Hey traders,

Tesla, Inc. (NASDAQ: TSLA) just ripped 11% in five days. For a company that size, that’s insane, and every beginner trader suddenly thought they needed to trade Tesla.

I get it, it feels like you’re missing out if you’re not chasing the stock everyone’s talking about.

But here’s the truth: the people who only watch Tesla are looking in the wrong direction.

Because when a giant like Tesla moves like that, it doesn’t just move Tesla. It sends shockwaves into smaller names most traders don’t even notice. And that’s where things get interesting.

I’m not talking about slow 11% gains spread out over a week.

I’m talking about the kind of explosive moves that can happen in a single session, sometimes from stocks trading for pocket change.

The problem is most traders never hear about them until it’s too late. By the time it’s trending on Twitter, the easy money’s gone.

That’s why I don’t chase Tesla. I watch what Tesla creates.

I’ll show you exactly how I track these sympathy moves, what I look for before I take a trade, and how to avoid getting smoked chasing the wrong names.

Tesla’s move doesn’t just impact Tesla. When a giant like that runs, it sends shockwaves into smaller stocks tied to the same story. These little guys ride the hype, sometimes harder than the leader itself.

That’s where penny and micro-cap stocks come in.

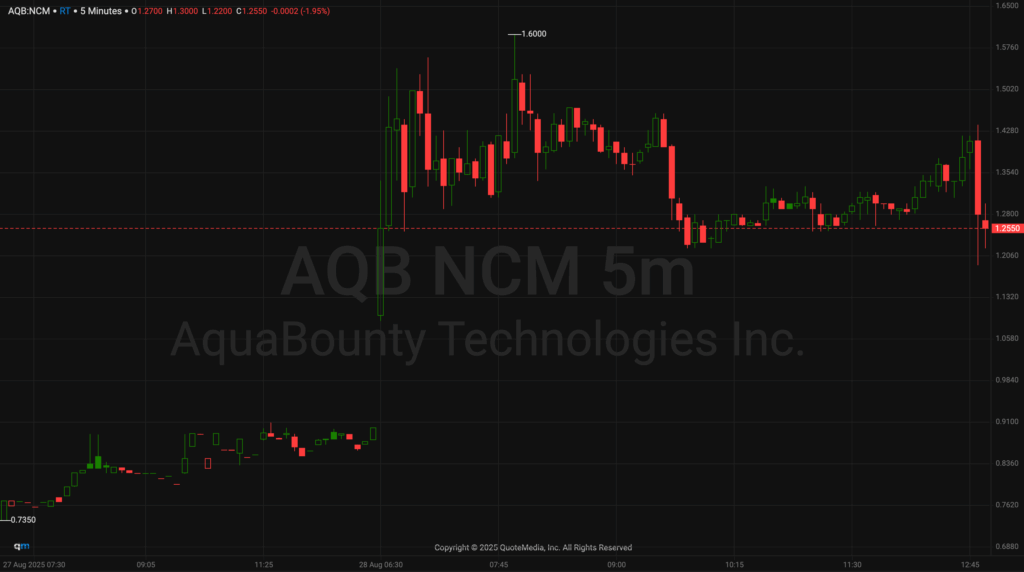

Take AquaBounty Technologies, Inc. (NASDAQ: AQB).

While Tesla’s been grinding out its 11% run, AQB popped 47% in one session. That’s four times Tesla’s entire five-day move, overnight.

