Hey traders,

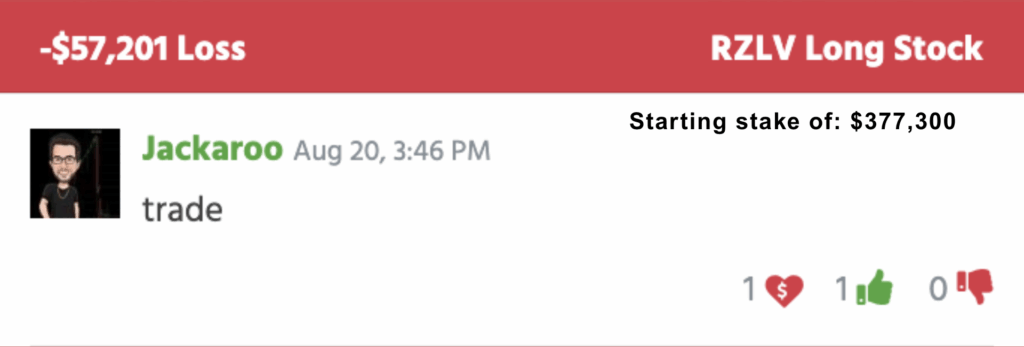

A few days ago, I burned through $57,201 in a single trade.

One ticker. One decision. One ugly reminder that the market doesn’t care how confident you feel.

It happened fast. I sized up big, 110,000 shares of Rezolve AI PLC (NASDAQ: RZLV) at $3.43. It felt like a layup, but I exited at $2.91.

That’s a 15% drawdown.

An amount that can make your chest tighten, even when you’ve traded for years.

When I go back and look at the numbers, the downside completely outmuscled the upside.

I basically set myself up for a 57k loss just to maybe make 20k. Not exactly smart trading.

And here’s the part that stings: I know better. My whole system revolves around finding repeatable setups with 3:1 reward.

But when I get impatient, when I size too big, I tilt the odds against myself and the market doesn’t hesitate to punish me.

The reality is, even seasoned traders slip. One moment of overconfidence, one oversized bet, one trade outside the system, and you’re handing back weeks of gains.

So yeah, I burned $57k. But it’s not the loss that matters; it’s what you do with it.

The full RZLV trade deserves a closer look, not because I enjoy reliving it, but because there’s a lesson worth more than $57,201 hiding in it.

RZLV checked the boxes. Liquidity, volume, momentum. I’ve traded this type of pattern countless times. On paper, the entry looked fine: $3.43 with a plan to sell into strength.

The problem

The problem wasn’t the setup. The problem was my position size. 110,000 shares. That meant every penny against me cost $1,100. If you’re doing the math, that’s $11,000 for a ten-cent drop.

Now ask yourself: would you risk $11k on a ten-cent move when the potential upside is maybe 20–30 cents?

But that’s exactly what I did.

The numbers

- Entry: $3.43

- Exit: $2.91

- Loss: $0.52/share × 110,000 shares = $57,201

Even in the best-case scenario, I might’ve made $20–30k. Yet I was risking nearly twice as much. That’s negative math.

The real issue

This wasn’t about charts or indicators. This was ego. I let confidence override logic. I convinced myself that “size equals conviction.” But conviction without math is just gambling.

Trading doesn’t reward confidence. Trading rewards discipline.

The bigger lesson

Over time, trading success boils down to repeatable math. My best trades share the same qualities:

- A+ setup I’ve seen hundreds of times

- Risk capped so I don’t blow up

- Reward at least 3x what I’m risking

That’s it. Nothing fancy. The math stacks in my favor, so even if I only win 70% of the time, my account grows.

But the moment I skip those rules, I flip the math against myself. One $57k loss can erase dozens of small wins.

How this applies to you

Before you take your next trade, ask yourself three questions:

- What’s my max loss in dollars?

- What’s my realistic upside?

- Does the ratio work if I repeat this 100 times?

If the math doesn’t check out, walk away.

Why I stick to my system

This is exactly why I built my Seven-Figure Cycles system.

It’s not about chasing every ticker or swinging big just to feel alive.

It’s about finding the setups where the math stacks in your favor, then repeating them with discipline.

Talk soon,

Jack Kellogg