Hey traders,

Let’s kick off the week with a reminder:

Just because a stock goes green doesn’t mean it’s a good first green day setup.

Most of the time, it’s not.

I’ve seen so many traders chase the first bounce they see and call it a pattern.

But unless that stock’s a former runner, closing strong, and pushing big volume, it’s probably just noise.

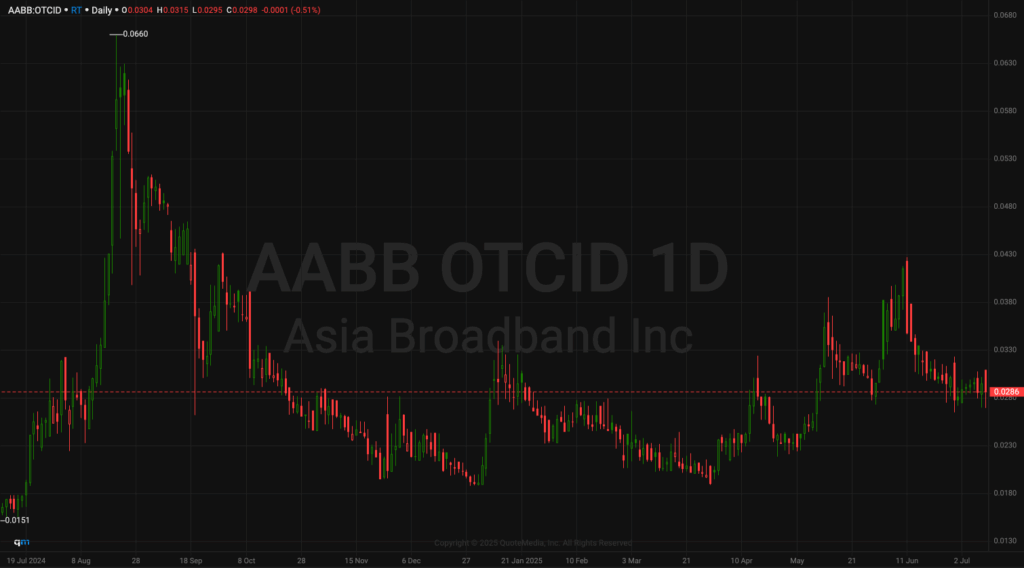

Asia Broadband, Inc. OTCPK: (AABB) gave a perfect example recently.

That thing has supernova history, real hype around its gold-backed crypto project, and it perked late day with range.

That’s a setup. That’s a real first green day worth stalking into the close.

