Hey traders,

The market’s been weird lately.

Moves feel forced, follow-through’s been spotty, and a lot of names just don’t hold up.

I’ve been trading lighter, and that’s on purpose. No point pressing when the tape’s shaky.Caught a good short on Hertz Global Holdings, Inc. (NASDAQ: HTZ)—just broke down exactly how I wanted.

Grabbed $30K on that one. And then it was the same idea with Webull Corporation (NASDAQ: BULL).

It showed strength early while everything else faded.

I sized in, took the move, then got out before it turned.

You don’t need massive wins when you’re keeping risk tight and picking your spots.

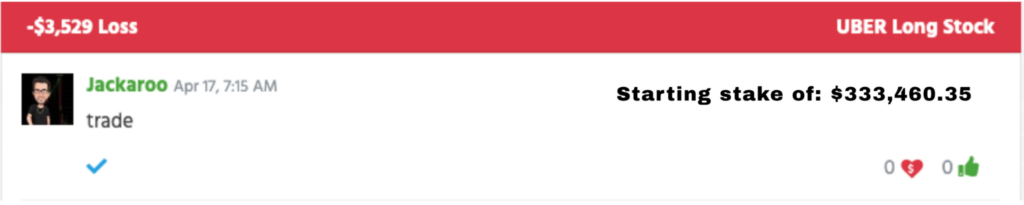

On the flip side, some trades didn’t work. Tesla, Inc. (NASDAQ: TSLA) and Uber Technologies, Inc. (NYSE: UBER) both rolled over on me, but the size was small. No stubborn holding, no chasing.

That’s been the goal lately—trade what makes sense, keep it small when things feel off, and don’t dig holes.

I’ve also been spending more time studying. Charting, reviewing past trades, scanning filings.

When the market slows down, I double down on prep.

It’s been a good excuse to check out some fresh research in the 8-Figure Advisory too—some good themes starting to show up there.

When the setups start clicking again, I’ll size back in. For now, I’m focused on staying sharp and protecting my edge.

If you’re in the same boat—less action, more learning—don’t waste it.

I’ll share more below about how I’m using this time to stay ready.

- Don’t Trade What You Don’t Want…

Here’s what I’m doing when the market stalls:

The slower the market gets, the more I study.

I’m not just sitting here waiting—I’m staying locked in, even if that means I’m taking fewer trades.

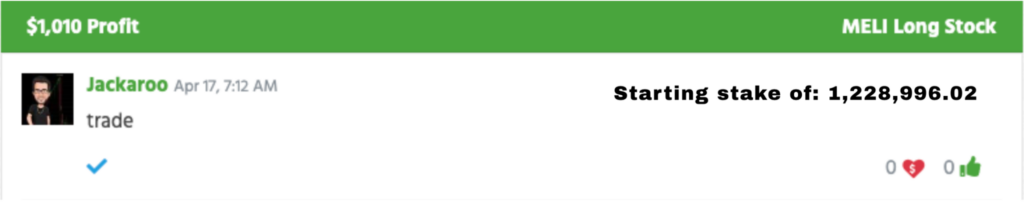

MercadoLibre, Inc. (NASDAQ: MELI) gave me something this week. I took a small position and caught a minor move, locked in just over a grand.

It wasn’t a big setup, but the price action looked tight and I liked the range it was working with.

Same with Direxion Daily Gold Miners (NYSE: DUST) —another quick trade, small size, about $5K booked.

Nothing I’d brag about, but they kept me engaged without putting real risk on the table.

I’m not trying to overtrade just to feel busy. This kind of tape punishes boredom.

That’s where losses like T-Rex 2X Long MSTR (NASDAQ: MSTU) and Strategy Incorporated (NASDAQ: MSTR) came from—names I thought had upside, but they just never got going.

Both were minor paper cuts because I sized small and cut quick.

That’s the difference between taking a hit and blowing up a chunk of your month.

More important than any individual trade has been the shift in focus.

Instead of obsessing over intraday noise, I’ve been stepping back.

That’s when I get the best clarity.

I’ve gone back through my last few hundred trades, looked at entries and exits, and noted what I did well—and where I slipped.

I’ve also been reading through current earnings reports and SEC filings.

Not because I need them for every trade, but because I want to know the full story when something good shows up.

This kind of reset reminds me how far structure takes you.

When I went through the Millionaire Challenge, I learned the value of routine and discipline.

I’ve never been the guy who trades just to feel alive—I wait for spots that make sense.

That mindset still guides everything I do, especially in slower periods like this.

I’ve also been stepping away from the screens more often.

I’m not checking out; I’m just breaking up the day with walks, quiet time, and a few minutes to think through trades without noise.

That mental breathing room adds up. It keeps my reactions sharp when it’s actually time to act.

Lately, I’ve been digging through some longer-term research in the 8-Figure Advisory, too.

I’m seeing early signs of sectors heating up.

It’s not enough to go heavy yet, but the groundwork is there.

When the patterns show up on the chart, I’ll already have context behind them.

That’s where you get the edge—putting in the work before the crowd shows up.

None of this stuff feels flashy. There’s no “home run” setup right now. But that’s fine.

Staying in rhythm during quiet markets pays off later when things pick up.

I’ve seen it happen too many times to think otherwise.

Right now, I’m staying small, staying sharp, and keeping my capital safe.

The opportunities will come. They always do. Just gotta be ready when they finally break through.

Talk later,

Jack Kellogg

P.S. If you’re using this slow market to level up, I put together something that might help.