Hey traders,

Most traders spend their mornings chasing strength.

They scroll through scans, read every alert, and lock onto the tickers moving fast, as if the biggest candle on the screen is a personal invitation.

And sometimes, that adrenaline-fueled instinct does catch a move.

But more often, it catches them off guard because what they’re chasing isn’t strategy. It’s noise.

The real opportunities, the ones that reward preparation, patience, and poise, don’t announce themselves with a spike.

They arrive in the form of fear. They show up when a stock that’s been climbing steadily, day after day, suddenly turns.

When buyers disappear, bids collapse, and the entire move unwinds in minutes.

That’s when most people panic.

But for the few traders watching for it, who know exactly what this kind of action can lead to, it’s not panic.

It’s a pattern. And it’s one of the most consistent setups I’ve seen across every market cycle, especially for small account traders who need edge, not excitement.

It’s the morning panic dip buy. And while it’s not glamorous, and rarely gets talked about the way breakouts do, I believe it’s one of the most powerful setups out there, because it teaches more than just timing.

It teaches control.

This isn’t a guess-the-bottom setup. It’s not about size or speed. It’s about watching carefully, reacting precisely, and understanding what kind of emotional shift needs to happen before the move even begins.

If you’ve ever felt like you’re just a little too late, or a little too early, or like your trades are built on hope instead of a plan… this is a pattern worth learning.

The most valuable trades I’ve ever taken haven’t been the biggest.

They’ve been the ones that made me a better trader, not just because they worked, but because they forced me to follow a plan when every part of me wanted to react emotionally.

The morning panic dip buy is one of those trades.

It’s a setup that only works if you let the trade come to you. It won’t reward early guesses. It doesn’t respond well to aggression.

But when it unfolds correctly, with structure, volume, and a clear signal, it can turn a moment of fear into a clean, controlled trade with defined risk and reliable reward.

The best part is when it shows up over and over again in hot markets, especially with low-priced, overextended OTC stocks.

