Hey traders,

I broke my own rule—and paid for it.

The setup felt clean. The price action looked strong. I told myself I had an edge.

But deep down, I knew I was forcing it. Oversized. Ignored a rule I’ve followed for years. The kind that’s saved me more times than I can count.

Instead of walking away, I clicked buy.

$104,522 later… I got the message.

I’m not writing this to complain. I’ve had big wins lately, too—some really solid ones. But the losses always teach you more, especially when they’re self-inflicted.

This game doesn’t care how long you’ve been around. You’re paying for one mistake, one moment of ego.

If you’ve felt the sting of a trade gone sideways because you knew better… you’re not alone.

I’ve got some thoughts fresh in my head while it’s all still raw.

Let’s talk about it.

$104K… torched in a day. Not my proudest moment.

I don’t care how long you’ve been trading—days like that test you. You start questioning everything: your process, setups, and sanity.

But here’s the kicker…

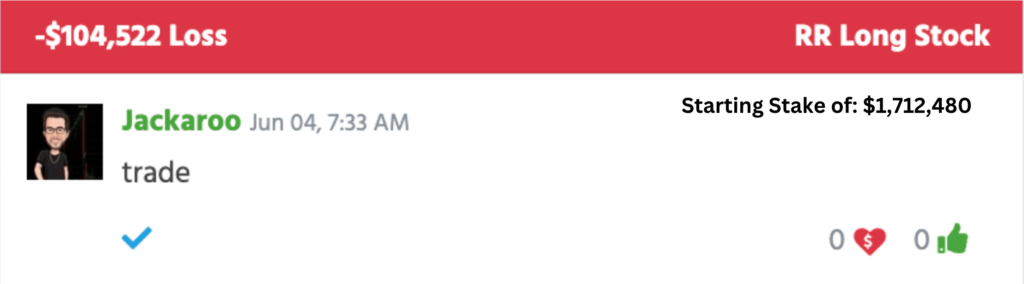

I took a big swing on Richtech Robotics Inc. (NASDAQ: RR), and I felt good about it going in. And then—boom. -$104,522. Gone, smacked like I owed the market money.

Not gonna lie, that one stung. But here’s the thing—none of it came as a surprise.

Every Big Loss Starts With a Small Rule Break

I didn’t follow my size rules. I let bias creep in. I got caught thinking “I’ve got this” instead of asking “what’s the risk?”

And when I look back on my worst losses from last week, Richtech Robotics Inc. (NASDAQ: RR),

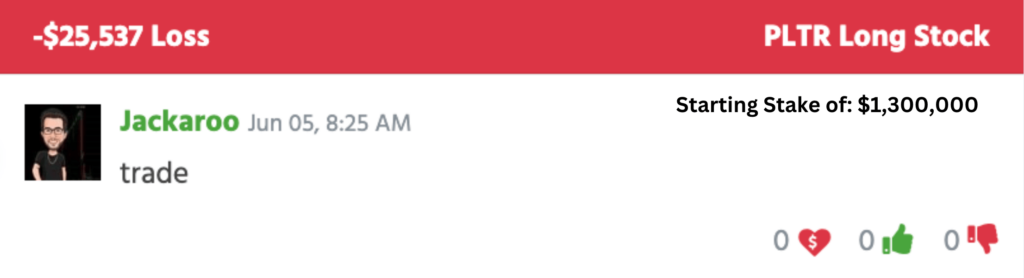

Palantir Technologies Inc. (NASDAQ: PLTR)

