Hey traders,

We’ve seen choppy action all over the place.

Fake breakouts, weak volume, random pops that look good for about 10 minutes… and then rug pull.

It’s that kind of environment where a stock perks premarket, looks like it wants to go, then completely dies the second you size in.

Or worse, you hesitate, skip it, and then it randomly goes 40% later with no clean entry.

That’s the kind of junk we’ve been dealing with.

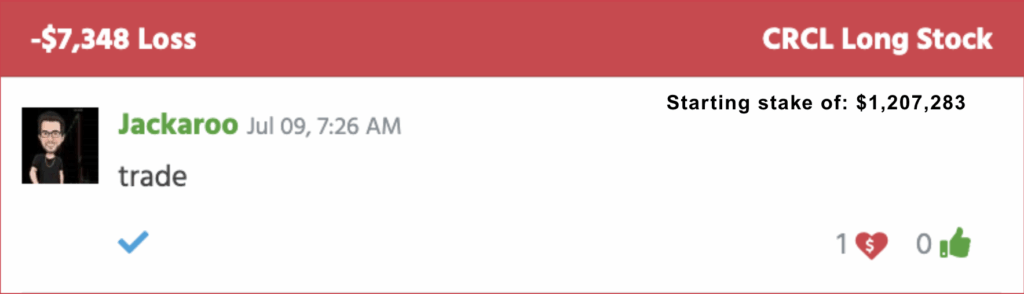

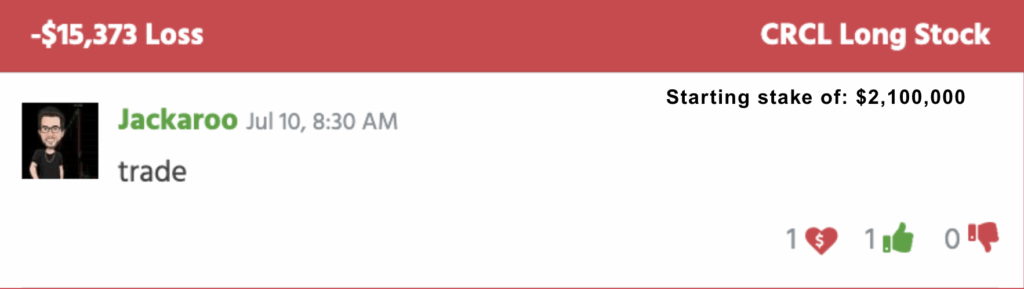

Circle Internet Group (NYSE: CRCL) was a perfect example.

I tried that one twice this week, first time, decent idea, but it went nowhere.

Second time, I thought we had a breakout lining up. Nope.

It perked fast, gave a quick push, then slammed right back down and trapped everyone.

Ended up eating losses both times, down over $20K total on that ticker alone.

Now I’m not telling you this to complain.

These losses came from setups I thought looked good at the time.

But in this kind of market, even solid ideas can flop fast. You either adapt, or you keep bleeding.