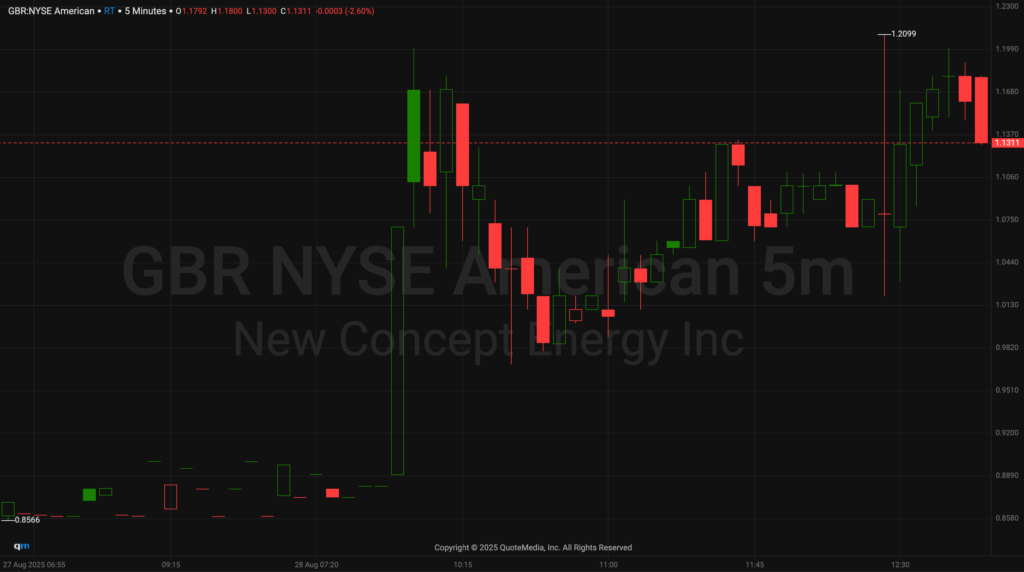

Or New Concept Energy, Inc. (NYSE: GBR), which ran 25% the same day.

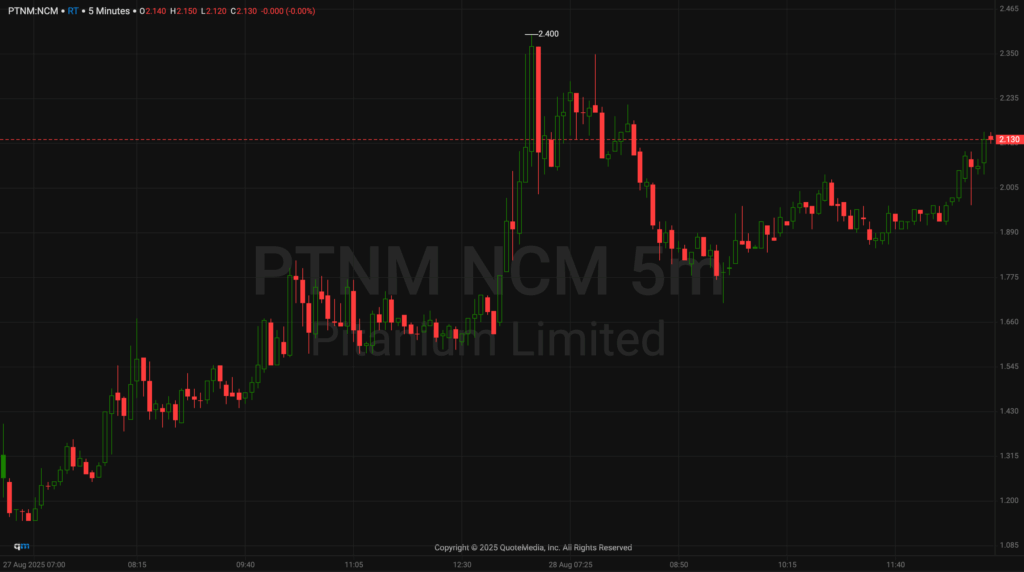

Pitanium Limited (NASDAQ: PTNM) ripped 21%.

