Hey traders,

Robinhood Just Changed the Game

They just launched short selling, and with it, they’ve opened the door to a part of the market that most traders still don’t fully understand.

It’s not the only update, either.

Their 2025 HOOD Summit laid out plans for retirement accounts, advanced options tools, and new research features like Robinhood Signals. But it’s the short-selling rollout that caught my attention, because I know exactly how much power (and pain) comes with it.

Short trades can be sharp, fast, and clean.

But they can also unravel in seconds if you’re even slightly off.

I’ve caught the clean backside when a stock fails to bounce, cracks a key level, and just fades away.

And I’ve been caught, stuck in a squeeze, second-guessing everything, watching red flood in faster than I could react.

If you understand the structure, know what weakness actually looks like, and use clear risk levels, you can trade shorts with precision.

And now that Robinhood’s introduced it to the masses, we’re going to see way more opportunities… and way more people blowing up by chasing setups they don’t fully understand.

Traders can now short directly from the platform’s ladder interface, part of a broader push that also includes new signal tools, improved options features, and real-time research.

It’s a big move, especially for an app that’s become the gateway to trading for so many.

But this kind of access brings consequences. Because shorting isn’t just another strategy, it’s a discipline that punishes hesitation and overconfidence harder than anything else I’ve traded.

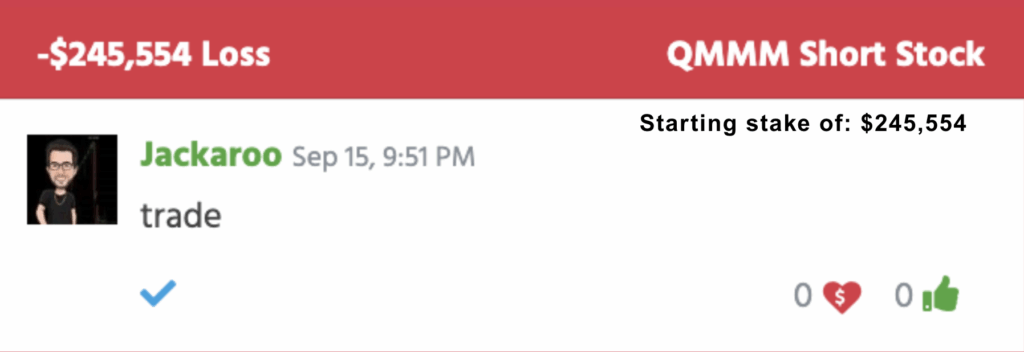

I’ve seen both sides of it.One trade that left a mark was QMMM Holdings Limited (NASDAQ: QMMM)

Thin float, stretched daily chart, fading volume, everything screamed backside. I took the trade. It blew past every level I expected, and I froze.

That single trade cost me $245,554 in one day. Not just a financial loss, but a shot to my confidence.

That’s why I rarely short now.

Not because it doesn’t work, but because it only works when you’re dialed in. The setups have to be clean. The timing has to be perfect. The risk has to be clear.

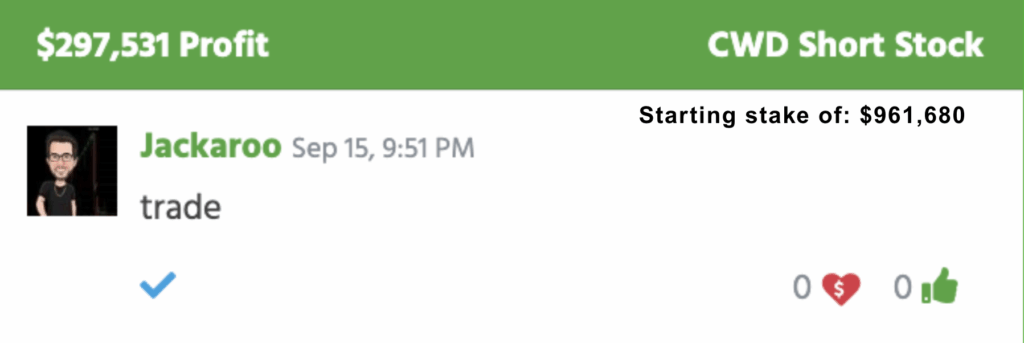

That’s how I handled CaliberCos Inc. (NASDAQ: CWD).

One of the better short trades I’ve taken.

It ran up, failed to bounce, and started breaking down clean.

I hit it with size, scaled out on the way down, and locked in $297,531. It wasn’t about calling the top; it was about respecting the structure.

But QMMM and CWD weren’t outliers. I’ve had smaller losses and wins too, trades that reinforced the same lesson: shorting magnifies everything. The pressure, the reward, the mistakes.

