Hey traders,

The first time I watched an OTC stock climb over 200% in a single session, I didn’t feel excitement or even curiosity.

I felt confusion.

The chart didn’t look like anything I was used to. The volume felt strange. The name sounded like a scam. And the price action moved so fast, I honestly wasn’t sure if my platform was glitching or if this thing was actually tradable.

So I did what most new traders do when something feels unfamiliar: I closed the chart and moved on.

A few days later, I saw it again. Same ticker, even higher. And this time, it clicked for me: the problem wasn’t the setup. It was my understanding of it.

Most traders are taught to avoid OTCs. They’re told they’re sketchy, illiquid, unpredictable, too risky to be worth learning.

And sure, if you go in blind, they absolutely can be. I’ve seen them move against traders faster than anything else in the market.

But over time, I realized that the very things that made these stocks feel “weird” at first… are the same things that make them powerful.

They operate differently. They move on different catalysts. They follow patterns that aren’t obvious if you’re only looking at listed names.

But when they go, they tend to go clean, without the kind of chop that usually comes with crowded names on major exchanges.

So today, I want to walk you through why OTCs still deserve your attention, how I spot the ones worth watching, and what I’ve learned from years of trading them, wins, losses, and everything in between.

To some traders, they’re the sketchy back alley of the market. To others, they’re where legends are made.

I’ve traded a lot of them over the years, and yeah, they’re definitely different. But they’re not something to fear.

They’re just misunderstood.

A lot of new traders either write them off completely or chase blindly when one starts running.

But like any corner of the market, OTCs work when the conditions are right, and when you understand how they move.

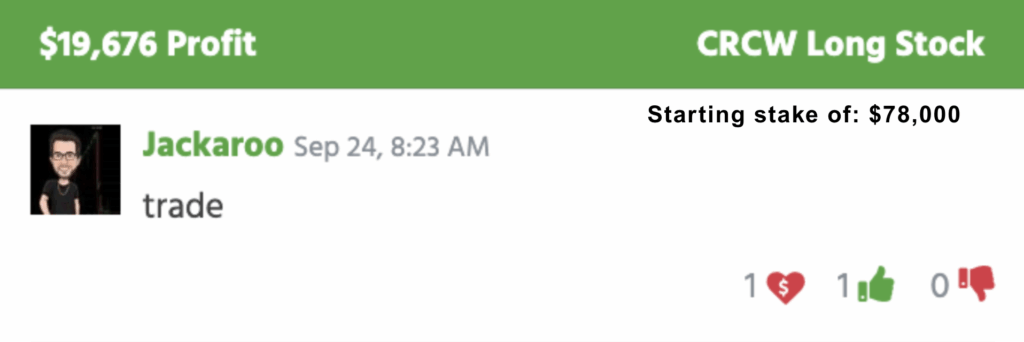

Take The Crypto Company (OTC: CRCW), for example, a tiny OTC crypto stock that popped on my radar a few weeks ago.

It wasn’t a flashy name, no huge PR. Just a low-priced runner catching volume in a hot sector.

But it wasn’t about the hype. It was about the pattern. The float. The sector. And the timing.

That’s the part most traders miss. They see a move like that and assume it’s random.

But there’s always something underneath it, and when you study those clues ahead of time, you can catch the move before it becomes obvious.

I’ve talked a lot lately about adapting to market cycles. That’s been one of the biggest shifts in my trading over the years.

I don’t force OTC trades anymore just because they’re familiar. I don’t stick to listed names just because everyone’s watching them.

I follow what’s hot. I follow the volume and the setup.

Lately, OTCs have been creeping back into play. Not across the board, but enough that I’m paying attention.

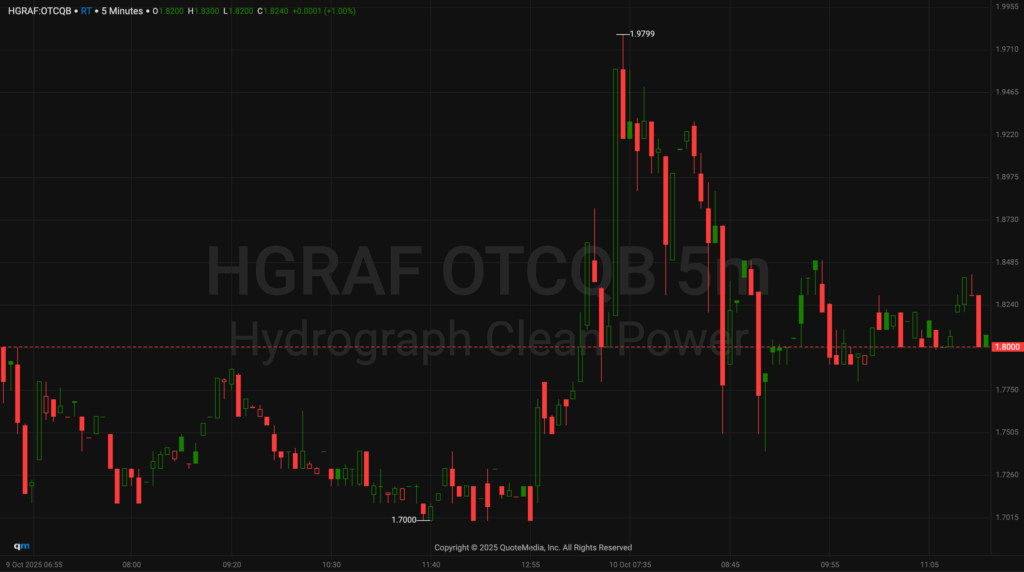

HydroGraph Clean Power Inc. (OTC: HGRAF) is one I’ve got my eye on right now.

It had a clean little move this past Thursday, climbing from $1.70 to $1.97 in under an hour.

Nothing massive, but the right kind of early action. Strong push, followed by some consolidation.

That’s how momentum starts to build.

I get it, if you’ve never traded an OTC, they can feel like unfamiliar territory. No flashy headlines. Weird tickers. Thin liquidity.

But that’s exactly why they work sometimes.

Fewer eyes = more edge, if you know what to look for.

- Float. Volume.

- Sector sentiment.

- Clean charts.

- Catalyst flow.

It’s the same playbook I use across every cycle, listed or OTC. And when those boxes line up, I don’t care where the stock trades. I care that the setup is strong.

That’s the difference between hoping something runs and actually understanding why it might.

So if you’ve been ignoring OTCs out of fear or chasing them with no real plan, take a step back and study the moves that worked. Go look at CRCW’s chart. Study how HGRAF moved.

Notice what happened before they broke out.

Because when the next one lights up, you’ll be ahead of the crowd.

Catch you later,

Jack Kellogg