Hey traders,

There’s a reason so many traders get stuck in the same cycle:

- Spot a mover.

- Chase the entry.

- Panic on the pullback.

- Exit with regret.

It’s not because they don’t understand patterns.

It’s because they never had a plan to begin with.

Most people wait for the market to excite them. They jump in after a big move, trust their gut, and hope it keeps going.

When it doesn’t, they react emotionally, not because they’re impulsive, but because they never gave themselves a framework to act from.

And if you don’t know your entry, risk, and goal before the trade, then you’re already behind.

Building a trading plan doesn’t have to be complicated. In fact, the simpler it is, the more likely you’ll stick to it.

But it has to exist.

You need to know exactly where you’re getting in. Where you’re cutting if it turns. And where you’re exiting if it works.

And when the market moves fast, especially in the first 15 minutes, that plan becomes your entire edge.

It keeps you from chasing. It tells you when to walk away. It anchors your decision-making when everything else feels chaotic.

So today, I want to break down exactly what a clean trading plan looks like, in practice.

Most traders want to focus on the trade.

They want to talk about entries, alerts, fills, and executions. But before any of that happens, before the volume shows up, before the chart confirms, the real work starts with a plan.

I don’t mean an idea. I mean a plan.

When I sit down and prep a trade, I don’t just stare at a stock and wait for it to “look good.” I write out three numbers before anything else:

- My entry.

- My risk.

- My goal.

Those three numbers turn noise into structure. They turn emotion into execution.

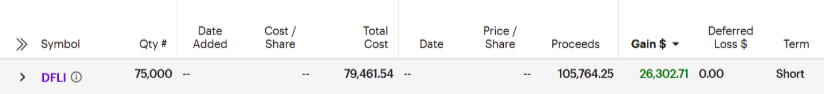

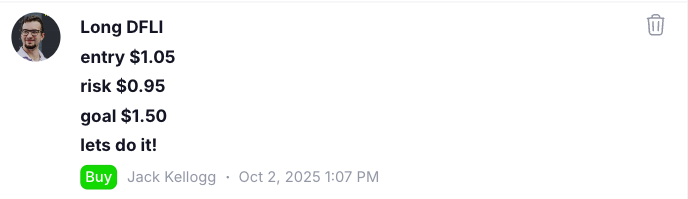

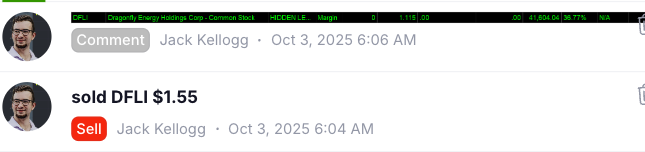

Let me walk you through what that looks like, and how it actually played out in a recent trade on Dragonfly Energy Holdings Corp. (NASDAQ: DFLI)

I saw a setup that I’ve seen a hundred times before. The chart had just started to curl after consolidating. Volume was building.

There was clear resistance at $1.50 per share on the daily. The float was low enough to move, but not illiquid. And I knew exactly what I wanted to do.So I wrote it out:

That was the plan.

Not “let’s see how it acts.” Not “maybe I’ll add later.” It was simple. Tight. Executable.

And once I had that plan, the rest of the trade was straightforward.

The setup confirmed. I got my fill. The move played out. I sold at $1.55 per share.

Clean. Done.

But here’s what matters most: the plan didn’t just help me manage the trade. It helped others follow it too.

Inside our community, members saw this idea in real time.

They understood the logic. They knew the levels. They had the same plan I did. And some of them caught the move with just as much confidence, not because they copied anything, but because they understood it.

That’s what a real plan does.

It builds conviction before the trade even starts. It gives you a reason to take the trade, and just as importantly, a reason not to if things change.

Because sometimes, the best outcome is not taking the trade at all. And if your entry gets too extended, if the risk level breaks down, or if the volume disappears, you walk away.

No questions. No second-guessing. Just discipline.

That’s why I drill this process over and over.

You don’t need to write a novel. You don’t need ten indicators or fancy models. You just need to get clear on your setup before you act.

And that comes down to a few core steps:

- Study the chart. Where’s the real resistance? Where’s the volume coming in? Is this thing alive, or just twitching?

- Find a clean entry. Not a guess, not a chase. A level that gives you edge without putting you in too early.

- Define your risk. Where does the pattern break down? Where must you get out to protect your account?

- Set a goal. Not a dream. Not a “what if.” A realistic price level based on structure, previous highs, or a measured move.

Once you have those things, entry, risk, and goal, you’ve built a real plan. And whether the trade works or fails, you’ve already won something bigger than a P&L: control.

Because you’re no longer reacting to the market. You’re participating in it with clarity.

That’s how this DFLI trade came together. And it’s how every single one of my cleanest setups starts, with a plan, on paper, before the chart ever gives me the green light.

So next time you’re tempted to jump into a hot stock just because it’s moving?

Pause. Write the plan first. Then decide if the trade deserves your capital.

It’s a small habit that will save you from big mistakes, and unlock the kind of trades that actually work.

Trade with a plan,

Jack Kellogg