Hey traders,

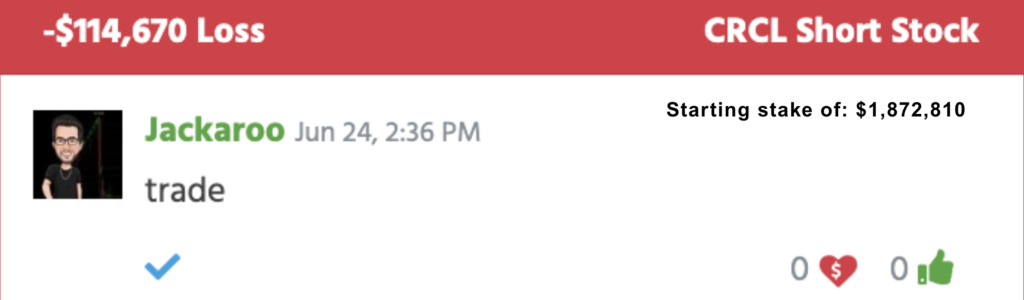

Circle Internet Group (NYSE: CRCL) gave me a big lesson last week.

My first trade on it went very wrong. I lost $114K! Ouch.

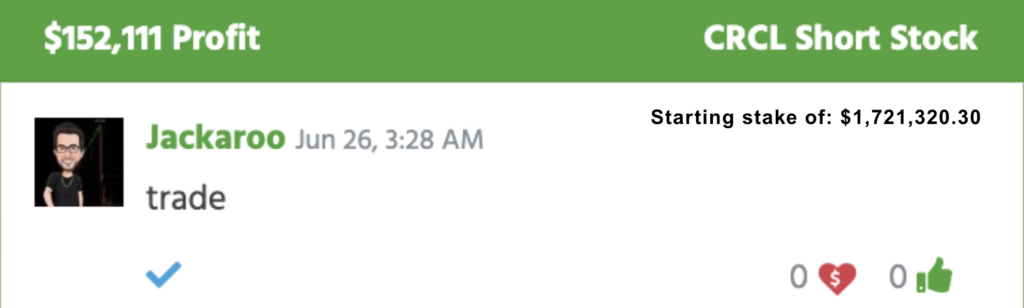

I rushed into it. It was a bad move, I know. But two days later, I was careful and waited for the right moment.

This time, I made $152K.

Trading is all about winning some and losing some.

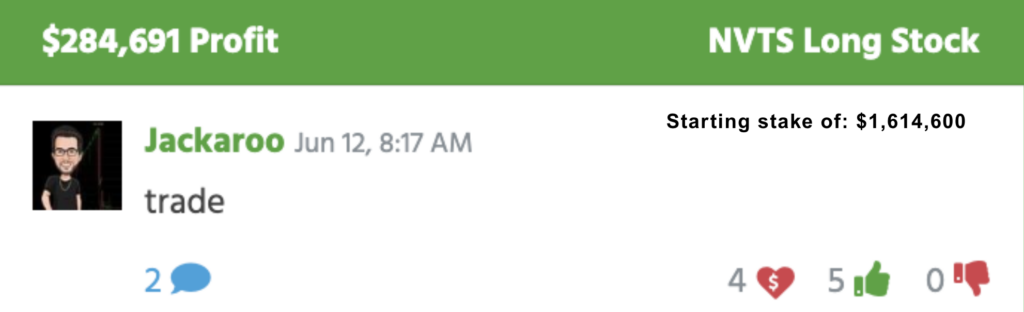

After that, NVTS gave me another great chance. I stuck to my plan, stayed calm, and got another win.

Good trades are still out there; you just need to know where to look.

Now, there’s a new stock I’m very excited about this week.

It has a small number of shares and some very good news.

Most traders didn’t even notice it at first, but now everyone wants to trade it. It reminds me a lot of NVTS right before it went up big.

I’m not jumping in right away. I’m watching it closely. If I could trade only one stock this week, this would be it.

Here’s why:

Usually, small biotech stocks pop up quickly, then disappear.

But VOR Biopharma (NASDAQ: VOR) did something different. Last week, it went from under $0.25 per share to over $1.

Instead of dropping fast afterward, it stayed up. That doesn’t happen often, and it’s exciting.

The reason behind the move is simple and strong.

VOR got a new boss and changed their focus to something called antibody-drug conjugates (ADCs). These are special medicines that people are very interested in right now.

They also made a deal with another company, RemeGen, for a medicine that’s already being tested in late stages.

When a company does something big like this, people pay attention. And the chart shows why.

VOR went up quickly, then kept its price. Most small biotech stocks don’t do this, they usually go back down fast. But VOR stayed strong, showing traders really like it.

This reminds me of NVTS earlier this month. At first, nobody cared. Then suddenly, everyone wanted in, and the price went higher.

I’ve learned trading isn’t about guessing what happens next.

It’s about watching closely and acting when things look right.

CRCL showed me how important patience is. Rushing cost me money, but waiting made it all back.

Trading isn’t about being perfect. It’s about seeing when a stock is strong and not ignoring it just because it already went up a bit.

Many traders make that mistake. They miss out or jump in at the wrong time.

VOR has shown it can stay strong, and now I’m waiting to see if it keeps going.

The market right now is tricky, and it’s not easy to find good trades.

But when a stock like VOR shows real strength, good news, and clear trading action, it deserves a close look.

I’m not rushing into anything, but VOR definitely earned its spot on my watchlist.

Let’s see what happens next,

Jack Kellogg