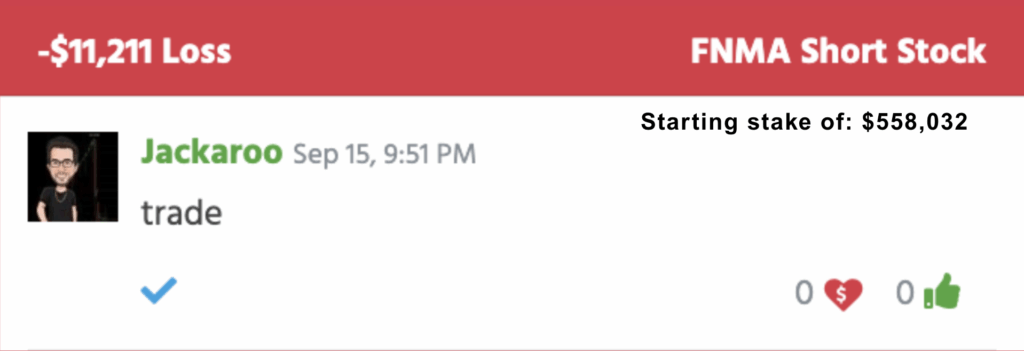

With Federal National Mortgage Association (OTCQB: FNMA), one of my favorite OTC stocks, I thought I saw weakness:

I took the short, only to get chopped and stopped for a $11,211 loss. Nothing dramatic, but it chipped away at my conviction, especially when I didn’t have a clear breakdown.

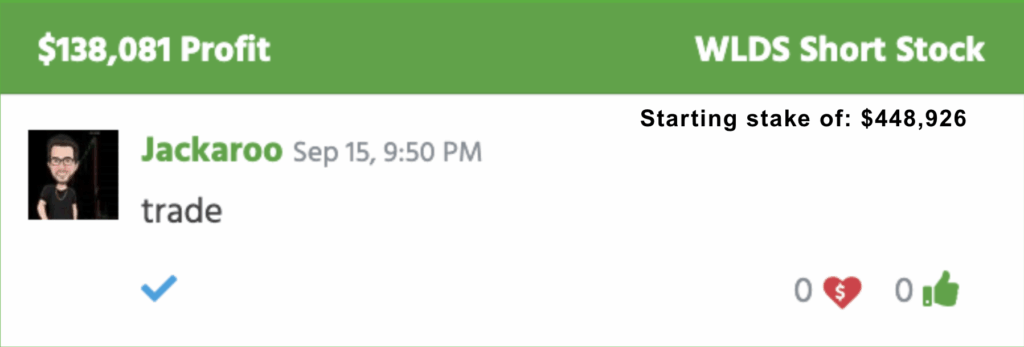

Wearable Devices Ltd. (NASDAQ: WLDS) was the opposite.

A clean backside fade with fading volume and no strength in the bounces. I sized in confidently, managed the risk, and walked away with a $138,081 gain.

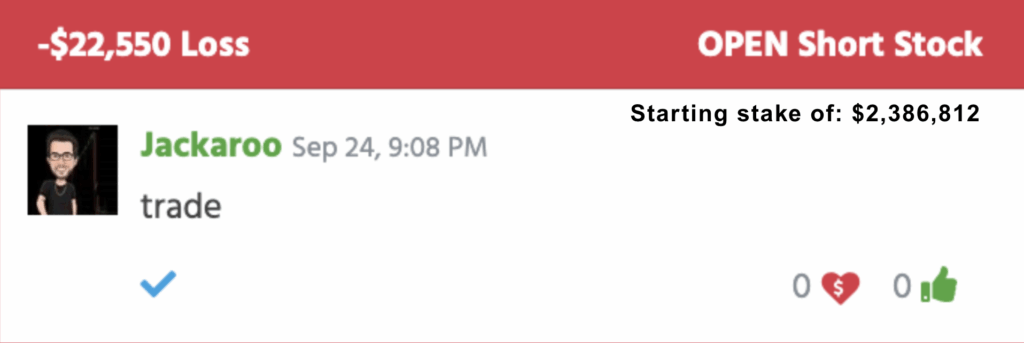

And then there was Opendoor Technologies Inc. (NASDAQ: OPEN)

One of my more recent shorts that reminded me just how quickly things can go from idea to execution to regret.

I sized in looking for a crack, only to be caught by a swift bounce. I cut it, took the $22,550 hit, and moved on.

That’s how shorting goes. It either pays you for your patience or punishes you for your assumptions, which is why I don’t enter these trades lightly anymore.

I wait for more. I require confirmation. And even when I do take the shot, I don’t swing for home runs.

I manage risk like it’s the only thing that matters, because with shorts, it usually is.

What makes Robinhood’s rollout so important right now isn’t just access. It’s timing.

Because this comes just as FINRA has approved a major overhaul of the PDT rule, opening the door for even more traders to take more trades, more often, especially in smaller accounts.

That means:

- More setups.

- More noise.

- More temptation.

And for those who’ve never traded a backside breakdown before, it’s going to be a tough lesson if they jump in blind.

But it also means opportunity, for the traders who know what to look for. Who’s done the film work. Who understands when a backside is real and when it’s bait.

If you’re going to short, now’s the time to build discipline rather than excitement.

Because the setups are coming, and with more retail in the mix, the emotional edge is only growing stronger.

If you’re thinking about shorting in this new market, don’t just guess; learn what real setups look like. I’ve laid out the exact trades, patterns, and breakdowns I’m watching next.

There’s a whole new side of the market opening up, one that rewards patience, not panic.

Don’t chase emotion. Trade with purpose.

Jack Kellogg