Hey traders,

Most traders wait for the breakout.

They stare at charts all day hoping something will finally move, and when it does, they scramble to catch it.

But the best setups don’t start with a breakout, they start quietly. They build over time, just under the surface, while the rest of the market feels uncertain or flat.

That’s the kind of action I watched unfold this week.

This week as we held our breath for the fed meeting, the market felt slow.

Headlines pulled focus. Momentum came and went. But if you were paying attention, a few small names began to show the kind of structure that always gets me interested.

Because the chart behavior told a story. The levels were clear. Buyers stepped in. Volume built gradually. And the setups gave you time to think instead of forcing a reaction.

When trades like that come together, they almost always share the same traits: a strong daily chart that holds its shape, a sector that’s already seeing momentum or news flow, a breakout level that doesn’t need to be adjusted or explained, steady volume that confirms the move once it starts, and enough room above that breakout for the trade to actually be worth it.

These weren’t the loudest setups in the market.

But they gave you a real chance and if you’ve been missing trades lately or second-guessing what to focus on, these are the patterns worth coming back to.

Now let’s take a look at the names that followed this exact script and why they stood out long before the rest of the market caught on.

Each one is showing a similar pattern; a setup I’ve seen play out again and again.

They’re pressing into clear resistance, holding higher lows, and getting support from subtle, steady volume.

They’re not chasing strength, they’re building it.

And when that structure lines up, I listen.

SciSparc Ltd. (NASDAQ: SPRC) stood out first.

It held cleanly above VWAP, sat right below a key level most of the day, and when buyers stepped in, it gave them exactly what they needed.

The breakout was fast, but it wasn’t random. The setup had been forming all morning.

Then I spotted AtlasClear Holdings, Inc. (NYSE: ATCH) another low-float name pressing higher without much noise.

It pulled back early, found support, then started curling.

Nothing dramatic. Just higher lows stacking in, volume building with each attempt.

When the breakout came, it looked almost too easy. But it was earned.

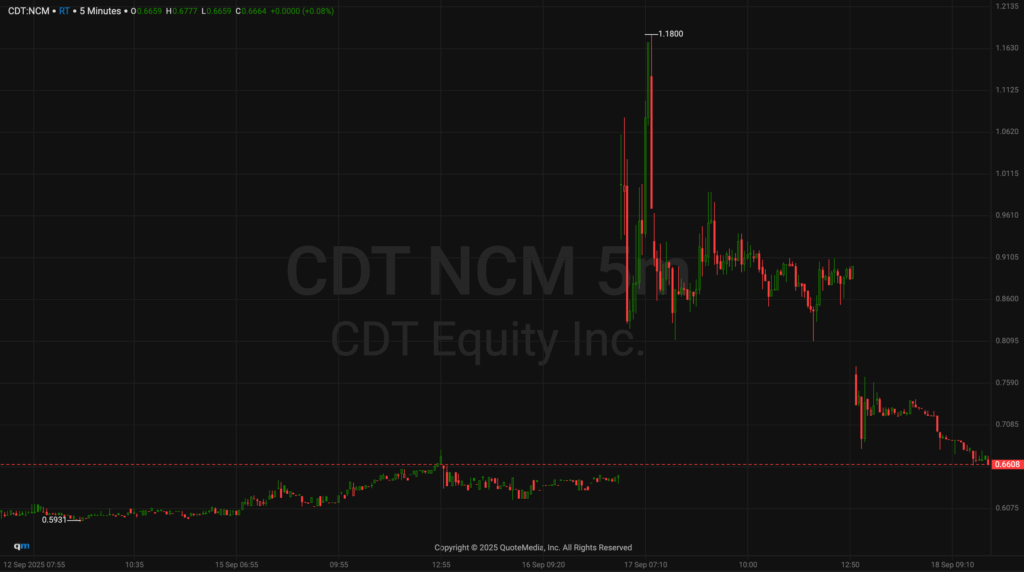

CDT Equity Inc. (NASDAQ: CDT) followed the same structure.

Coiled just under a round-number level, higher lows squeezing the range tighter with every bounce.

It didn’t spike until volume made it impossible to ignore, but everything leading up to that moment gave you time to prepare.

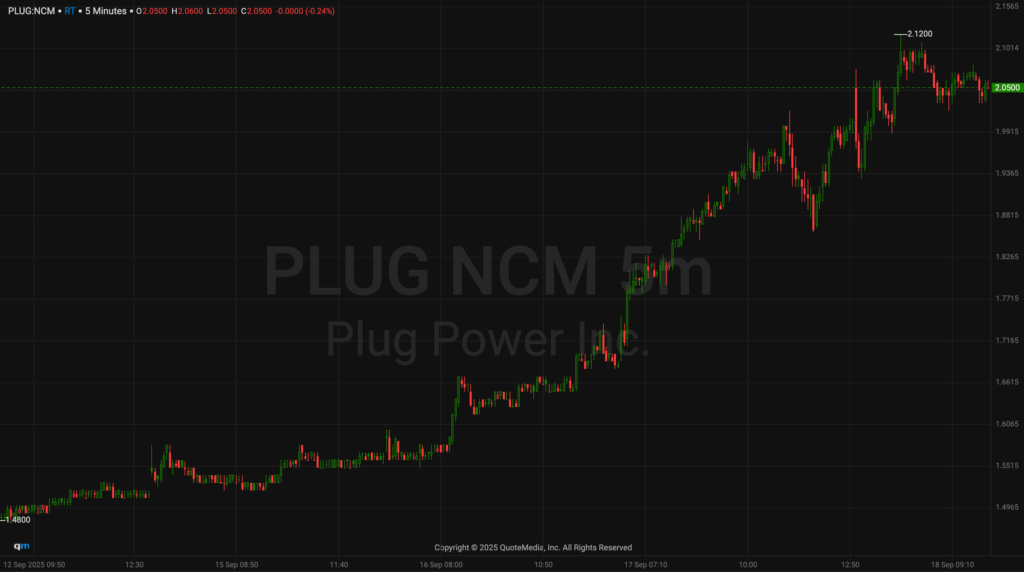

Even Plug Power Inc. (NASDAQ: PLUG), a clean energy stock that’s been beaten down for weeks, started to show similar strength.

It based for days, broke trend, and held. No one’s really talking about it, but the structure is there.

It’s not a confirmed breakout (not yet) but it’s one I’m watching.

That’s the point. These aren’t just random tickers I cycle through every day.

They’re names I’m watching right now because they’re following the same pattern I’ve seen lead to strong, clean trades, especially in a choppy market where most setups aren’t delivering.

What I’ve noticed this week is that the best names all have five things in common:

✅ A clear level traders are watching

✅ Volume building before the breakout

✅ A sector or story that’s starting to rotate back in

✅ Higher lows pressing into resistance

✅ And a chart that gives you time to think, not react

When I spot one or two of these traits, I stay curious. But when I see all of them show up across multiple names in different sectors, I pay attention.

This kind of action doesn’t come along every day. But when it does, it usually shows up in clusters.

One good chart leads to another. A small move in one sector sparks interest in another. And suddenly, the whole tape looks different.

That’s what this week felt like. And that’s why I’m watching these names closely.

They didn’t just move, they moved with structure. And in a slow market, that’s one of the only signals worth trusting.

Catch you in the next alert,

Jack Kellogg