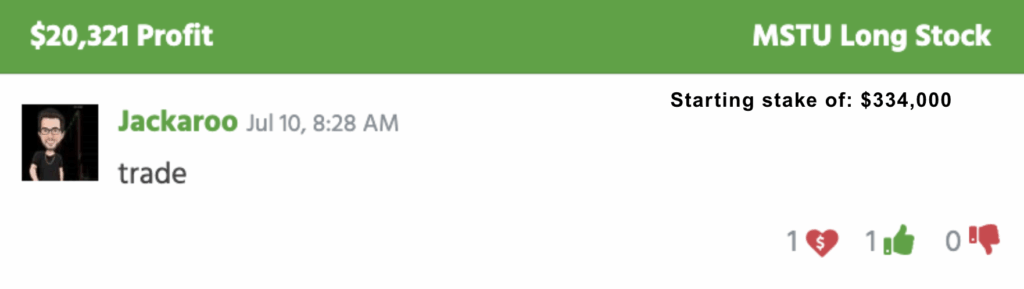

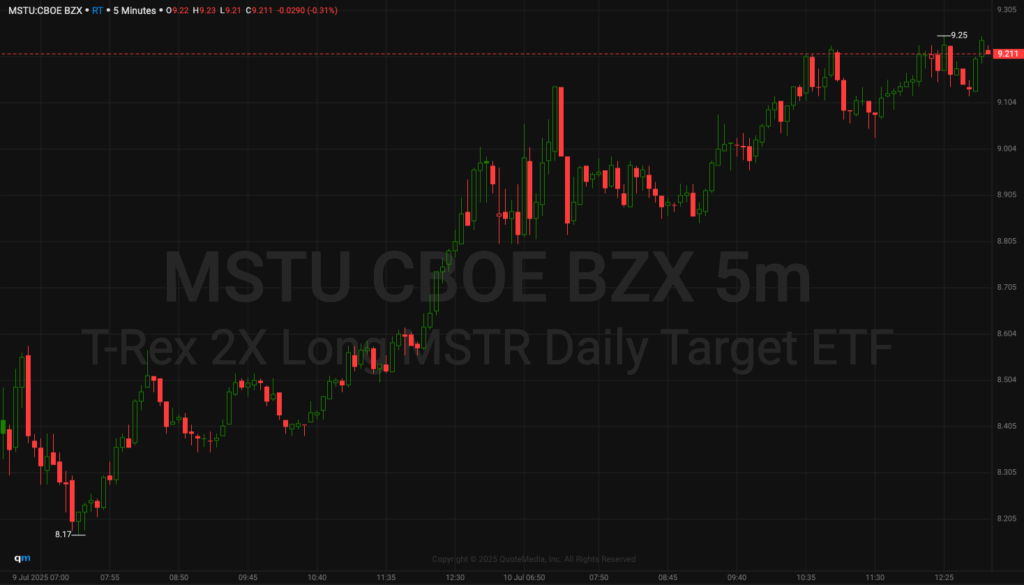

So lately, I’ve shifted. Staying lighter. Waiting for the clean stuff. Letting the chart prove it wants to go before I jump in.T-Rex MSTR Daily Target ETF (NASDAQ: MSTU) is a good example of when it actually works.

Because the price action followed through. Volume came in, levels held, and it gave clean entries with range.

That’s the stuff I’m focused on heading into next week, names that’ve shown strength or held trend while everything else chops around.

You don’t need to hit every play. You just need to hit the right one.

Here’s what I’m watching into the weekend and early next week:

T-Rex MSTR Daily Target ETF (NASDAQ: MSTU)

This $9.00 per share area looks interesting.

With Bitcoin heating up again, we could see some sympathy momentum sneak in.

Strategy Incorporated (NASDAQ: MSTR) gets all the attention, but this one might run quietly if crypto stays hot.

Hertz Global Holdings, Inc. (NASDAQ: HTZ)

Steady grind higher with clean higher lows.

Might be ready for a leg up if volume comes in. Not a chase, but it’s behaving well enough to keep on radar.

