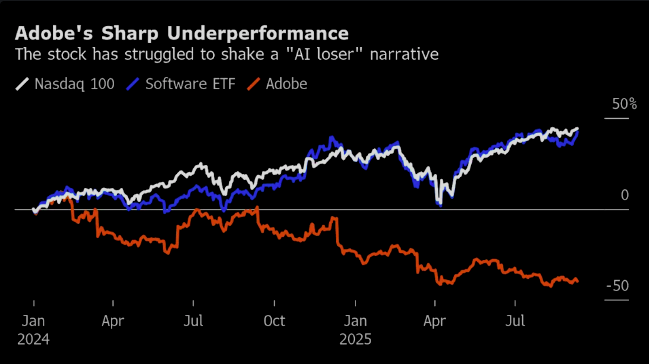

Look at what happened when Adobe Inc. (NASDAQ: ADBE) reported earnings not long ago.

They bragged about AI adoption across their products, beat Wall Street estimates, and still the stock fell more than 2%.

Investors didn’t buy the hype. The demand wasn’t there.

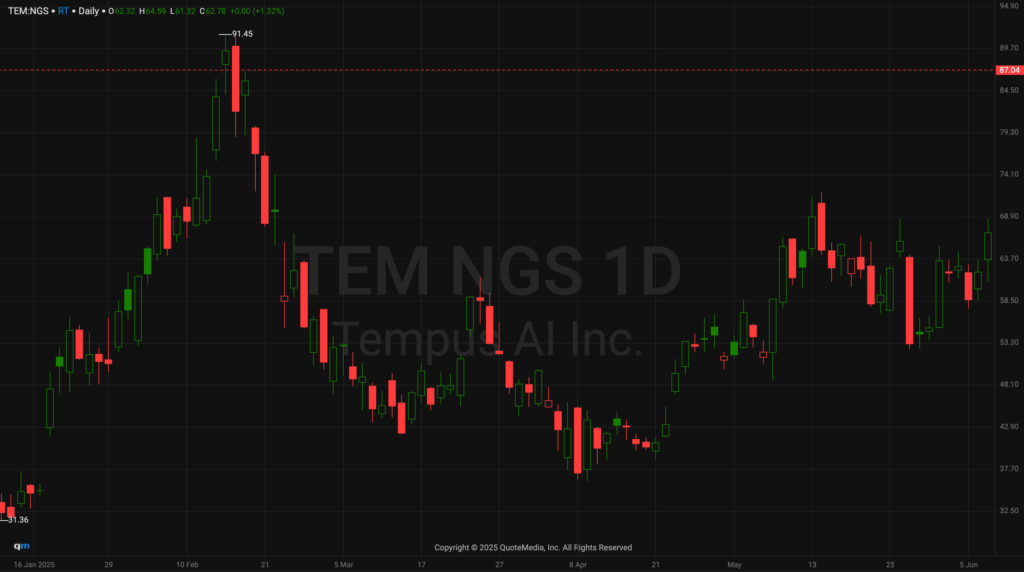

Or take Tempus AI, Inc. (NASDAQ: TEM).

News broke that the FDA cleared one of their imaging platforms.

The stock spiked more than 13%, which is a monster move at first glance.

But almost immediately, sellers stepped in. Profit-taking sucked the life out of the breakout, and the run stalled before most latecomers could react.

That’s the lesson. A catalyst alone doesn’t create follow-through.

A press release or a fancy demo means nothing unless real buyers step in behind it.

Without juice, volume, momentum, and confirmation, you’re just holding a bag with a buzzword attached.

If you want help filtering hype from setups that actually have juice, I walk through exactly how I do it inside my training. You can check it out here.

When I look at AI trades, I don’t care what the press release says.

I care about whether the demand shows up on the chart.

Strong volume at a breakout level tells me institutions are buying. That’s juice. No volume? No trade.

This isn’t just an AI problem; it’s every hot sector. EVs, weed, crypto, biotech… the cycle repeats every time.

The first wave of hype creates opportunity, but most of the late-stage plays turn into traps.

So here’s what I want you to take away: don’t let the headline make your decision.

The story may grab attention, but the chart tells the truth. Wait for juice before you commit.

Because hype drains accounts. Juice builds them.

Stay patient,

Jack Kellogg