Hey traders,

This morning felt like one of those moments where everything just clicks.

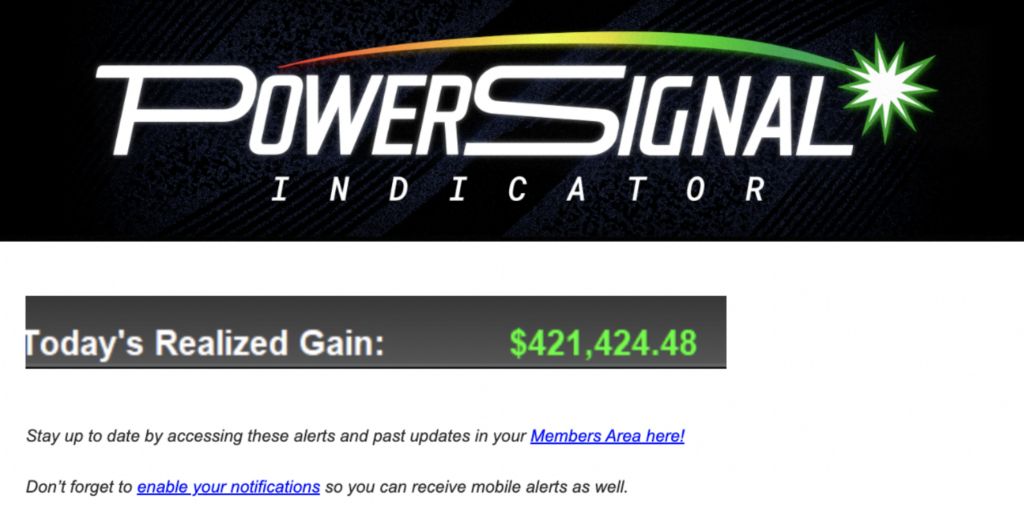

I rolled over, checked the market, and saw two of my trades already locked in. One from my Power Signal Indicator:

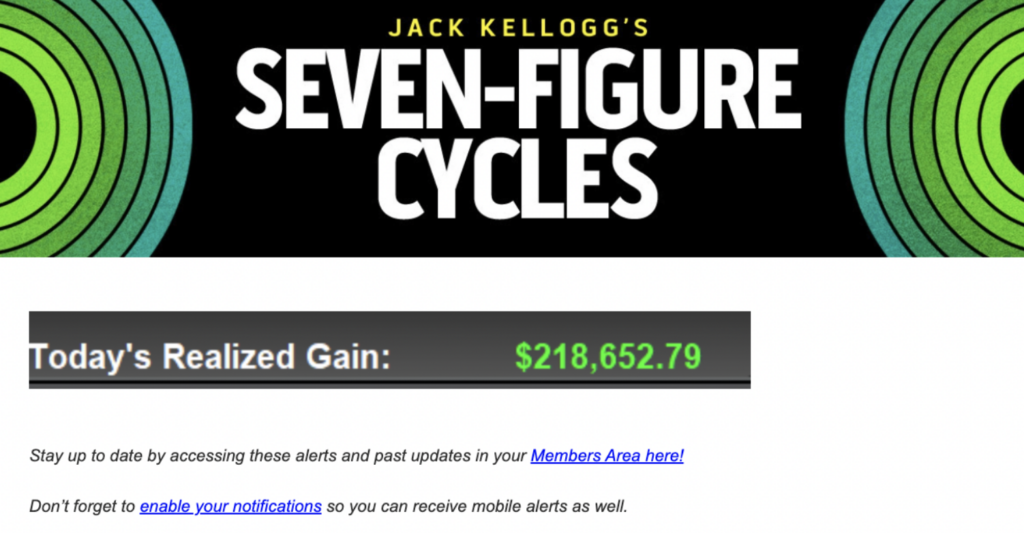

And one from my Seven-Figure Cycles:

Both of them hit.

It’s kind of surreal when you think about it.

Not just the number (although yeah, it’s wild waking up to $600K+ in realized gains) but the fact that it came from sticking to the same process I’ve used for years now.