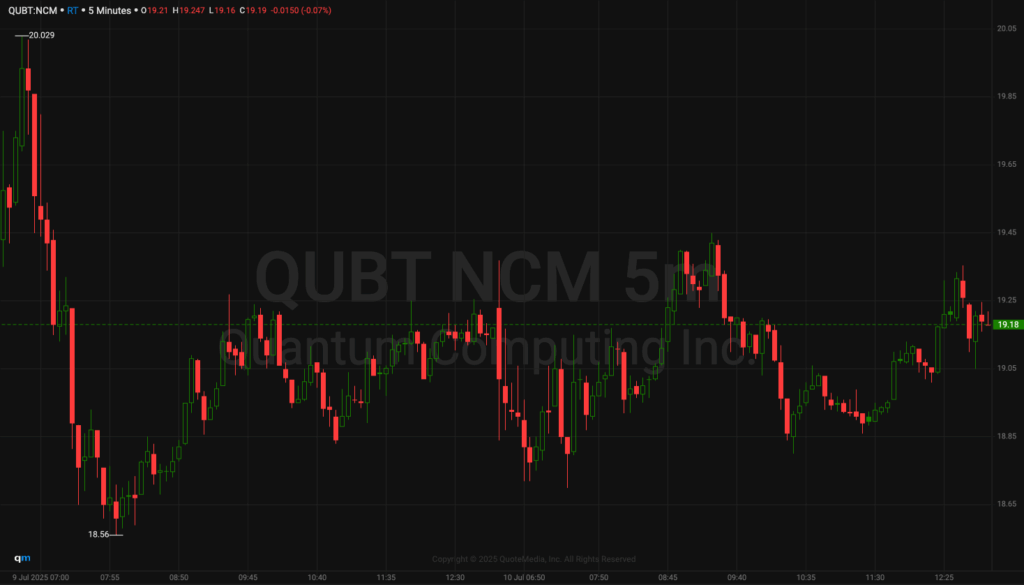

Quantum Computing Inc. (NASDAQ: QUBT)

Three red days in a row, but trend still intact.

Watching for a weak open that snaps back red to green.

Could catch a reversal move if buyers show up.

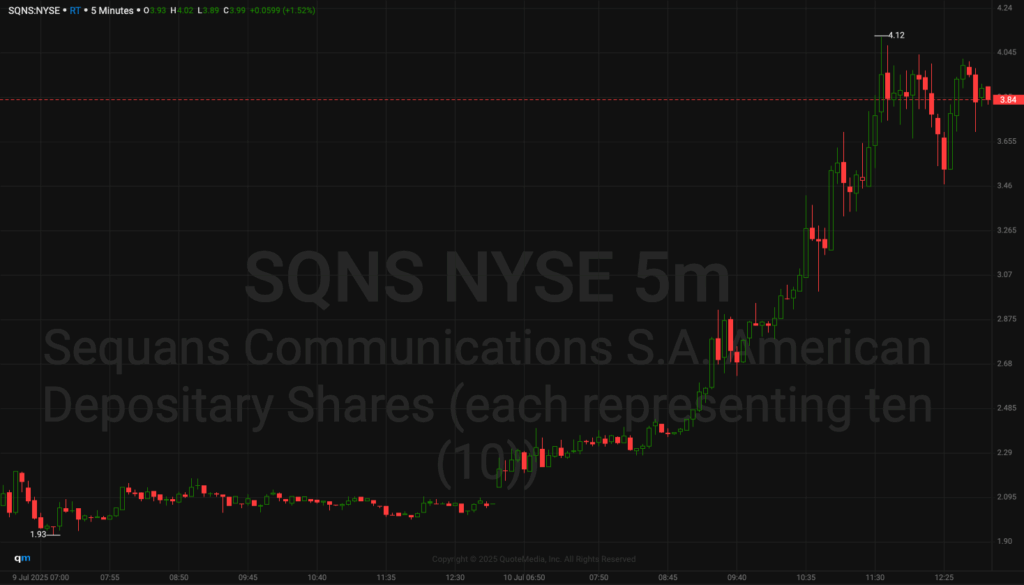

Sequans Communications S.A. (NYSE: SQNS)

After that big pullback, this actually held way better than I expected.

If shorts are still lingering, this could squeeze back toward the $2.20 range.

Needs confirmation, but worth watching.

I’m not going into the weekend with size, but I’m not zoning out either.

These are the types of setups that can sneak up fast when everyone else checks out early.

Jack Kellogg

P.S. Tim Sykes just announced the $100K Summer Summit, he’s sharing trade plans, strategy breakdowns, and what’s setting up for the rest of summer. Lock in your spot now.