Hey traders,

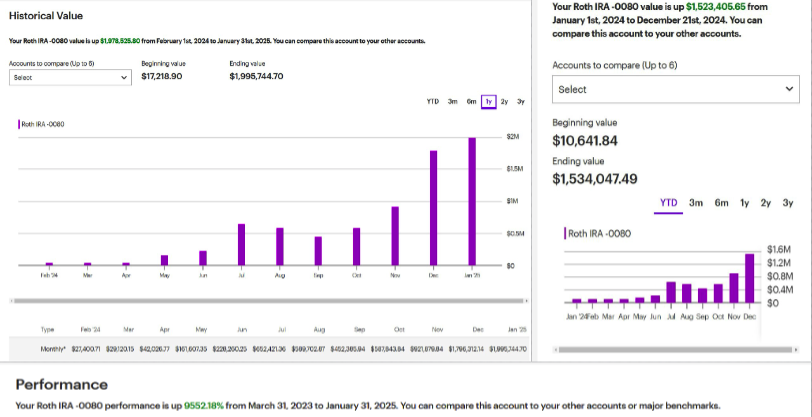

At the beginning of last year, I gave myself a challenge.

Not to prove anything to anyone else, but to see what would happen if I applied everything I knew to a small account — no shortcuts, no margin, no leverage.

I opened a Roth account with just $10,000 and made a promise: I’d trade it like it was my only shot.

I’d use the same setups I’ve studied for years, respect every rule I’d learned the hard way, and see how far I could take it.

Twelve months later, the account hit $1.8 million.

The journey wasn’t linear. It never is.

There were early wins — small but consistent. I only traded setups I trusted.

If it didn’t fit my process, I let it go.

That’s how I avoided getting chopped up during slow periods, and how I stayed focused on the plays that actually move the needle.

The patterns I relied on weren’t complicated. In fact, they’re painfully simple.

But when you really understand them — when you’ve seen them play out a thousand times — they work.

Those twelve months were powered by three specific setups I trust with real money

One of my go-to setups was the First Green Day.

It’s exactly what it sounds like: a stock that’s been sliding finally catches volume and closes green.

That one shift can set off a chain reaction.

I look for that green close paired with unusual volume and some kind of catalyst — news, momentum, sector buzz. I rarely trade it that day.

I’m watching for the move to come the next morning.

I also leaned heavily on the Morning Panic Dip Buy.

This one’s all about timing.

I look for a stock with a recent history of spiking that suddenly tanks right after the open.

When it hits a key level — maybe a prior support or premarket low — and starts bouncing on increased volume, that’s the signal.

The panic flushes out weak hands. The bounce is where smart money steps in.

The third setup I used again and again was the Multiday Breakout.

I’d track stocks that kept rejecting at the same level — the resistance.

If it rejected three, four, five times, even better. That told me when it finally broke through with volume, the move would be strong.

It was just a matter of being patient and ready to act when the volume came in and the level cracked.

Those three patterns — that’s what got me to $1.8 million.

I didn’t force trades outside of them. I sized up only when I saw one of those setups forming clearly. I passed on everything else.

But this challenge also pushed me to get sharper in every area — from risk management to discipline to mindset.

I had to manage emotion after watching the account hit $900K and then fall back to $460K in a single month.

That stretch almost took me out. But it also forced me to get even stricter with my process.

I came back focused, cut the noise, and traded like I still had only $10K in the account.

Now I’ve put everything I learned — the patterns, the rules, the turning points — into a full video breakdown.

Inside, I show the trades that worked, the ones that didn’t, and the small details that made the difference.

I also share some of the other tools and frameworks I used, like the four indicators I keep on every chart, the biggest mindset shifts that kept me in the game, the cheat sheets I keep on my screen, and the mistakes that nearly wiped me out.

That’s why I did this challenge. Not to show off… but to show what’s possible.

You’ll see the real numbers. The entries. The exits. The exact setups I used to turn $10,000 into $1.8 million.

Stay dialed in,

Jack Kellogg

P.S. If you want to track what I track, I built the Power Signal Indicator into my system so traders can spot these moves early—even in choppy markets…