Hey traders,

You ever watch someone justify a bad decision like it somehow makes it better?

“I returned something for $100 and bought something else for $80… so I made $20.”

“I used points, so technically it was free.”

Not so funny when I see traders doing the same thing with five-figure positions.

- They baghold and call it “patience.”

- They size up and call it “confidence.”

- They throw around words like “conviction” while quietly hoping for a miracle.

That’s not a strategy. That’s just denial wrapped in a buzzword.

Most people in this market aren’t actually trading, they’re negotiating with their own logic and calling bad decisions smart ones, just so they don’t have to change.

But at some point, you stop coping and start thinking differently.

You stop pretending you’re fine, and you start doing math that actually holds up.

That shift changed how I trade.

Some trades don’t just cost you money—they sit with you afterward.

Not in a loud, dramatic way.

More like a quiet weight, you look at your screen, not because you expect anything to change, but because you’re trying to process what already happened.

Last week gave me more of those than I’ve had in a while.

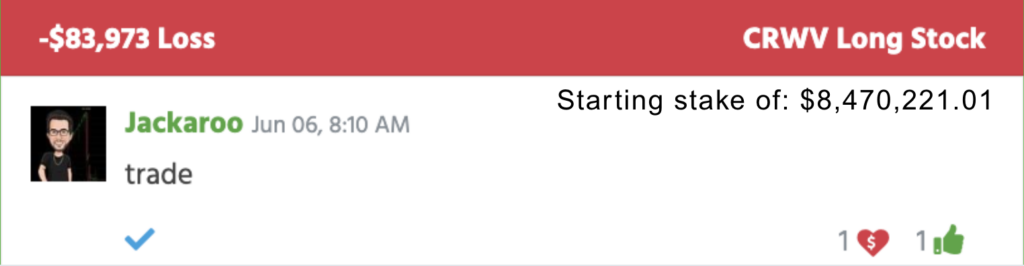

CoreWeave, Inc. (NASDAQ: CRWV) pulled over $83K out of my account.

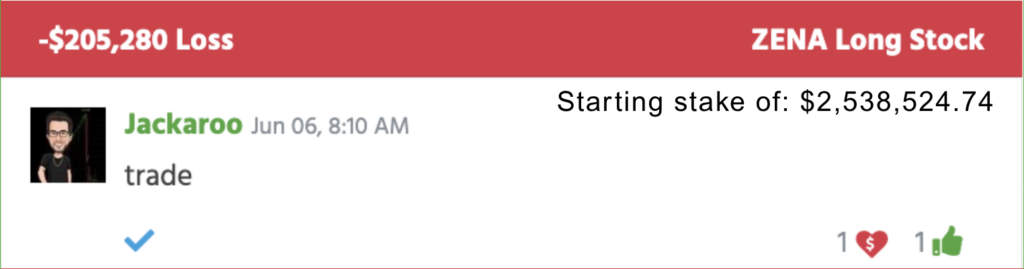

ZenaTech, Inc. (NASDAQ: ZENA) took another $205K.

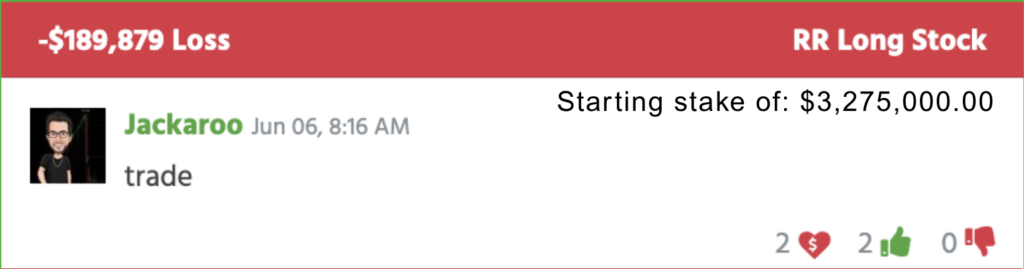

Richtech Robotics Inc. (NASDAQ: RR) followed up with a $189K hit.