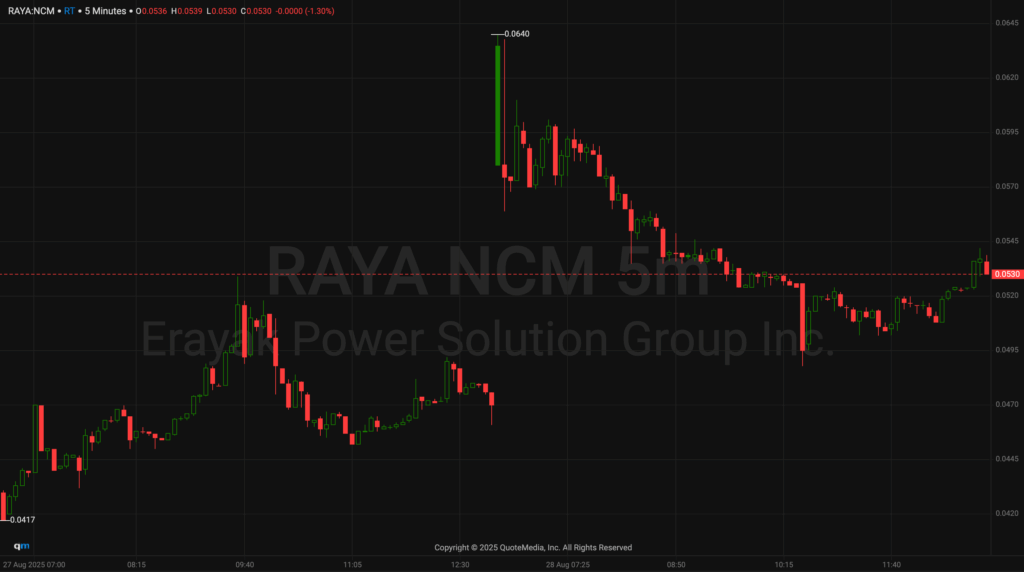

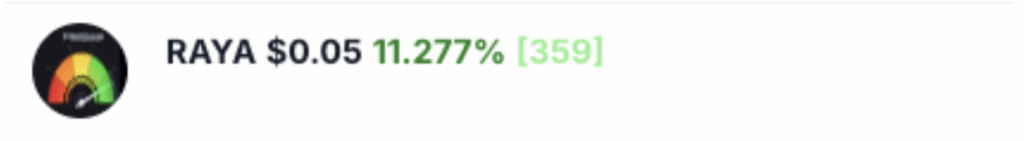

And then there’s Erayak Power Solution Group Inc. (NASDAQ: RAYA),

Trading around five cents, which just topped the Power Signal indicator list yesterday. That’s a big deal.

You won’t see CNBC talking about stock trading for less than a pack of gum, but I promise you that traders watching those signals were paying attention.

This is why I don’t waste my time chasing Tesla itself. Sure, it’s a flashy name.

However, the real juice is in the cheap sympathy plays, the stocks that echo Tesla’s momentum with even more volatility.

Why sympathy plays matter

When a leader moves, Tesla, Bitcoin, NVIDIA, whatever, momentum doesn’t stop at the leader. Traders look for “the next best thing.” It’s the same psychology behind why random AI penny stocks doubled when NVIDIA reported blowout earnings.

Sympathy plays happen because:

- Traders chase anything “in the same sector.”

- Algorithms scrape headlines and pump volume into related tickers.

- Retail loves cheap stocks they can afford more shares of.

So a Tesla move gets you 10%, but a sympathy micro-cap can give you 100%.

How I find them

It’s not magic. I’m looking at:

- Sector heat: If EVs are running, I’m scanning every cheap EV-related ticker.

- Signal tools: Lists like the Power Signal help catch momentum before the crowd.

- Volume flow: If an illiquid name suddenly trades 10x its normal volume, that’s a clue.

Once I spot them, I’m not trying to marry the stock. These plays are short-term trades, not long-term investments. Get in when momentum’s building, get out before the rug pull.

The risk no one talks about

Here’s the catch: micro-cap sympathy plays cut both ways. They can double in a day, but they can also dump 30% in minutes. That’s why beginners blow up chasing them.

The difference between winning and losing here comes down to discipline:

- Keep size small.

- Cut losses fast.

- Don’t hold and hope.

If Tesla’s move is a jog, sympathy plays are sprints.

Sprinting gets you places faster, but only if you know when to stop before you pass out.

Tesla’s run looks massive on paper. But if you’re trying to grow a smaller account, chasing Tesla won’t get you far. The real edge comes from watching what Tesla creates.

That’s where the micro-cap rockets live. And that’s where I spend my time.

Catch you in the next alert,

Jack Kellogg