Hey traders,

A lot of traders feel stuck right now.

They’re waiting for things to settle, for the headlines to quiet down, for some kind of confirmation that it’s safe to step in again.

I get why—it’s been nonstop this year. One day it’s tariffs. The next it’s a stalled trade deal.

Then it’s Trump warning about “disturbances,” or the Treasury pushing negotiations into summer.

But while everyone else has been watching and waiting, I’ve stayed active.

I’ve stuck to a system that’s worked through all of it.

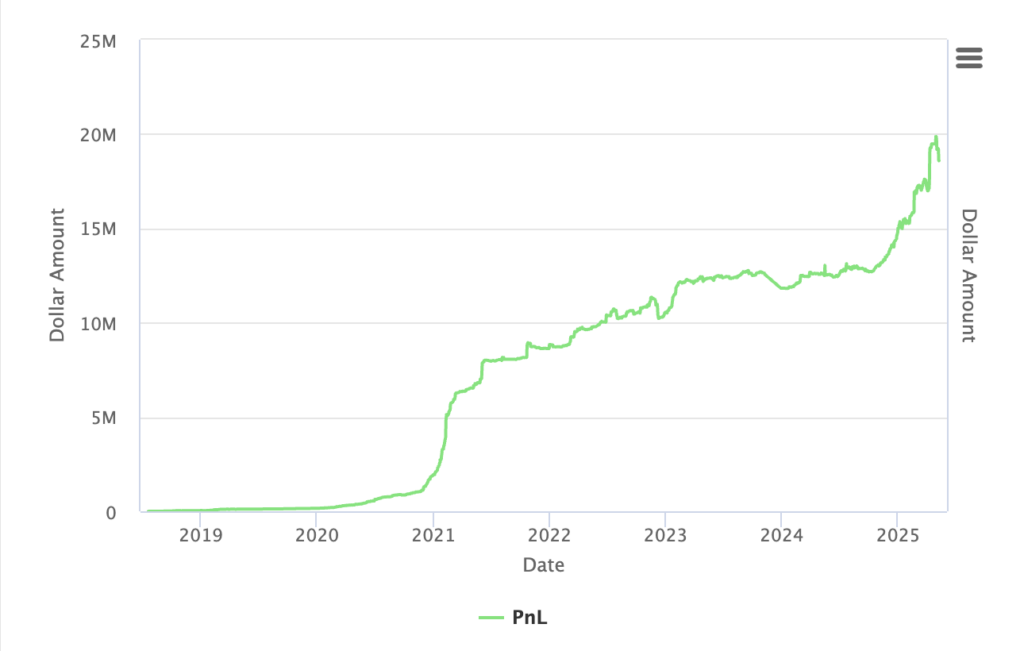

Since January, that approach has helped me generate over $4 million in profits, and it’s not because I’m making massive bets or predicting what politicians are going to do next.

I’m reacting to what the market gives me. That’s it. When volatility hits this hard, price tells the story before the headlines catch up.

That’s why I’m not stepping aside or playing it safe.

I’ve seen this kind of market before—plenty of times. It’s fast, unpredictable, and messy, but it’s also full of opportunity if you know what to look for.

I’ve built a strategy that doesn’t get shaken out by the chaos, it actually thrives on it.

And right now, there’s something happening under the surface that’s creating some of the cleanest setups I’ve seen in years.

Let’s clear something up real quick…

A trade war isn’t just politics.

It’s not just tariffs or tweets.

It’s a full-on disruption in how capital flows.

When countries like the U.S. and China start slapping fees on each other’s imports, it doesn’t just affect factories—it hits currencies, commodities, retail, tech, shipping… everything.

It throws a wrench into normal expectations, and that’s when traders like me step in.

Because while long-term investors wait around hoping things settle down, I’ve been using the volatility to hit bigger moves in shorter windows.

Since January, I’ve made over $4 million.

Not from forecasting headlines, but from reacting to price action created by those headlines.

And now, the whole market’s caught in this tug-of-war again.

There’s confusion around tariffs. More delays in negotiations. Even Trump said to expect a “disturbance.” That’s all fine with me.

Because the setups I look for thrive on that kind of instability.

Tomorrow night at 7PM ET, I’m going live to walk through the exact process I’m using right now.

I call it my Trade War Lifeline.

This strategy came from experience—cycles where nothing made sense until price started tipping its hand.

Once that momentum kicks in, you’ve got to be fast and focused.

I’ve seen this play out in 2020, 2022, and now again in 2025.

The traders who stay reactive (who have a real plan) can stack wins while everyone else sits out.

Tomorrow night, I’ll show how I:

- Find the tickers with the strongest momentum

- Time entries without getting faked out

- Avoid traps that most traders walk right into

- Manage risk without giving trades too much room

Plus, I’m giving away one trade idea during the event that I believe could double in the next 12 months—regardless of how this trade war shakes out.

It’s not some flashy gamble. It’s the kind of setup I’ve traded over and over again when conditions line up like this.

And make no mistake—the window for this won’t stay open forever.

Once the market starts absorbing this next phase of tension, things will shift. That’s why I’m going live tomorrow; to show you how I’m catching it in real time.

>> Join Me Here <<

See you Thursday at 7PM.

Jack Kellogg