Hey, Traders,

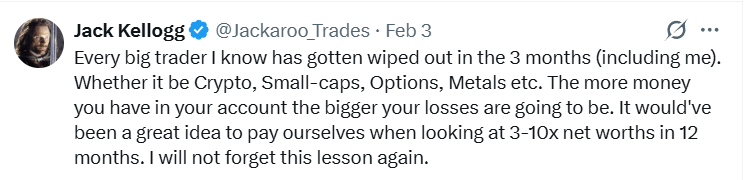

Let’s just get this out of the way right now: The market’s been rough lately, and many of us — myself included — have been taken to the cleaners along with it.

Anyone who says otherwise is either not trading size or lying to your face.

And while losses are just part of the game, the lessons they impart still sting sometimes, as I posted earlier this week:

Because of that, I want to talk about how I’m handling things now and how to move forward gracefully, even when the market clocks you.

Because it can, it will, and it does — sooner or later.

If you’ve also taken a hit recently, I want you to understand, first and foremost, that it doesn’t mean you’ve lost your edge.

All it means is conditions have changed.

Areas like crypto and precious metals went from hot to violent really FAST, and others that looked clean suddenly just … weren’t.

It happens.

So, instead of blowing up because you’re pretending you didn’t lose, or getting emotional about your losses, stop right there.

Let’s get a handle on this before it handles us.

Patience, My Friend

I’ve been trading long enough to know that when I start feeling frustrated, the market is telling me to slow down instead of sizing up.

The lesson is you don’t get paid to be right. You get paid to manage risk.

When markets are choppy, conviction can be dangerous, and being flexible is much more important to your financial health.

Since I’ve been trading full time — almost a decade now — I’ve had setups that worked for months suddenly evaporate within days or weeks.

So, instead of responding to an uncomfortable shift by forcing trades, I’ve learned to step back and ask myself one simple but powerful question:

“What is the market rewarding right now?”

This time, the answer is patience.

That means making fewer trades with smaller size and using faster stops with zero ego involved.

Frankly, I don’t care how good a thesis sounds if price action isn’t confirming it.

Hope isn’t a strategy, and neither is revenge trading after a red day.

The Fear-Greed Continuum

Another thing traders struggle with during drawdowns is considering the bigger picture.

A loss in crypto or precious metals feels huge when you’re staring at it, but in the context of a full trading career, it’s just noise if you can learn to control your risk.

The damage comes when you break rules to “make it back.”

I did that early in my career and it never ends well.

So, to reset after losses, I go back to process: entries, exits, and position size.

I journal every trade, especially the bad ones, so I can better spot my errors and the patterns I followed at the time.

I ask myself, “Was I early? Was I chasing? Was I trading bored?”

Most of the time, the answer isn’t complicated and neither is the mistake.

I also remind myself that no market moves in a straight line forever.

Crypto, metals, small caps, and large caps all run in cycles driven by fear and greed.

When something goes parabolic, it cools off eventually. When it implodes, it stabilizes at some point.

Keep on Keeping On

As traders, our job isn’t predicting a stock’s exact turn but surviving until the next clean opportunity presents itself.

To do that, you have to respect your red days and take gains faster, regardless of how far a ticker keeps on running.

It’s difficult, sometimes, but necessary.

If a trade doesn’t work quickly in this environment, I’m out because I know I can always get back in.

Traders who make it long-term keep their losses small and their confidence intact.

Confidence doesn’t come from winning every trade, either; it comes from trusting your rules, even when things aren’t working.

That’s another necessary evil.

If your account is down right now, I’m sorry, but ultimately it means you’re still in the game.

Markets are always going to test you. Losses will always show up.

What matters most is how you respond to them.

Stay focused,

Jack