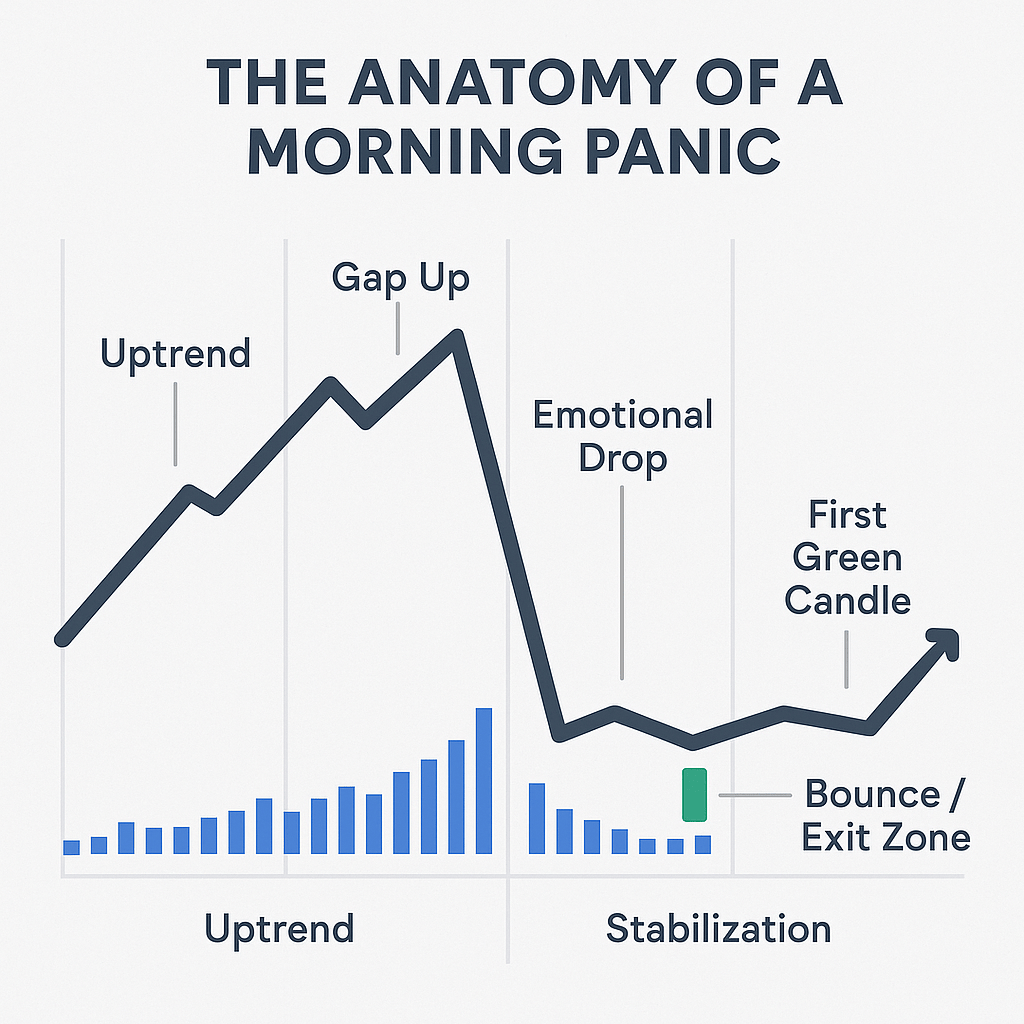

You start by stalking a name that’s been climbing for several days in a row, not parabolically, but steadily. Ideally, it’s gapping up each morning and closing near its highs.

The kind of pattern where everyone watching it begins to believe it’ll never pull back, where social media starts throwing out wild price targets, and where latecomers pile in out of FOMO.

Then comes the morning.

The same stock gaps again, but there’s no follow-through this time. It starts to slip.

Then it drops faster. Suddenly, the crowd that chased strength is underwater, and the entire move begins to collapse under the weight of too much confidence.

This is the panic. And this is where the opportunity begins.

But only if you’re watching for it and only if you have the discipline to wait for confirmation.

What I’ve learned is that the best panic dip buys don’t just fall a little.

They flush, often dropping 30%, 40%, even 50% from their highs within minutes.

That’s not random. That’s emotion. It’s all the late longs hitting the exits at the same time. And it’s where you have to be at your calmest.

Because it’s tempting to try to buy the low, to think it’s “gone too far.”

But the reality is, these stocks, especially OTC runners, can always go lower. That’s why I never buy into weakness. I wait.

The entry comes after the flush slows down.

- When the chart shows a moment of stability.

- When the tape begins to shift.

- When size shows up on the bid, the pace changes, and a green candle finally forms, ideally on heavy volume.

That first green five-minute candle is your signal. Not because it guarantees a bounce, but because it shows that the panic is subsiding.

It tells you the tide may be turning, and if it is, that’s where you get in, with a clear stop at the low of the day.

This pattern requires patience. A basic understanding of volume and structure. And the ability to wait for price to confirm what emotion already hinted at.

And when it works, it’s fast.

The best ones bounce hard and quick, sometimes recovering 20–30% in minutes.

It’s about reacting to a specific moment, taking profits into strength, and moving on.

What makes this setup so important for small accounts isn’t just the reward but the structure it demands from you as a trader.

You can’t trade it well unless you have a plan, know what you’re looking for, and are willing to wait for it, sometimes for days, and walk away when it’s not there.

If you’re still trying to figure out where you fit in this market, or what kind of trader you want to be, I suggest studying this pattern.

You won’t find it every day. But when you do, and when you execute it right, it can teach you more in one trade than a dozen alerts ever could.

And that, more than anything, is what builds confidence. It was not just a green trade, but knowing exactly why it worked.

Talk soon,

Jack Kellogg