Hey traders,

Fall’s Creeping In… And It’s Time to Reset

I can feel it already, summer’s winding down.

The volume sucks. Setups feel forced. Most traders either disappear completely or keep swinging at garbage and wondering why they’re bleeding out.

Every year around this time, I see the same pattern:

Summer messes with your head.

It makes you lazy. Sloppy with entries. Undisciplined with sizing.

You convince yourself you’re just “staying active,” but really… you’re just feeding your worst habits.

I’ve done it, including this year.

The slow grind of summer makes it easy to forget what real trading looks like.

It doesn’t mean you’re a bad trader; it just means it’s time for a reset.

Because once September hits, the game changes fast.

Volume returns. Runners show up.

If you’re not mentally sharp and fully focused, you’ll either miss the best trades… or blow up chasing the first fake-out that spikes.

This next stretch can make or break your year. But you can’t bring that lazy summer mindset into fall.

2 Trades That Snapped Me Back Into Focus

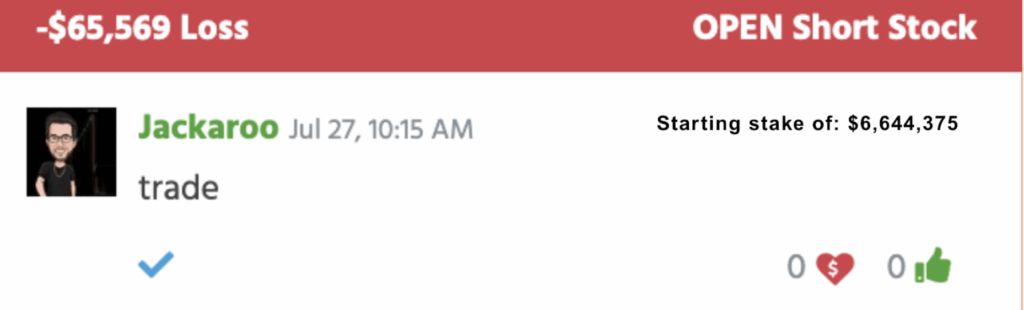

Let’s start with Opendoor Technologies Inc. (NASDAQ: OPEN).

I went short with size, got a small move, then it reversed, and I held longer than I should’ve.

Ended up eating a $65,569 loss.

Less than a 1% move against me… but when you’re oversized and not fully focused, small moves hurt big.

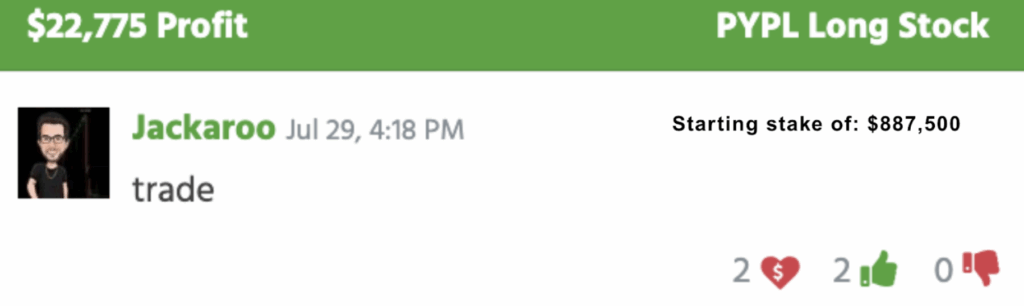

Then came PayPal Holdings, Inc. (NASDAQ: PYPL).

Clear catalyst, strong volume, clean breakout.

I bought 12,500 shares at $71 and sold at $73.

Pulled $22,775, simple 2.8% move, clean execution. Didn’t overthink it. Didn’t hesitate. Just traded the setup in front of me.

One trade reminded me what not to do. The other reminded me what trading should feel like. So now I’m flipping the switch.

Here’s What I’m Doing to Get Ready for Fall:

This next stretch of the year can make or break your whole 2025. So I’m not winging it.

I’m treating this reset like a full system tune-up.

1. Clearing out the noise

I’m done with “maybe” trades.

No more guessing. No more justifying weak setups with phrases like “well, it’s kind of holding up…”

If it’s not an A+ setup with clean risk and real potential, it doesn’t get my money.

My job is to sit, watch, and wait. Not to stay busy.

2. Reviewing everything I traded this summer

Every trade I took this summer, win or loss, gets reviewed.

- What was the setup?

- Did I size properly?

- Did I stick to the plan or chase?

- Was it actually my setup, or someone else’s hype?

This isn’t about beating myself up.

It’s about understanding what’s been working… and cutting the junk.

3. Locking in my mental game

Discipline tends to slip in slower markets.

Fall brings more volatility, which means more chances to screw up if you’re not sharp.

So I’m resetting my mental rules:

- No chasing

- No revenge trades

- No “one last trade” at 3:45 pm to try to turn around a bad day

- No oversized positions on half-baked ideas

I’ve seen too many good traders blow up right before the real moves come. Not doing that.

4. Sharpening my watchlists

I’m prepping my watchlists now, not when the market heats up.

That means scanning daily, spotting repeat runners, and building my go-to basket.

When the big move shows up, I don’t want to be scrambling; I want to already know the ticker, the range, the personality, and the levels.

Fall rewards traders who come in focused. Not perfect, just intentional.

If you’re still trading like it’s summer, you’ll miss it.

You don’t get time to ramp up slowly. You either prep now or play catch-up for the next 3 months.

Quick Check-In: How’s Your Mindset Heading Into Fall?

Take the 1-minute Fall Trading Reset Poll and compare your mindset and prep with other traders.

Let’s come in sharp.

The best trades of the year could show up any week now.

Don’t be the guy still stuck in summer mode,

Jack Kellogg