Hey traders,

Hey,

We’re heading into the last few days of May.

Feels like the month just blinked by, but my trades definitely didn’t.

I’ve already started going through everything—every entry, every exit, every “What the hell was I thinking?” moment.

Some trades made my month. Others… tried their best to wreck it.

I don’t wait for the calendar to flip before I review.

I do it while the pain still stings and the wins still feel good. That’s when the lessons actually land.

This month had it all. A few setups felt like free money.

Others lured me in and then smacked me across the face.

One trade hit so hard it had me questioning everything… but that’s the game. I either learn or repeat the same crap again.

If you’ve been grinding through May green, red, or just barely hanging on, I’d seriously suggest pulling up your charts and notes.

Not to judge yourself, but to understand your decisions. That’s where the edge comes from.

I looked back at my own plays and pulled out a few that taught me something I’m not gonna ignore heading into June.

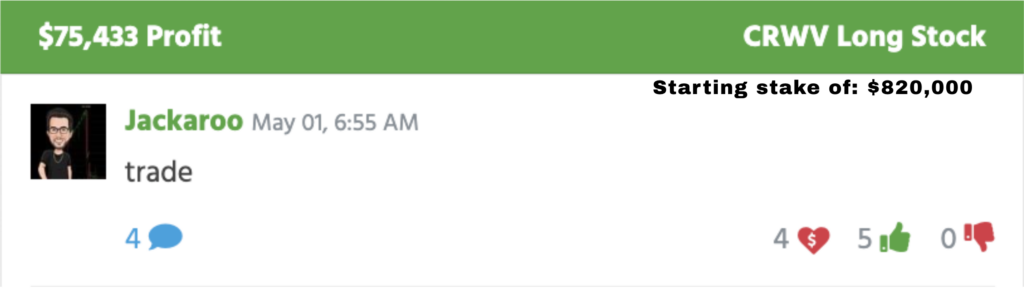

✅ May 1 – CoreWeave, Inc. (NASDAQ: CRWV) – $75,433 Profit

On paper, this was a killer way to start the month.

But I sized in late. I reacted to the move instead of planning for it. I got rewarded for bad execution.

Lesson: Sometimes you win, but it still wasn’t a good trade.

If I make this kind of entry 10 times, I probably lose 6 or 7 of them. Don’t let a lucky win blind you to bad habits.

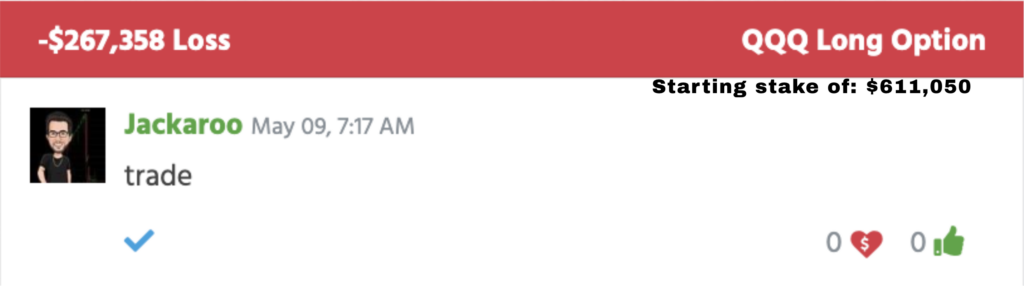

❌ May 9 – Invesco QQQ Trust (NASDAQ: QQQ) – $267,358 Loss

This one’s still burned into my brain.

Massive size. Weak plan. I chased the bounce and got smoked.

I didn’t have a stop mapped out. I just “felt” right about the trade… and paid for that feeling.

Lesson: Size without structure is just a big bet. And big bets with no plan usually end one way: red.

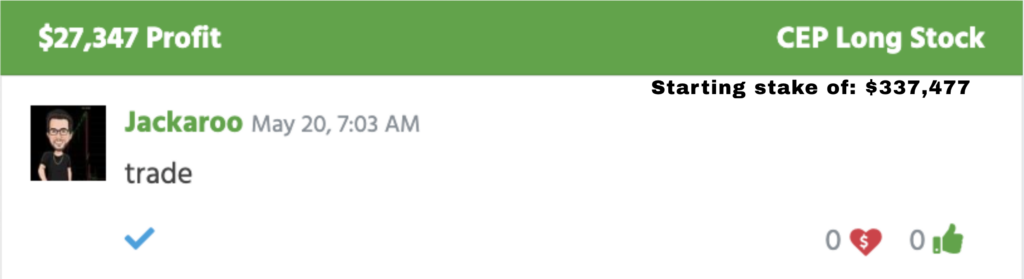

✅ May 20 – Cantor Equity Partners (NASDAQ: CEP) – $27,347 Profit

This one actually went well. But only after I missed it earlier in the month.

The first time CEP started to move, I sat there and watched it go.

Because I was still rattled from a loss the day before. I didn’t trust myself.

Lesson: Missed trades are mirrors. If you’re frozen, there’s something you haven’t dealt with yet.

Fear, doubt, and hesitation show up when your process isn’t clear.

These three trades weren’t about being right or wrong. They were about what I learned after the dust settled.

That’s the kind of stuff that sticks—and actually helps next time.

If you haven’t reviewed your own trades yet this month, don’t wait until the weekend.

Take 30 minutes. Look at your biggest wins and your worst screw ups.

Ask yourself why they happened.

Do that now, while it’s still fresh. June will thank you.

Stay dialed in,

Jack Kellogg

P.S. I wouldn’t have caught that CRWV move—or had the guts to go back in on CEP without my Power Signal Indicator lighting up.