Hey traders,

You can find the right setup.

You can build the perfect watchlist, catch the catalyst, and map out every level on the chart. You can know exactly what you want to see, and still walk away with a result that doesn’t match the plan.

That disconnect happens more often than traders like to admit.

The setup looks right. The idea makes sense. But something in the execution goes off track. Maybe the entry comes too early, or the size is too big. Maybe there’s hesitation, a late chase, or no clear exit plan when things start moving.

That space between seeing a good trade and actually trading it well is where most traders struggle, not because they don’t know what to do, but because the emotions in the moment make it harder to do what they planned.

You can’t control the outcome of a trade. But you can control how you approach it.

The way you execute it says more about your consistency than the quality of the setup ever will.

Execution is the difference between potential and progress.

When you understand that, you stop obsessing over finding the “perfect” chart and start focusing on how you show up when the opportunity is right in front of you.

That’s where growth happens. That’s where consistency begins.

There’s a moment traders don’t talk about often.

It happens after the research, after the scanning, after you’ve done everything right in theory. You spot the setup, recognize the opportunity, and tell yourself you’re ready. Then, something changes. Not in the chart, in you.

Doubt creeps in. Or urgency. Sometimes both.

You question whether it’s too early. You wonder if you sized too heavy, or if you should have waited for confirmation.

The trade you were confident in just minutes ago suddenly feels different. Not because anything major has changed but because the pressure of executing it has arrived.

That pressure is where most traders break from their process.

They don’t freeze because the chart changed. They freeze because their emotions took over.

The truth is, spotting setups becomes easier with time. Once you’ve studied enough, patterns start to show themselves. You begin to recognize structure, volume, momentum — and you start anticipating where opportunity might come from.

But turning that recognition into a well-executed trade is something else entirely.

That requires a process that’s grounded enough to stay clear when emotions rise. It means knowing your size ahead of time, being honest about your risk tolerance, and having the discipline to wait for the conditions that align with your strategy, not just your hope.

Good trades don’t start with adrenaline. They start with preparation.

The difference between a winning trade and a frustrating one is rarely about the setup itself. More often, it’s the decisions that happen once you’re in it.

- Are you adjusting your plan because of the market or because of fear?

- Are you letting a pullback shake you out of a trade you still believe in?

- Are you holding too long because you don’t want to be wrong about the exit?

These aren’t technical problems. They’re emotional ones. And every trader has felt them.

What helps is coming back to the idea that consistency doesn’t come from predicting moves it comes from preparing for them, and then sticking to your process when the moment shows up.

That means taking size that allows you to stay calm and focused.

It means knowing your stop before the trade starts, and committing to it.

It means accepting when your plan gets invalidated and having the strength to walk away clean.

The setup may create the opportunity, but your execution is what gives it a chance to work.

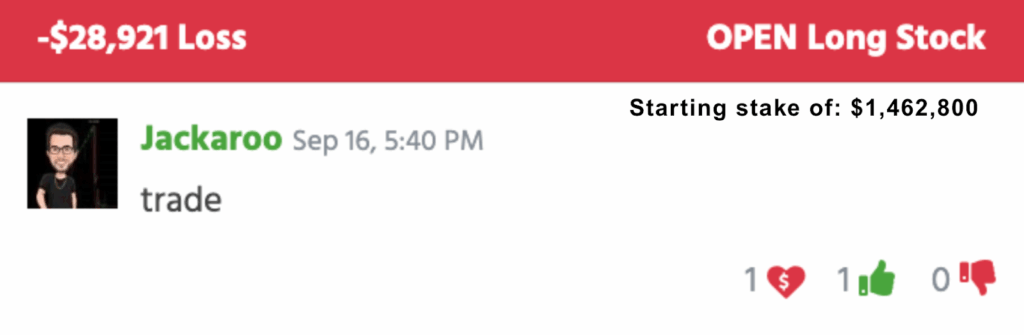

I saw this recently in a trade with Opendoor Technologies Inc. (NASDAQ: OPEN).

It was a setup I knew well, one I’d already traded multiple times that week. I felt like I had the read. The chart looked strong, the volume was coming in, and I didn’t want to miss the move.

So I took it.

But I didn’t size the trade based on confirmation. I sized it based on conviction.

When the stock didn’t push, I held on. It dipped a little, and I told myself it would bounce.

It dipped more, and I tightened up mentally, but not on the chart.

When I finally exited at $9.05, it wasn’t because my stop got hit. It was because the pressure finally did.

That 15-cent move cost me $28,921.

Not because the setup was bad, but because the execution wasn’t clean.

I was too early. Too big. Too certain.

And in the end, the trade didn’t fail. I just didn’t give it the structure it needed to work.

The most frustrating trades were rarely about being “wrong”; they came from moments when I didn’t follow through on what I already knew.

Sometimes that meant jumping in too early because I didn’t want to miss it.

Other times, it meant cutting a position I should have stayed in because I let a minor dip feel bigger than it was.

On the flip side, some of my best trades didn’t look that special on the surface. But the plan was clear, the execution was steady, and the result reflected that.

That’s what makes the difference over time. Not the chart, not the news, the way you handle the trade once it’s live.

Next time you spot a setup you like, pause and ask:

- Do I know my size?

- Do I know where I’ll stop and where I’ll scale?

- Am I reacting to the chart, or to fear?

You don’t need more setups. You need more control when the right ones show up.

And that comes from building a process you trust enough to follow, even in the moments when it’s hardest to stay calm.

That’s what separates good traders from inconsistent ones.

And it has nothing to do with finding the perfect chart.

Talk soon,

Jack Kellogg