Hey traders,

Most traders quit before the real move shows up.

They burn out by 2 PM. Checked out mentally.

Staring at chop all day, hoping for a setup that never comes. And when it finally does, they’re already gone.

Power Hour doesn’t care who’s still watching. It just shows up.

Every so often, in the final hour, the whole tone shifts.

One second you’re staring at dead volume and fake levels… then the switch flips.

That’s where the edge hides.

Not in guessing where the bottom is. Not in forcing a morning breakout. Not in trying to scalp garbage at lunch.

But in waiting.

Just waiting for everyone else to leave, then taking their spot.

The last hour of the day brings something different.

Three things stack up in what we call Power Hour:

- Traders who held all day start making final decisions

- Volume comes back in, especially on hot tickers

- Breakouts get cleaner as the range tightens beforehand

That combo creates a setup where the risk gets tight and the reward opens up fast.

And if you’re locked in and ready when that pressure releases, you can hit it hard with total confidence.

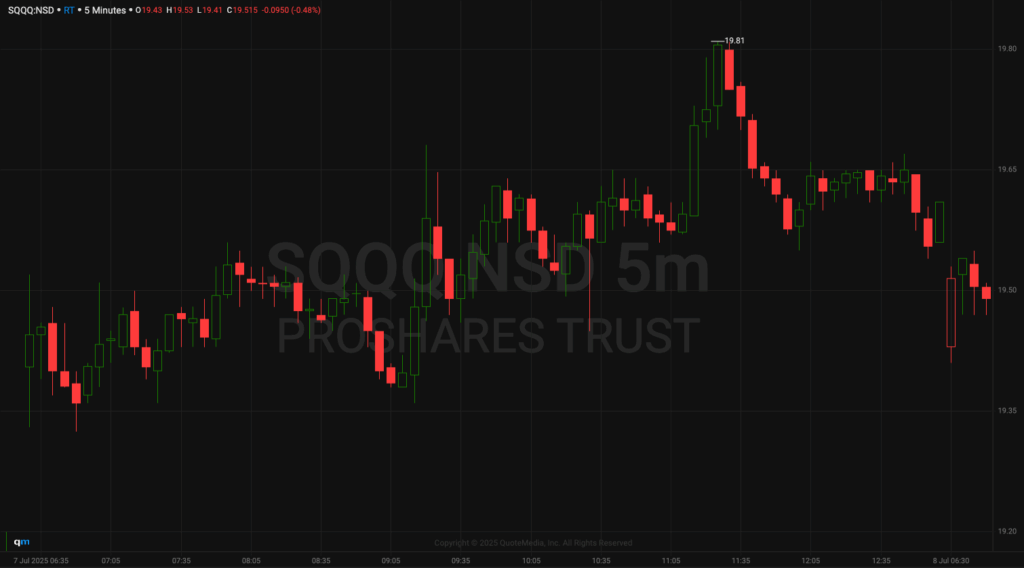

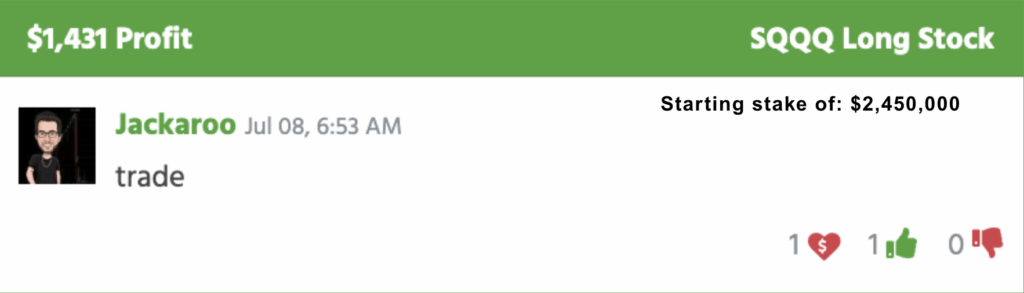

That’s exactly what happened on July 7th with ProShares UltraPro Short QQQ (NASDAQ: SQQQ).

Most of the day looked like a snooze-fest. Price coiled under $19.40. Volume stayed light. No momentum. No reason to force anything.

So I didn’t. I just waited.

Then right around 3:00 PM Eastern, it popped.

It was nothing massive, just a clean setup with tight risk. That’s the part most traders don’t get: you don’t need to swing for 10% if the setup’s dialed and you trust your execution.

That’s the moment where most traders would say, “Damn, I was watching that earlier,” and then sit on their hands while it runs without them.

But are you still in the chair? Have you done nothing all day except stalk the chart and stay patient?

You just step in.

Entry came at $19.40 per share.

Stop tucked under the breakout candle, maybe $19.25.

Let the target breathe. It hit $19.81 before the close.

Just clean, high-probability trading with defined risk and enough time to let the trade work.

I’m not saying you need to trade Power Hour every day. I don’t.

But when a ticker spends all day tightening, and that final hour flips the switch?

That’s the moment I want to be sharp. Present. Ready.

It’s not about catching the low or being early.

It’s about waiting for the pressure to build and stepping in after the confirmation shows up, when most of the crowd has already packed it in.

These trades don’t need perfection.

They need patience. Awareness. Focus.

You either show up when it matters, or you miss it while scrolling your phone, waiting for some “A+” setup that already happened.

Trade smart. Trade clean. Stay alert until the bell.

Catch you at close,

Jack Kellogg