Hey traders,

Last week brought a few solid setups. Some played out well, some didn’t.

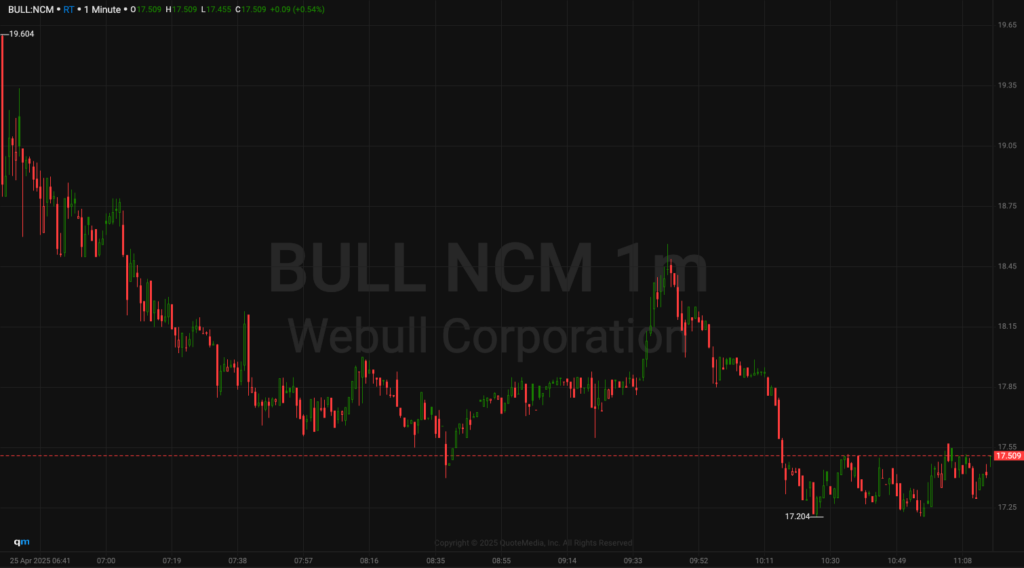

One name, though, kept offering clean opportunities.Webull Corporation (NASDAQ: BULL) gave me three separate trades that followed the same system I’ve relied on for years.

Each one looked different, but the process stayed the same.

The first trade came after the stock held above a breakout level with strong volume.

I bought strength, scaled out into the move, and didn’t overstay.

Later, BULL pulled back to support and reclaimed a key level with size on the bid.

I stepped in again, waited for the push, and trimmed into strength. It felt like the kind of trade that rewards preparation, not speed.

The third setup looked tighter—smaller size, faster scalp, but still followed the structure.

That sequence brought in over $60,000 total across those trades.

I didn’t try to force anything. I didn’t chase. I saw an opportunity, stuck to the process, and acted when the edge appeared.

If your trading feels reactive or scattered, this could give you a better way to approach repeat setups without getting stuck in bad habits.

BULL paid me three times.

The key was not getting distracted by noise or trying to predict the next move. I focused on what the chart gave me.

The first trade came early.

BULL pushed through a breakout level with volume and held above it.

I waited for the confirmation, took a position near $42.82 per share, and sold into strength at $44.44.

The setup followed a pattern I trust. The risk made sense, the range was there, and the trade played out the way I expected.

Later, the stock sold off. It held support near $24 per share, started to build, and eventually reclaimed that level with real size stepping in.

That was the second trade. I took 10,000 shares at $24, and sold into the push to $26.75.

It was a clean setup that paid well because I stayed patient.

The third trade happened a bit quicker.

The stock gave a small window with tight risk, so I sized down and took 2,000 shares around $25 per share, selling shortly after at $26.03.

This one wasn’t about big gains—it was about continuing to execute the process correctly.

Across all three trades, I stayed inside the system.

I didn’t need to call the top or bottom. I just needed to read the chart, control risk, and take profits where the setup allowed.

That’s what I teach in Seven-Figure Cycles.

Each month, I outline the patterns I’m watching, the names I plan to trade, and the way I structure each setup.

Then, when things start to move, I send real-time alerts so members can see how it all comes together.

I don’t treat the market like a guessing game.

I look for repeatable setups and follow price action with a plan.

Last week, BULL gave me three chances to do that.

I traded other tickers as well, but this one stood out because of how consistent the structure looked every time.

Most traders miss out on these moments because they either overcomplicate the setup or abandon it after one trade.

When something’s working, I don’t move on just to chase the next shiny thing.

I stay focused and wait for the next clear opportunity, then I take it if the structure’s still there.

If you want to see how I build that structure every month—and how I turn it into trades like these—make sure you check out this week’s breakdown.

Stay focused,

Jack Kellogg

P.S. If you’re still guessing out there or hopping from one random play to the next, the Challenge gives you structure. You’ll learn how to spot these repeat setups, how to manage risk like a pro, and how to trade with purpose—just like I did with BULL last week.