Hey, Traders,

When I first got into this business, I’d wake up in the morning and see five or 10 stocks moving, then feel like I had to jump on all of them.

I had some major FOMO issues back then.

Most of the time, I took a bunch of random trades and got chopped up.

It was depressing and frustrating — not to mention expensive.

But over time, I realized my whole approach was doing more harm than good.

At some point, I finally caught up to the fact that I didn’t have to chase every single play (even though I really wanted to).

No, all I really needed to do was calm the heck down and be ready to pounce on the right one.

So, newer traders, please hear me when I say this: You don’t need action every minute of every day.

You don’t even need much action every day of every week.

But what you DO need is to chill out and listen to the guy who’s been there:

Some of my best weeks have come from just one or two good setups.

That’s it.

Pretty crazy, I know.

But it’s also pretty sweet when you actually have some structure and a plan.

So, let’s help get you there with a nice example.

Quick Case Study

Now, for that example:

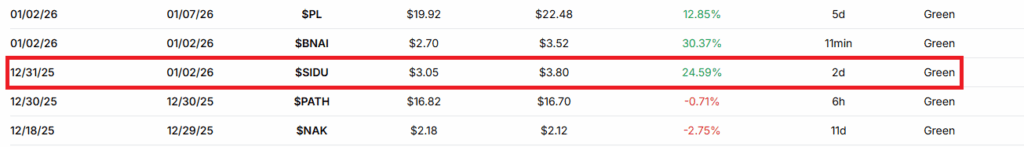

I began watching Sidus Space, Inc. (NASDAQ: SIDU) at the end of December.

The chart had potential, but I wasn’t in a hurry.

So, I waited, tracked the volume, and watched how the stock held up.

When I saw the setup I liked, I entered on December 31, then held SIDU a couple days and sold into strength on January 2, with a nearly 26% gain:

That one trade made the slower days before it totally worth the boredom and proved — once again — that you don’t need to trade every day to grow.

You just need to stay ready.

It’s easy to feel like you’re not doing enough when the market’s slow or your favorite setups aren’t showing up.

But that’s exactly when discipline matters most.

A lot of traders get impatient and start taking B or C setups just to feel busy.

That’s when mistakes happen, when you trade things you don’t really know, or don’t really have a plan for.

In the words of the old-school anti-drug commercials:

“Just say no.”

Deadly Hunter, Silent and Still

For me, tracking means more than just watching a ticker.

Think of it like tracking prey in a forest: You crouch quietly in the brush and observe the environment around you to be able to suss out the deer.

You look for scat on the ground and scan for hoof prints, allowing these clues to lead you to what you’re (quietly, subtly, and cunningly) chasing.

With stocks, I’m looking at that same kind of bigger picture:

▶️ How many days has it been running?

▶️ What’s the volume like?

▶️ Is there news, or is this just hype?

I try to figure out where the crowd is chasing and where the real edge is.

That’s what I write down in my notes, and I check on these things every day. I’m not always trading, but I’m always preparing.

When SIDU started moving, I already had the key levels mapped out.

That’s the goal with every setup I take, and when nothing lines up, I sit out.

I protect my capital and my focus.

That way, when the next clean setup shows up, I’m sharp and confident.

No Shortage of Opportunities

The truth is, there will always be trades out there.

But that doesn’t mean you have to be in all of them.

The more you slow down and wait for your spots, the better your results get. You build consistency by being selective.

I know it’s not always exciting to sit around and watch from the sidelines.

But, believe it or not, this game isn’t about excitement.

It’s about execution.

You can’t execute well if you’re distracted by every shiny ticker that pops up on your screen.

Stay focused,

Jack