Hey, Traders,

I spend a lot of time watching the SPY and QQQ exchange-traded funds, but I’m happy to let them marinate until I’m finally ready to pounce.

Until price action and the bigger picture align, there’s just no sense in wasting my energy.

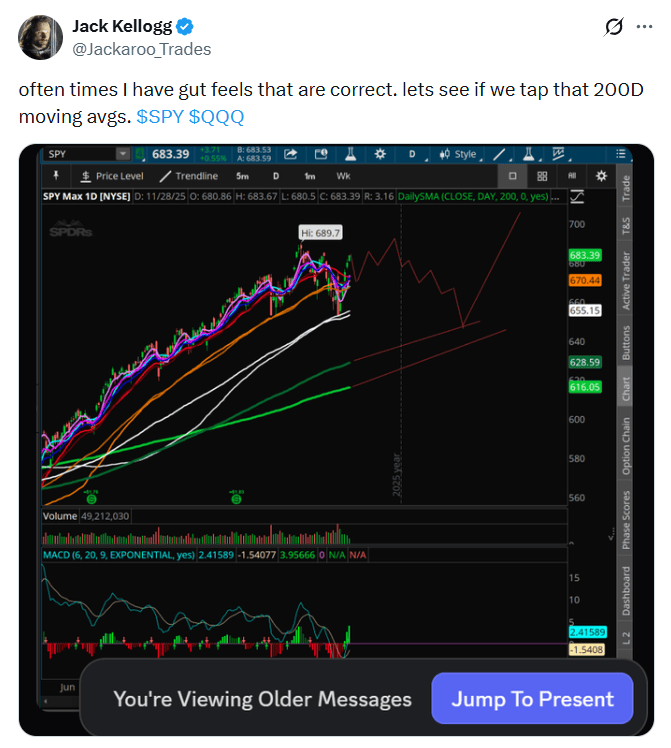

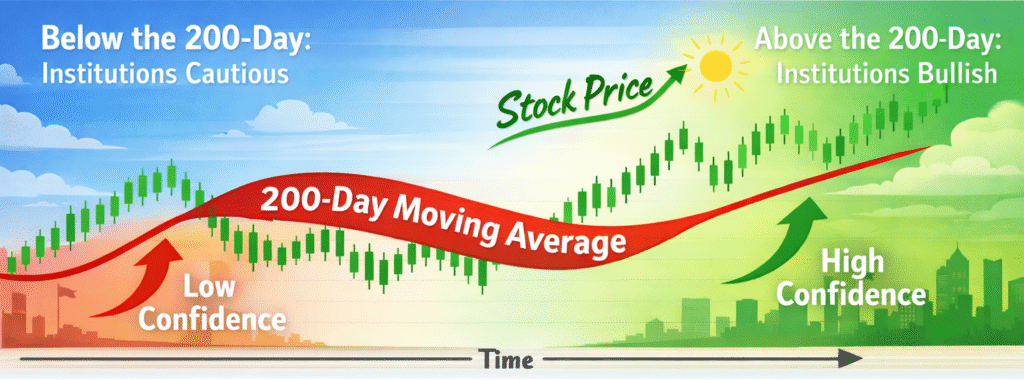

As I posted on X last week, I pay especially close attention to the 200-day moving average:

This approach keeps me disciplined and grounded because it forces me to follow a plan instead of reacting to every little market noise.

In this way, I’ve learned to let the market come to me.

If you want an analogy, think of me as a big lazy lion lounging in the tall grass of the Sahara in one of those boring nature documentaries.

While smaller prey might skate past me as I sprawl on the plain, the minute I spot a zebra on the horizon, I’m fully alert and roaring into action.

The same applies to moving averages.

They’re just guides that help traders separate their zebras from all those pesky little hares (or understand direction, trend, and momentum without feeling overwhelmed).

Let’s take a moment to understand how and why these averages work so well.

Present, Prepared, Patient

A moving average smooths prices into a single flowing line that tells a story about who controls the market.

When price stays above an important moving average, buyers are demonstrating strength and commitment.

But when price drifts away from that support, energy shifts and conditions change.

I care about the 200-day moving average because it shows where the biggest, most powerful players in the market — institutions and large funds — are leaning.

Trading in the same direction as they are gives me a much higher chance of success and allows me to stay focused on high-quality setups.

Waiting also builds strength and discipline, and showing up every day with the same plan allows me to keep growing over time.

The market gives clear signals to those who stay present, prepared, and patient.

Types of Moving Averages

When not watching funds, I spend a lot of time teaching the different moving averages that traders should understand and respect, such as:

⏩ The 10-day moving average: This one tracks short-term price action and reacts quickly to momentum shifts, which is useful for traders who like fast-paced moves.

⏩ The 20-day moving average: This offers a slightly broader view and often helps swing traders identify healthy trends and pullbacks.

⏩ The 50-day moving average: This one plays a larger role in market structure and sentiment, since many institutions watch it closely to judge medium-term trend health. When price holds above the 50-day, confidence tends to stay strong, and when price moves back toward it, that level often acts as a natural point of interest. These reactions reveal how committed buyers remain during periods of consolidation or expansion.

⏩ The 200-day moving average: This remains the most important line on my chart because it defines the long-term direction of the market. When indexes reclaim this level, optimism and participation tend to increase, and that shift creates opportunity.

A Practical Example

In early 2025, fear was spreading after tariff headlines tied to President Trump, so I focused on price, volume, and moving averages instead of emotion.

When I saw that selling pressure was fading and buyers were returning, I was confident a market bottom was forming.

That moment turned into a bull rally, and years of watching charts helped me pinpoint the shift early.

Spending decades in the market builds pattern recognition and intuition that turn out to be spot-on more often than not.

I’ve watched panic transform into opportunity many times, and I’ve learned that even the largest assets repeat the same behavior in certain conditions.

Traders who show up every day develop foresight through repetition, and moving averages help reveal those patterns in real time.

Patience, preparation, and respect for structure continue to guide my trading.

I hope that when you’re ready, they can help guide yours too.

Stay focused,

Jack