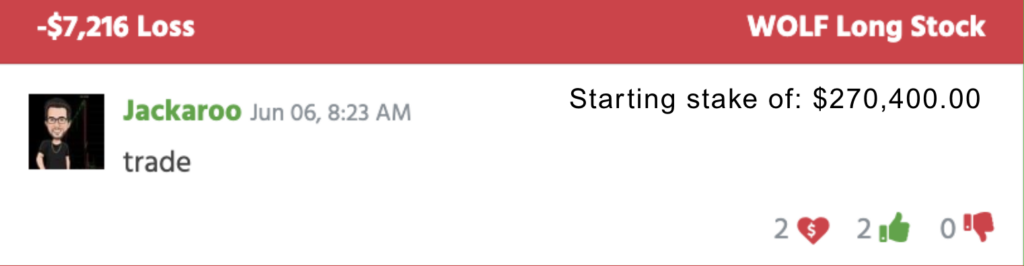

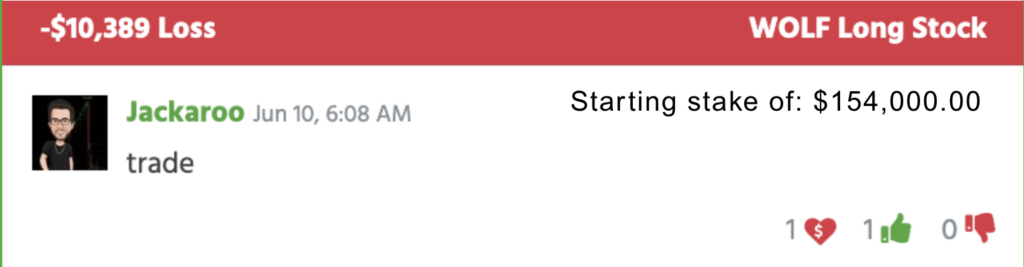

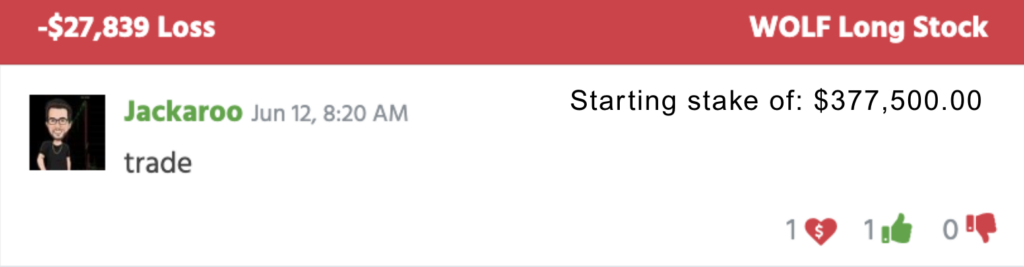

And WOLF managed to tag me three separate times, just to drive the point home.

I’ve had plenty of losing days, but this stretch felt different. It didn’t come from sloppiness or chasing. It came from trading the same way I always had, just in a market that no longer paid the same way.

That’s the trap.

You keep doing what worked before, hoping it starts working again, but when the market shifts, those same setups stop paying, and the risk only gets sharper.

Every hesitation gets punished. Every wrong move hits harder.

You don’t bounce back from that by pushing harder. You do it by adjusting.

That’s what led me back to options.

For years, I avoided them; I thought they were too complex, too layered, too far removed from what I knew.

It felt like a different world, filled with math I didn’t understand and strategies that didn’t apply to the way I trade.

But I was wrong. Once I stripped it down and looked at what they actually are, it made sense.

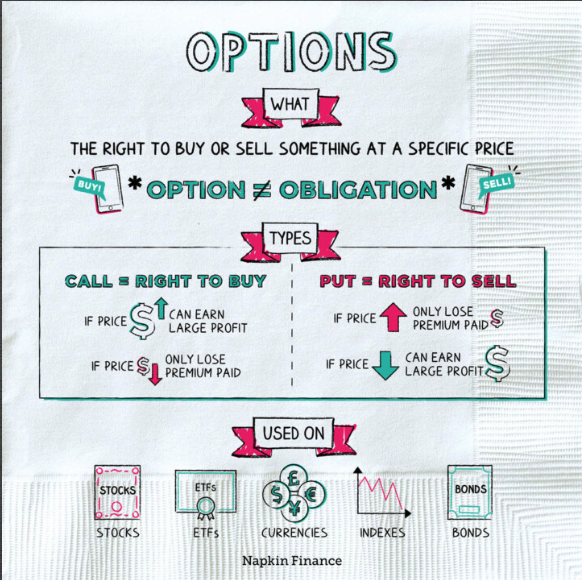

Options are contracts. That’s all. You’re paying for the right—not the obligation, to buy or sell a stock at a certain price. That simple shift in structure completely changes the way you can take risks.

If I like a stock and want exposure to the upside, I don’t need to tie up ten or twenty grand just to get exposure. I can spend a few hundred dollars on a call contract.

If the move happens, I still win. If it doesn’t, I already know exactly what I’m risking before the trade even starts.

That’s what I needed.

It’s not another setup; it’s just a way to stay in the game without exposing myself to the kind of hits that shake confidence and drain momentum.

It also opened up other doors. If I think a stock might drop, I can use puts to profit or protect a long position.

If I want to collect smaller, consistent wins in a choppy market, I can sell premium. If I want to manage different layers of risk within a single trade, I can build positions that give me flexibility, not just an all-or-nothing outcome.

It’s not about being fancy. It’s about being smart.

The more I used them, the more I realized options aren’t complicated.

They’re just unfamiliar.

Once you see how they function, they become another part of your toolkit—one that gives you much more control in chaotic or one-sided markets.

And maybe that’s what bothered me most last week—not just the losses, but the fact that I let the market dictate everything.

I wasn’t using all the tools available. I wasn’t defending myself. I was showing up with the same game plan, even when the environment had clearly shifted.

That’s what most traders miss: they keep doing the same thing, hoping it starts working again, and when it doesn’t, they start rationalizing it.

They lean on hope, start doing mental gymnastics to explain why they’re still holding., start telling themselves “it’ll bounce”.

They size up instead of cutting down. And they give it a name—“conviction” or “discipline”—when really, it’s just fear of change.

That’s what made the whole “girl math” trend hit me sideways.

It’s funny on the surface. But it’s the same logic I see traders using to justify risk they can’t control.

It’s emotional reasoning. And that stuff might work on social media, but it doesn’t work in the market.

You can’t lie to your account. You can’t manifest a comeback. You can’t trade based on how you wish things would go.

The market doesn’t care what name you give your mistakes. It just tallies the outcome.

So you don’t need to be perfect. You just need to stop pretending that what’s not working will somehow fix itself.

That’s the kind of trading I’m leaning into now.

If you’re ready to stop guessing, stop winging it, and actually learn how options work in the real world, join the live webinar next week. It’s worth your time.

It’s not some overcomplicated lecture.

It’s a clear, beginner-friendly breakdown of how to use options to take smarter trades, protect your account, and stay aggressive even when stocks get choppy.

Whether you’re new or just want more control, you’ll walk away with something useful.

I’ll be tuning in too. If you’re serious about growing as a trader, you won’t want to miss it.

Adapt or get smoked.

Jack Kellogg