Hey traders,

Stops give traders the most headaches.

- Set them too tight, you’re out before the trade even develops.

- Set them too loose, you’re bagholding a loser way longer than you should.

- Skip them completely, you’re one trade away from blowing up.

That’s why so many traders hate stops. Not because stops don’t work, but because most people use them backwards.

The point of a stop isn’t to save your ego. It’s not about being right. It’s about protecting your account from the trades that go wrong.

If you don’t figure that out, you’ll either bleed to death slowly or get chopped up until you quit.

There’s a smarter way.

A way to set stops that actually make sense, where your trades get room to breathe, but your account stays safe.

Most new traders never learn it. That’s why most new traders never make it.

The problem is most traders treat them like magic numbers.

They either set them randomly like “2% below my entry” or they don’t use them at all.

Both approaches fail.

There are better ways. Here’s how I think about stops:

1. Chart-Based Stops

Put your stop just below support or above resistance. If that level breaks, the setup is invalid anyway.

Example: If a breakout fails and closes back under the breakout line, that’s where I’m out.

2. Dollar-Risk Stops

Decide how much you’re willing to lose—say $100. Place your stop at a level that equals that loss based on your position size. This forces discipline.

3. Volatility Stops (ATR)

Some stocks whip around more than others. If your stop is too tight, normal noise takes you out. ATR (average true range) gives you a measure of expected movement. Use it to set a stop that accounts for volatility.

4. Trailing Stops

For winning trades, trail your stop under higher lows (in longs) or lower highs (in shorts). That way, you lock in profits without selling too early.

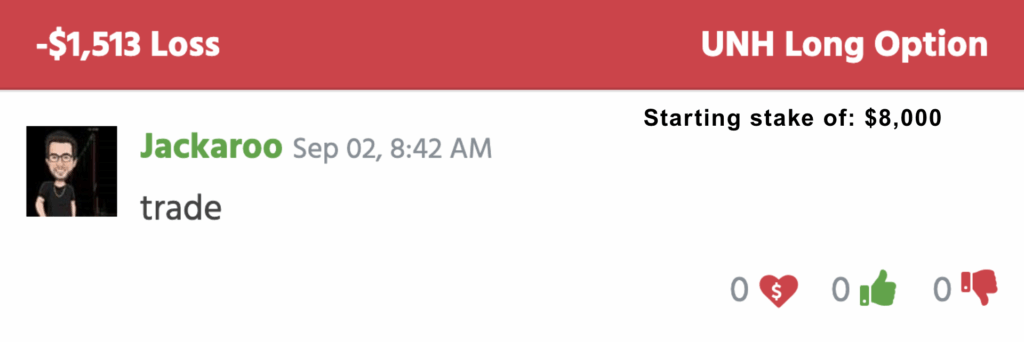

UnitedHealth Group Incorporated (NYSE: UNH)

Yesterday I traded UNH.

My entry was $0.20. When the trade didn’t move my way, I cut at $0.16 for a 20% loss. That was –$1,513.

Not fun, but here’s the alternative: if I held, the contracts expired worthless. That would’ve been –100%.

The stop didn’t save me from a loss, it saved me from a total account bleed.

That’s what stops are for. Not perfection. Protection.

Your stop isn’t there to make you feel good. It’s there to keep you trading tomorrow.

Most beginners either get chopped out too early or hold way too long. Both destroy accounts.

The smarter move? Place stops with intent. Use levels, size, or volatility. Always tie it to a plan, not emotion.

Trade without stops, and you’re one bad move away from disaster. Trade with stops the right way, and you stay alive long enough to catch the wins that matter.

The market will always test you. Stops make sure you survive the test.

Catch you in the next alert,

Jack Kellogg