Hey traders,

There’s always someone telling you it’s too late.

That the stock already ran. That you missed it. That it’s topping. That it’s a scam. That the robots are trash.

I’ve heard it all.

And conviction isn’t built in the moment. It’s built before the trade even starts.

When I first started watching Richtech Robotics Inc. (NASDAQ: RR), it wasn’t the hottest stock yet.

But the signs were there: price structure, volume, narrative, float rotation. I started building the idea over days, then weeks.

And when it gave me the confirmation I needed, I had the plan ready.

Not a prediction… a plan.

I didn’t guess. I didn’t size in randomly. And when the trade started to work, I didn’t panic. Because I already knew what I was doing, why I was in it, and what would make me exit.

It ended up being one of my biggest wins ever: over $2.8 million in total profit across multiple legs of the same trade.

The point is that trade only worked because I knew exactly what I wanted from it before I ever entered.

When people ask how I held a trade for this long, through every shakeout and pullback, the real answer isn’t about timing.

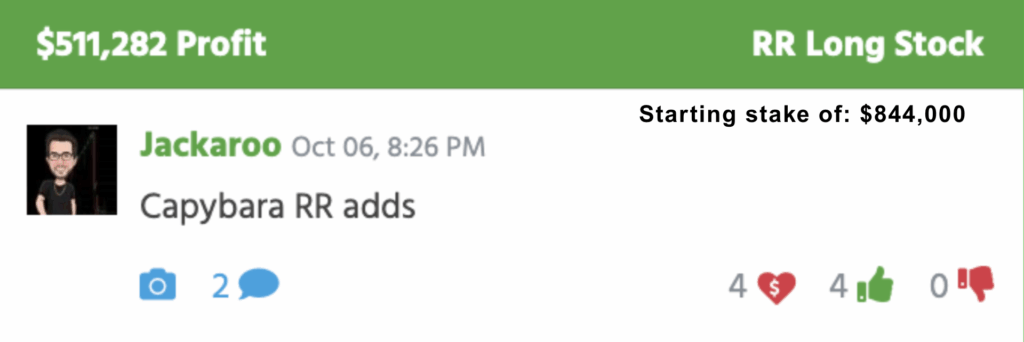

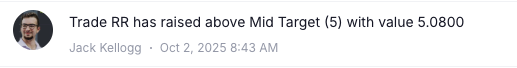

I’d been watching RR since mid-September. I saw the story building, the volume rotating, the chart shaping up.

So when it finally started to curl, I already had a plan.

That plan didn’t say “buy and hope.” It said:

- Here’s my entry

- Here’s my target

- Here’s what I’ll do if it breaks down

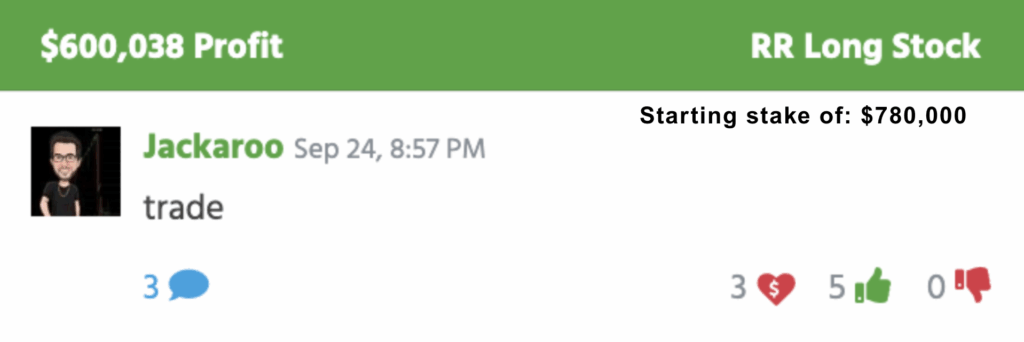

On September 24, I sold part of my position at $4.60 for a $600K gain.

That move alone would’ve been enough for most traders to call it a day.

But I held the rest. Because the plan still made sense.

The structure was intact. Volume was steady. The narrative hadn’t cracked.

And that’s the part I want to show you most, I wasn’t holding because I wanted more money. I was holding because the trade hadn’t broken yet.

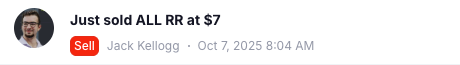

Wrapped up the trade yesterday morning and dropped the details for members in Seven Figure Cycles.

Not because I guessed the top, but because I followed the structure the whole way up.

I dropped it on X too, being open about trades, good or bad, is how we all learn and grow.

$RR +$2,825,829.93

— Jack Kellogg (@Jackaroo_Trades) October 7, 2025

Announced the trade from A to Z.

They told me the robots were trash, I bought more.

They told me it was a scam, I bought more.

They told me It topped, I bought more.

They told me I was fucking crazy, yes I am.

Conviction. pic.twitter.com/m9OOQktigf

Because this kind of execution doesn’t start when the stock breaks out, it starts way earlier, when you’re stalking the idea, refining the levels, and visualizing the plan.

And yes, this setup came from a watchlist I’d been building through one of our cycle frameworks, the same process I walk through in Seven-Figure Cycles. It’s how I narrow down the noise and know where to focus.

You don’t need a huge account or perfect timing to win like this. You need patience, clarity, and a plan you’re willing to stick to.

So before your next trade, ask yourself:

- Did I study the chart?

- Do I know my levels?

- Am I clear on my risk and reward?

- Do I actually have a reason to be in this trade?

Because without that size, alerts and hype won’t save you.

But with it?

You can trade with clarity. You can build conviction. And eventually, you can hit the kind of trades that feel effortless, not because they’re easy, but because you were ready.

That’s the real lesson in this RR trade. Not the profit… the process.

You’ve probably heard me say it a dozen times by now: have a plan. Trades like this are the reason I drill it so hard.

Trade with a plan,

Jack Kellogg

P.S. I tracked RR for weeks using the same process I’m using to spot the next one. Want in? Click here to see how it works.