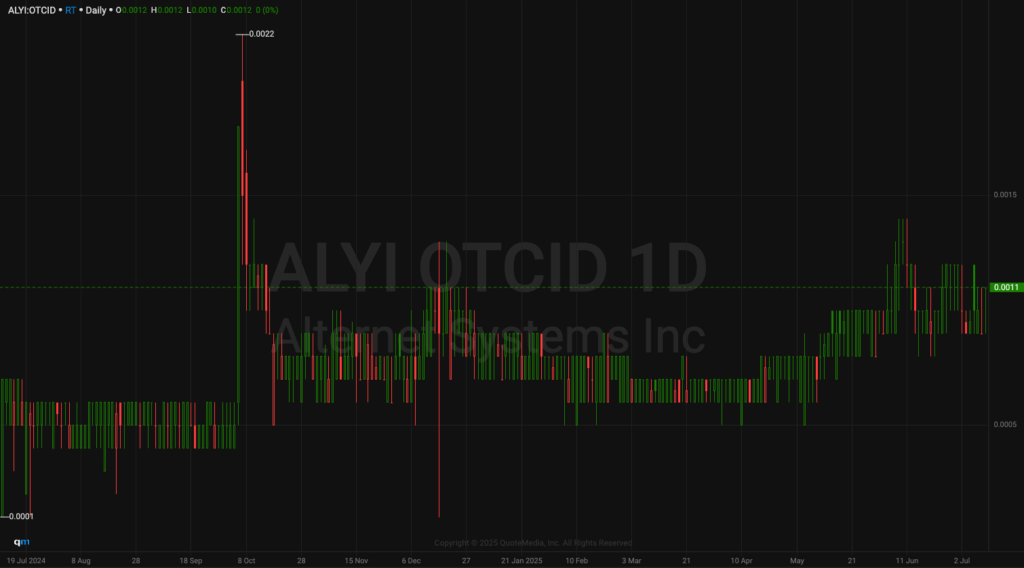

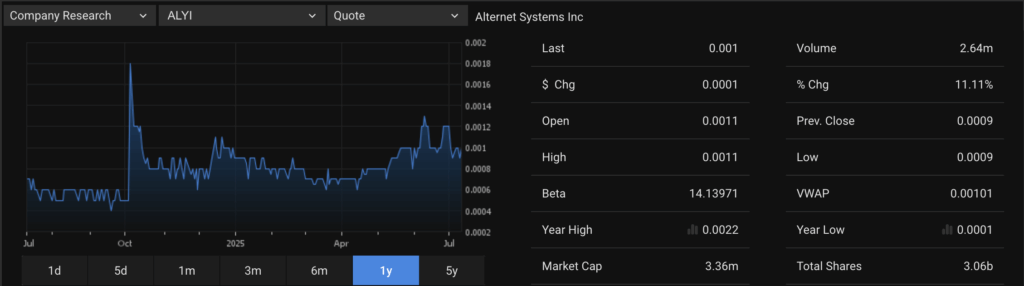

Now compare that to a ticker like MBAK Energy Solutions Inc. (OTCPK: ALYI)

Another former runner, but it’s been dead lately.

It had a little pop on a press release, then faded hard the next day.

That’s what I call a “one-and-done.”

Looks decent on the surface, but no juice behind it. No volume, no trust, no follow-through.

So what makes a first green day actually worth trading?

It’s not just about seeing green candles or a big intraday spike.

I’m looking for a specific combo that increases the odds of follow-through.

Let me break it down…

1. Former Supernova:

If a stock ran big before, like doubled, tripled, or went full face-melter mode, it has what I call “runner DNA.” Traders remember it.

They’ve seen it rip in the past, so they’re always looking for a reason to chase it again.

When a former supernova perks up again after weeks or months of doing nothing, it grabs attention fast.

That memory is powerful. And it helps fuel the next move.

2. Big Percent Gain on Volume:

I’m not touching a stock up 3% with weak volume. I want to see something actually move.

Like 20%, 30%, 50% or more, with volume that proves there’s real interest behind it.

Anyone can pump a stock up a few pennies. That doesn’t mean it’ll hold.

But when there’s volume, millions of shares traded, it means people are involved.

That’s what creates opportunity.

3. Strong Close Near High of Day:

This is huge. Most fakeouts fade into the close.

You get a little morning spike, then the thing just bleeds the rest of the day. I want the exact opposite.

I want a stock pushing into the close, preferably finishing near the day’s high.

That shows buyers want in, even late. And that pressure can spill into the next day’s open.

4. No Heavy Resistance Above:

Even if everything else looks great, I’m checking the daily chart.

Are there any obvious walls above? Prior failed breakouts? Ugly candles that trapped traders?

If the stock’s bumping into a bunch of past resistance, I’m cautious.

But if it’s clearing levels and has room to run, now I’m interested.

5. Tied to a Hot Sector or Story:

You’ve seen it: AI, Bitcoin, EV, weed, when a sector’s hot, everything in that space can move.

If it fits the theme everyone’s chasing that week, I’ll absolutely pay attention.

And remember, a weak company in a strong sector can still give you a great trade.

All five of these things together are what make a true first green day setup worth stalking.

But if you’re only getting two or three of these? You’re gambling.

I don’t care how nice it looks at 10 a.m. I want the close to look better than the open.

If it’s real, day two usually gives a gap or a second push. If it’s fake, you’ll know fast the next morning.

The best part is you don’t even need to catch the bottom.

You just need to show up prepared when the right setup proves itself.

That’s how you win consistently,

Jack Kellogg

P.S. Tim Sykes just announced the $100K Summer Summit. He’s breaking down patterns like this and sharing trade plans for the rest of summer. Traders who take this stuff seriously have already grabbed their spot.