Hey traders,

Most traders think once you sell, the game’s over. Cash the win, move on, wait for the next shiny ticker.

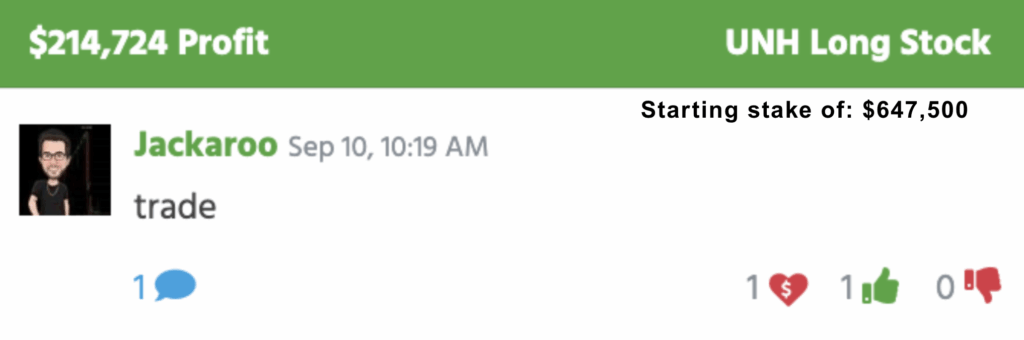

But this week, I pulled $326K out of one stock… by trading it twice.First trade: UnitedHealth Group Incorporated (NYSE: UNH) in at $259, out at $345 → $214K profit.

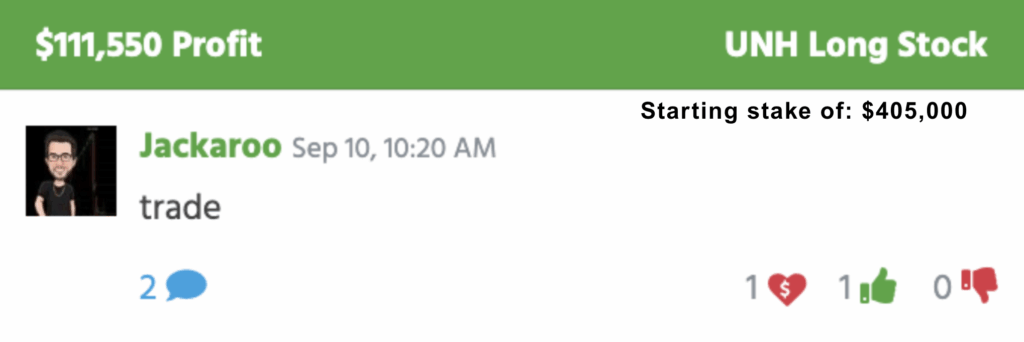

Second trade: UnitedHealth Group Incorporated (NYSE: UNH) in at $270, out at $344 → $111K profit.

Same stock. Same day. Two clean wins.

Now, when I sold the first time, I could’ve shut it down. A lot of traders would’ve.

But the setup didn’t just vanish because I exited. The stock reset, the conditions lined up again, and I trusted my process enough to hit it a second time.

And that second bite added another $111K.

It’s crazy that this happens more than people realize. If you’ve ever felt the frustration of selling and then watching a stock keep running… you’ll want to see exactly how I spot these repeat setups.

Because once you know what to look for, you’ll stop beating yourself up for “missing the move” and start recognizing when the market is basically handing you a second chance.

Trading doesn’t always reward the first try. Sometimes, it rewards the trader willing to step back in.

On Wednesday, I traded UNH twice. The first trade felt textbook. Entry at $259, exit at $345, profit over $214K. A lot of traders would’ve called it a day.

But I knew the stock had more in the tank.

After the first run, UNH pulled back. Not in a weak way, though, the price action showed strength holding, volume confirmed interest, and the setup that triggered my first entry flashed again.

That’s when most traders hesitate. They think, “I already sold, the move’s over.”

That hesitation kills opportunity.

I didn’t look at it as chasing, I looked at it as the same high-odds setup appearing twice.

So I stepped back in at $270, rode it to $344, and booked another $111K. Total: $326K from two trades in one ticker.

Now let’s be real, double-dipping doesn’t always work.

You can’t just jump back in because you feel like squeezing more out of a stock. You need reasons. For me, it came down to three things:

- The setup repeated. Patterns don’t care that you already traded them. If the structure re-forms, it deserves a look.

- Volume stayed strong. Big buyers didn’t leave after the first run, which told me momentum wasn’t gone.

- The signal confirmed. My PowerSignal Indicator lit up again, showing unusual buying pressure building. That’s my green light.

Without those confirmations, I would’ve walked away. But when all three lined up, I trusted the process.

That’s the mindset shift I want you to take away: don’t assume one trade means the end of the opportunity.

If your setup repeats, it can pay to revisit the ticker.

The market doesn’t care if you already booked a win, it only cares about what’s happening now.

This doesn’t mean you should revenge trade or chase every pullback.

Discipline still rules.

Most of my big wins come from just a handful of repeatable setups, and I stick to them like glue.

That’s why when UNH gave me the same look twice, I was ready.

Think about it this way: you don’t need 20 different strategies to succeed.

You need one or two that you trust enough to trade over and over.

When you master those, every time the market hands you another shot, you’re ready to pounce.

So if you’ve ever sold a stock, watched it keep running, and kicked yourself for missing more, don’t. Ask yourself: did the setup actually repeat? If yes, then maybe the move wasn’t done.

That’s the real edge. Patience + discipline + the confidence to strike again when conditions match your playbook.

Until next time,

Jack Kellogg