Hey traders,

I hate to admit it… but I still make dumb mistakes.

Even after wiring out over a million bucks.

The other day I revenge traded a garbage setup—chased a low-float with no plan just because it felt like it should go. I got smoked. And I knew better.

You’d think by now I’d have this thing mastered. Truth is, success doesn’t fix your habits. If anything, it makes it easier to cheat on your rules when things get slow or you’re feeling too confident.

I’ve been journaling a lot lately—trying to stay sharp—and three patterns keep showing up. Not chart patterns. Mistake patterns.

Stuff I still catch myself doing from time to time, even though I know better.

Here’s what I wrote down:

- I trade boredom

- I size too early

- I revenge trade after losses

Sound familiar?

Let’s talk about each one.

Mistake #1: Trading Boredom

Quiet days are dangerous. No action. No volume. But you still want to feel like a trader.

That’s when I go hunting. Scan too long. Convince myself a C+ setup has “potential.” Next thing I know, I’m stuck in some illiquid junk getting whipped around.

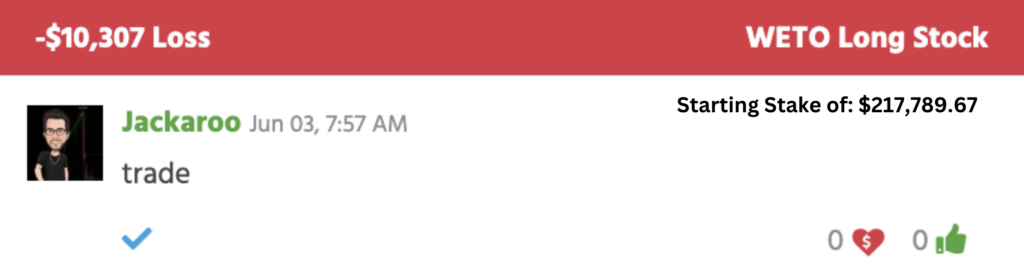

On a slow Monday, I jumped into WETO—no plan, no catalyst, just vibes. It looked “active” on the scanner, so I convinced myself it had potential. I dropped in over $217K on the entry… all for a -4.7% fade I never should’ve touched.

That was me trading out of boredom, not strategy.

When the market’s slow, I switch to “watch mode.” I study charts, track hot sectors, build watchlists—but I don’t need to trade. Some days the best move is no move.

Now I even write the trade as if I’m taking it, with full entry/exit plans, but don’t hit the buy button. If it works, cool—I was prepared. If it doesn’t, I saved money.

Mistake #2: Sizing Too Early

I get hyped on A+ setups. Especially if it’s one of my favorite patterns. And I’ll size up early—way before the move confirms.

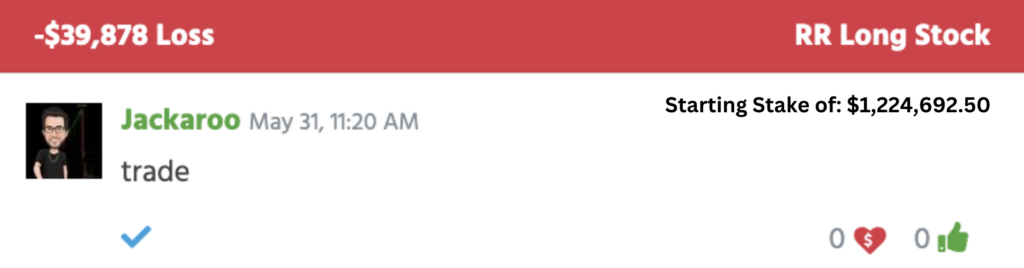

I’d just had a big green trade on RR the day before. So when it started perking again, I got excited and slammed size—over 500,000 shares.

I didn’t wait for confirmation. I just assumed it’d run again. That assumption cost me nearly $40K. The setup never confirmed. I was just early. And heavy.

Sometimes it works. Most of the time, I end up taking a paper cut… or worse.

I remind myself: “Let the stock prove it.” I start smaller. Let the move confirm. Add when it starts working. Press when the market agrees—not when I want it to work.

Sizing up should feel like a reward, not a gamble. Earn it.

Mistake #3: Revenge Trading

This one hurts the most.

One loss, I get frustrated. Two losses, I start forcing. Before I know it, I’m in back-to-back-to-back trades with zero setup and full ego.

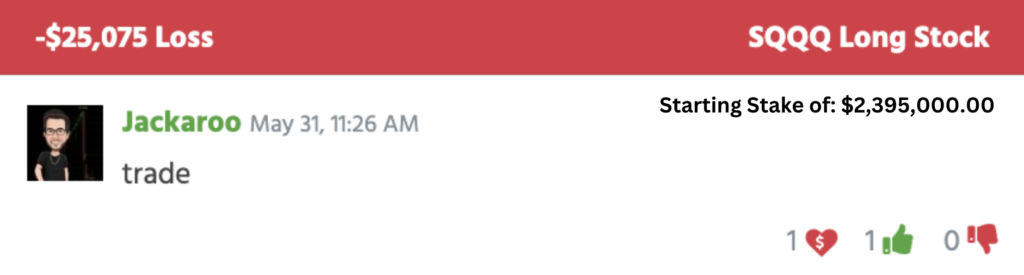

I started May 31 in the red. I took hits on all my other trades for the day… and then tried to claw it back with SQQQ.

No real edge—just emotion. I wanted a win, fast. So I slammed 100,000 shares and hoped it’d bounce. It didn’t.

That one trade added another $25K loss to an already sloppy day.

Revenge trading never works. I should’ve walked away.

Now, when I take a red trade, I close the laptop. Seriously. I go outside. Touch grass. Take a walk.

If I don’t reset, I spiral. If I reset, I trade smart the next day and usually make it back clean.

No trader outgrows discipline. I used to think success meant fewer mistakes. Now I know it means catching them faster and adjusting before they get expensive.

So if you’ve been:

- Forcing random trades

- Sizing like a maniac

- Chasing after a red

…then maybe it’s time to tighten things up.

That’s exactly why I built the Power Signal Indicator, not for perfect traders, but for people who need a structure when the market’s messy or the mental game starts slipping.

Want to give it a shot? You can test drive the full system for 30 days.

Stay dialed in,

Jack Kellogg