Hey traders,

Quick quiz, no pressure.

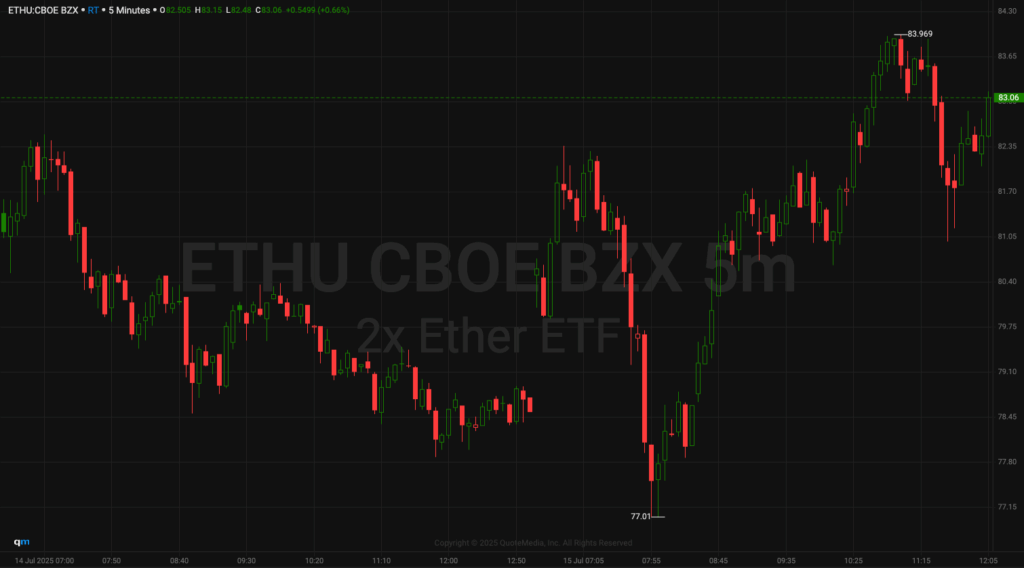

Let’s say it’s Monday morning, and you see this:

- The stock’s a former runner

- It’s up 30%+ off the lows

- Volume’s steady, not wild

- The chart’s hanging near HOD

- And it’s tied to a sector that’s kinda warm, not blazing hot, but definitely in play

Do you take the trade?

Do you wait for the breakout?

Do you skip it entirely?

That’s the kind of decision I’ve had to make over and over lately.

This one was on Volatility Shares Trust Ether ETF (NASDAQ: ETHU).

And I had to decide fast.

It looked like trash early, sold off hard, tested new lows at the $77 per share mark and most people bailed.

But then it started creeping back. No explosion. No news hype. Just controlled strength.

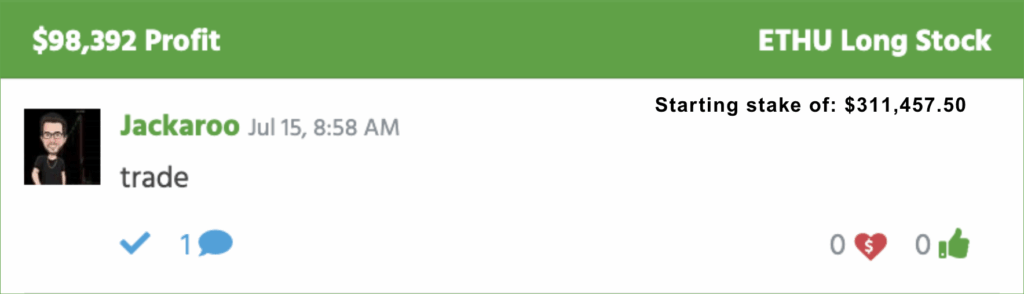

That’s when I leaned in and got rewarded with a $98,392 profit.

- Entry: $62.29

- Exit: $81.97

- Position Size: 5,000 shares

- +31.59% gain

Would you have taken the trade? Or sat on your hands?

Most traders missed this move completely.

They saw the panic and walked away. But I’ve seen this pattern enough to know better.

This is where preparation pays off:

Recognizing a shift in momentum before it becomes obvious.

Watching price action tighten up and buyers take control.

And being ready to size in when it confirms.

That’s the move. That’s the edge.

This week, ask yourself:

Are you showing up with a plan? Or just reacting and hoping something sticks?

This week, keep your radar sharp. The clean setups won’t scream. They’ll whisper.

Be ready,

Jack Kellogg