Hey traders,

I spotted something this week that made me pause mid-scroll: Global X Uranium ETF (NYSE: URA), the uranium ETF, just cracked a fresh 52‑week high.

Not a tiny move either. We’re talking 100%+ from its low. And yet, barely anyone’s talking about it.

Because uranium isn’t a trendy headline play like solar or oil.

But it’s powering something way bigger: AI.

Data centers chew through electricity 24/7, and the more AI ramps up, the more consistent, large-scale power they need.

Nuclear power fits that bill better than wind or solar ever could.

Even Washington’s shifting. Federal support for nuclear energy just got louder, and big tech’s quietly buying in.

That’s not a coincidence, it’s a clue.

But here’s the question I’m asking now:

Did you miss the move… or is it just getting started?

Global X Uranium ETF (NYSE: URA) just hit a fresh 52‑week high.

Let me break down what that means:

First, what URA actually is.

It’s an ETF that tracks a bunch of companies in the uranium and nuclear power business.

Think of it like a shopping basket filled with companies that dig up uranium or build reactors. Instead of betting on one mining company, you get a little bit of lots of them.

That basket includes mostly Canadian and U.S. firms, and the fee for holding this ETF is under 1%, which isn’t cheap, but it’s not crazy either.

So, why is it spiking now?

Data centers run 24/7, and AI toys hog electricity like nobody’s business.

Solar and wind can’t match that steady output.

Nuclear can, so big tech is paying attention.

On top of that, the U.S. has been re-opening doors to nuclear energy, Trump’s past executive orders focused on American uranium supply, and newer policy moves show bipartisan support for nuclear as a key part of clean energy expansion.

That kind of official backing gets investors thinking this could be a longer‑term story.

But from a trader’s protective stance, you don’t just dive in because something’s going up.

You want to know if momentum will stick.

That’s when we look at something called weighted alpha, which basically says, “How much did the price move in the last year, and did most of the movement happen recently?”

URA’s weighted alpha clocks in at 47.25, which tells us most of the gains came recently, not just some random bounce from a year ago.”

That’s one of the strongest signs momentum traders look for

That matters because you’ve got confirmation from two sides: clear story behind the surge, plus recent price action backing it up.

And right now, uranium looks like it’s in the early innings.

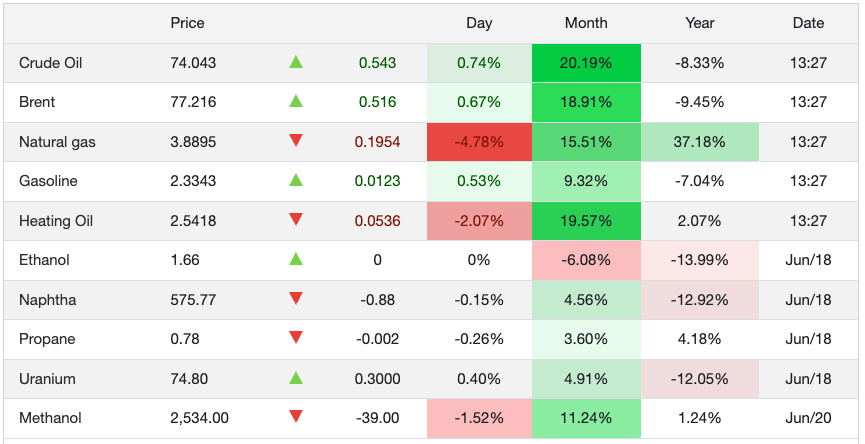

Most energy names have already made big moves, crude oil jumped 20% in the last month, natural gas popped over 15%, and even gasoline’s up nearly 10%.

But uranium? It’s barely up 5%, still lagging on the year.

That tells me one thing: this move’s still under the radar.

So while oil and gas have already made big runs, uranium is just starting to wake up. That’s your window, before headlines catch on.

I’m not saying buy URA tomorrow. I’m saying understand why it’s moving, then build your plan.

This trade’s not just a bet on price; it’s a play on what powers everything else.

I’ll be watching it closely for this setup to continue to build.

This is the kind of move you want to study, not because it’s flashy, but because it teaches you how real momentum actually works.

Stay curious, stay disciplined.

Jack Kellogg

P.S. Are you watching this move? Or want to see how I track trades like this in real time? I’ve got more setups coming soon. Stay ready.