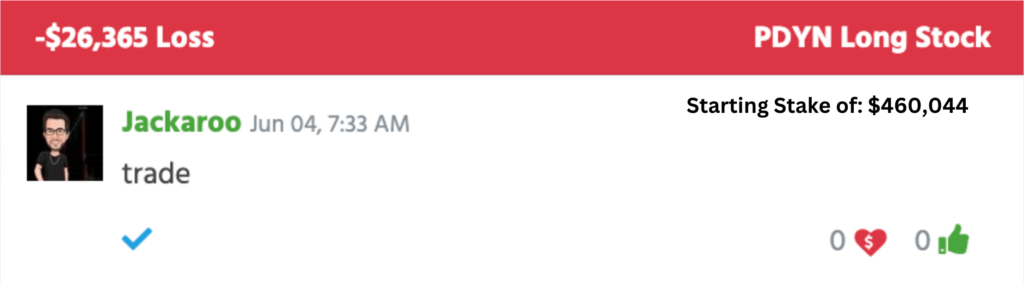

Palladyne AI Corp. (NASDAQ: PDYN)

The common thread always comes down to discipline. Or the lack of it.

Not the market. Not some shady news catalyst. Not bad luck.

Me.

That’s hard to admit. But if you’re serious about trading long term, you’ve gotta get brutally honest with yourself.

Rules Aren’t There to Limit You

They’re there to protect you.

From your own ego, from overtrading, from the fantasy that every setup turns into a home run.

When I stick to my rules, I don’t always win, but I control the downside. And that’s what gives me staying power.

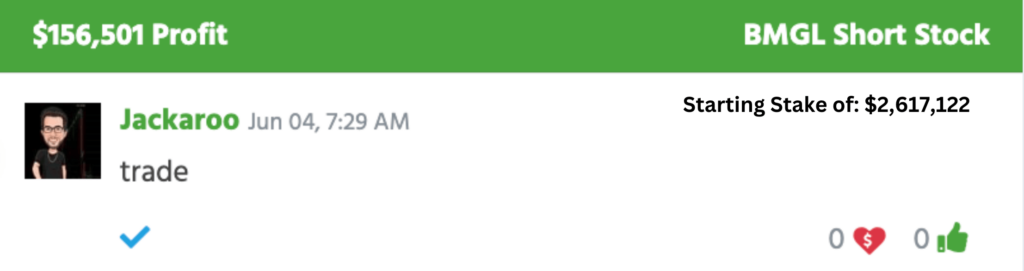

Like last week—yeah, I took a few gut punches. But I also banked:

- $156,501 on Basel Medical Group Ltd (NASDAQ: BMGL)

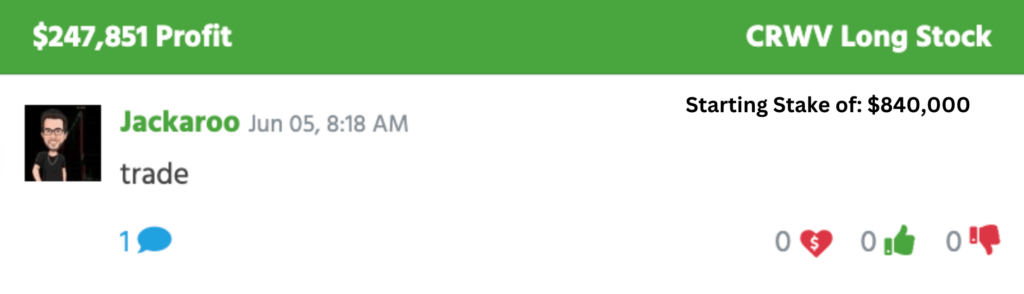

- $247,851 on CoreWeave, Inc. (NASDAQ: CRWV)

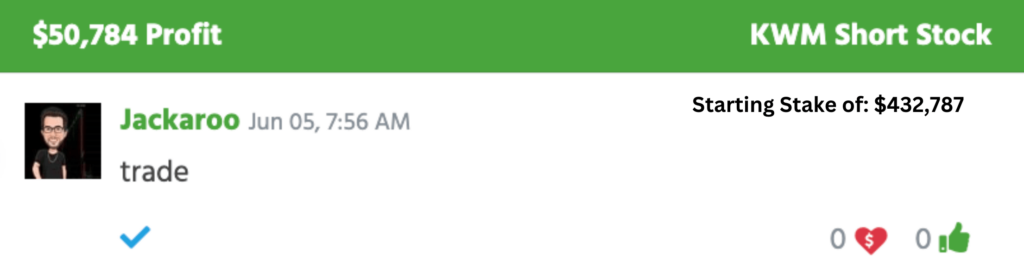

- $50,784 on K Wave Media Ltd. (NASDAQ: KWM)