I didn’t throw out a bunch of trades, or chase anything.

I just waited for my system to show me what made sense and sized up when the opportunity felt right.

I’ve been trading long enough to know these kinds of mornings don’t come around often.

But when they do… man, they remind you why the work matters and why the patience matters.

If you’re still second-guessing entries, cutting winners too early, or hesitating when the moment actually shows up… this is the kind of day that shows why the prep matters.

Some mornings just hit different.

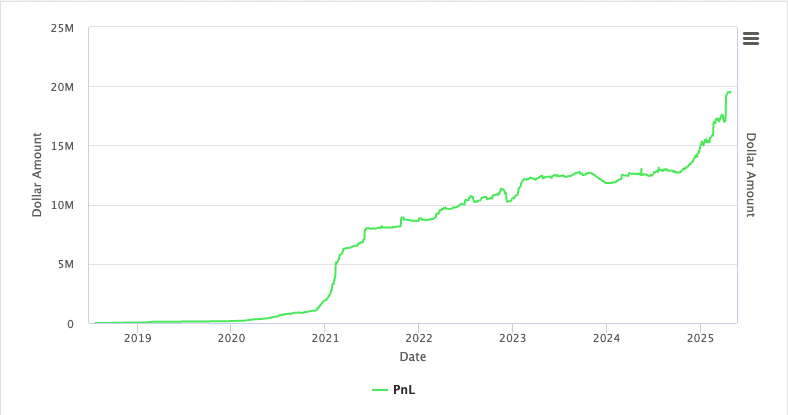

Not because of the number in the PnL, although, yeah, seeing it always reminds me how far this thing has come.

This isn’t just about today. It’s the full run, my profits and losses from the beginning.

You can see the ups, the slow stretches, the times where things didn’t move much.

But you’ll also see what’s happening now… creeping up toward that $20 million mark.

And honestly? It still feels like I’m just getting started.

That’s the part I want to talk about today.

Everyone always wants to know how the big wins happen.

The truth is that it never starts with a win.

It starts with waiting.

I didn’t wake up and magically find two tickers ready to rip.

These stocks had been on my radar already. I had my eye on Hims & Hers Health, Inc. (NYSE: HIMS) after my Power Signal Indicator lit it up — crazy short interest, the whole setup looked like it was just waiting to explode.

I put just over a $1.5M starting stake into HIMS once the PowerSignal alert lined up — not blindly, but because everything about the setup told me it was time to size up.

At the same time, AGM Group Holdings Inc. (NASDAQ: AGMH) popped on my Seven-Figure Cycles scan — no hype, no noise, just one of those clean patterns that usually leads to something if you stay patient.

I sized into AGMH with around $660K starting stake once the Seven-Figure Cycles alert triggered.

The setup looked like one of those quiet tickers that could explode — so I leaned in and held it overnight.

I knew the setups had potential. So when the price action confirmed what I was looking for, I stepped in.

That kind of trust doesn’t come from one or two green trades.

It comes from years of doing the same thing, over and over — watching setups fail, tracking patterns, learning how to manage risk when things don’t go my way.

And yeah, I still take losses. I still miss trades. But when it lines up like this, when I feel that click that tells me to size up and that’s when I don’t hold back.

I think a lot of traders mess this part up. They chase every setup and wonder why they’re drained by noon, or they hesitate when it’s actually time to step in.

It’s not about trading more. It’s about trading with intention.

If you’ve been in this game for a while and feel like you’re always one trade away from blowing up, I’ve been there.

I took time to slow down and trust the process, not just the outcome.

What happened this morning didn’t come from guessing or hype. It came from watching, waiting, and staying patient. It came from respecting my edge, not forcing it.

Two trades, both clean. The kind I’ll remember, not just because of the PnL, but because of how calm it all felt.

That’s what I want for you—not the money (although that’s cool), but the confidence.

The calm ability to step in and know you’re doing exactly what you should be.

That’s the part that sticks with you long after the trade’s closed.

Trade confidently,

Jack Kellogg