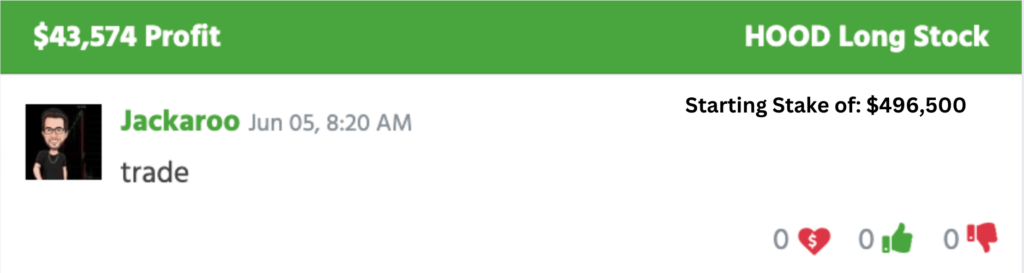

- $43,574 on Robinhood Markets, Inc. (NASDAQ: HOOD)

All those wins came from setups I waited for. Ones that lined up with the Power Signal Alerts—the only alerts I trust enough to size into aggressively.

You Don’t Need to Trade Everything

That’s another trap—thinking more trades = more profits.

There are a lot of days when I sit on my hands. Not because I’m lazy. Because I’m protecting my focus.

Let’s say you get a Power Signal on a breakout with huge volume, a clear catalyst, and a perfect entry spot. That’s when you press. That’s when you earn your edge.

But when you’re just clicking buttons out of boredom, chasing subpar plays, or revenge trading because you’re red?

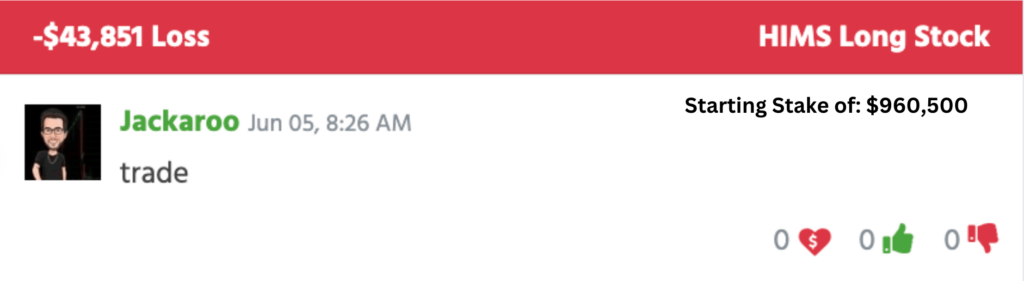

That’s how you spiral into a $43K loss like I did on Hims & Hers Health, Inc. (NYSE: HIMS).

Don’t do that. Please. It’s not fun.

The Power Comes From Saying “No”

A lot of new traders think rules make them miss out. Like, discipline means fewer opportunities.

But you see the truth when you see that the rules create the opportunity.

So If You’re Struggling Right Now…

…ask yourself this:

- Are you following your rules?

- Are you sizing right?

- Are you chasing noise or waiting for conviction?

And if you’re not using something like Power Signal Alerts, you may be spending too much time guessing.

Those alerts narrow it down. They help me focus on high-probability setups, cut the clutter, and stick to my plan.

They won’t make you disciplined. But they’ll make it way easier to stay disciplined—if you let them.

My Biggest Lesson This Week?

Discipline isn’t exciting. But neither is blowing up your account.

I’ll take boring and profitable over exciting and broke—every time.

Stay dialed in,

Jack Kellogg

P.S. If you want to track what I track, I built the Power Signal Indicator into my system so YOU can spot these moves early—even in choppy markets…